| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8479897000 | Doc | 55.0% | CN | US | 2025-05-12 |

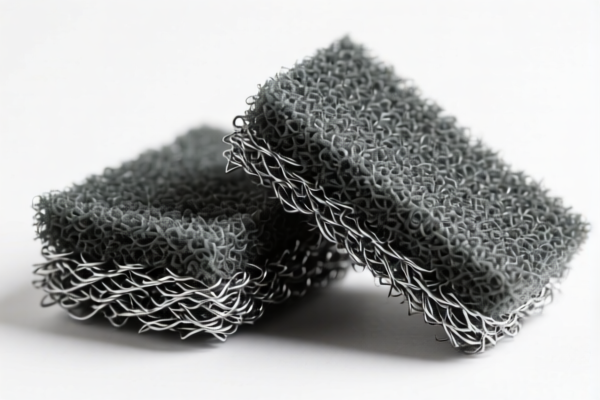

HS Code 8479.89.70.00: Detailed Analysis for Carpet Sweepers – Import from China

This document provides a comprehensive breakdown of HS Code 8479.89.70.00, specifically for carpet sweepers imported from China (CN). It covers the classification, duty rates, and important considerations for customs clearance.

1. HS Code Breakdown & Meaning:

The HS Code is a globally standardized system of names and numbers to classify traded products. Here's a detailed look at 8479.89.70.00:

- 84: Chapter 84 – Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof. This indicates the product falls under the category of machinery.

- 8479: Heading 8479 – Machines and mechanical appliances having individual functions, not specified or included elsewhere in this chapter; parts thereof. This narrows down the category to machines with specific, non-elsewhere classified functions.

- 8479.89: Subheading 8479.89 – Other machines and mechanical appliances. This further specifies that the product is a machine not covered by more specific headings within 8479.

- 8479.89.70: This is the specific code for Carpet sweepers.

- 8479.89.70.00: The final two digits provide even greater specificity. In this case, it definitively identifies the product as carpet sweepers.

2. Product Classification:

This HS Code is specifically assigned to non-electric carpet sweepers that operate manually. Electric carpet sweepers would fall under a different HS Code (likely within 8508, relating to electrical machinery).

Important Note: If your carpet sweepers have any electrical components (even a small motor), double-check the classification. Misclassification can lead to significant penalties.

3. Duty Rates & Taxes (Import from China):

As per the provided data, the following duty rates apply:

- Basic Duty: 0.0%

- Additional Tariff: 25.0%

- Additional Tariff (Post April 2025): 30.0%

- Total Tax: 55.0% (This likely represents the combined effect of the additional tariff, but may include other taxes depending on the specific import regulations.)

4. Key Considerations & Required Documentation:

- Material Composition: The material used in the construction of the carpet sweepers (e.g., plastic, metal, wood) may affect the applicable regulations.

- Single Invoice Value: Be prepared to provide a detailed invoice with a clear breakdown of the value of each carpet sweeper.

- Country of Origin: Ensure accurate documentation proving the product originates from China to benefit from any applicable trade agreements.

- Certification: Depending on the destination country's regulations, you may need to provide certifications related to product safety (e.g., CE marking for Europe, or other relevant standards). Please verify the specific requirements for your destination country.

- Post-April 2025 Tariff Changes: Be aware of the planned increase in the additional tariff to 30% after April 2025. Factor this into your cost calculations.

- Declaration: Ensure the product description on your customs declaration accurately reflects "Carpet Sweepers" and the HS Code 8479.89.70.00.

5. Disclaimer:

This information is based on the data provided and general customs knowledge. Import regulations are subject to change. It is strongly recommended to consult with a licensed customs broker or the customs authorities in your destination country for the most accurate and up-to-date information. They can provide guidance specific to your import situation and ensure compliance with all applicable laws and regulations.

Customer Reviews

No reviews yet.