| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6304920000 | Doc | 36.3% | CN | US | 2025-05-12 |

| 6304930000 | Doc | 39.3% | CN | US | 2025-05-12 |

| 5705002090 | Doc | 58.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4016910000 | Doc | 57.7% | CN | US | 2025-05-12 |

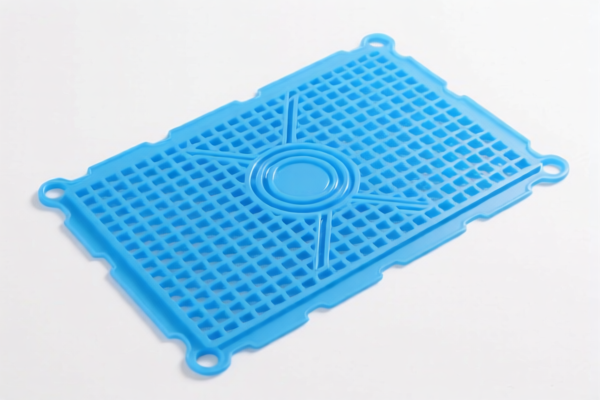

Okay, let's break down the HS codes and tax implications for your "STAIR MAT" declaration. Here's a structured analysis to help you understand the best classification and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific grouping within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific for further refinement.

Analysis of Your HS Code Options

Here's a breakdown of each code you provided, with explanations and recommendations:

-

6304.92.00.00: Other furnishing articles, excluding those of heading 9404: Other: Not knitted or crocheted, of cotton (369)

- Chapter 63: Linens, etc. (This suggests the mat is made of cotton and used as a household furnishing.)

- Heading 6304: Other furnishing articles.

- Subheading 6304.92: Specifically for cotton articles that aren't knitted or crocheted.

- Tax: 36.3% total (6.3% base + 30% additional tariff after April 2, 2025).

- Suitable if: Your stair mat is primarily made of cotton and isn't a knitted or crocheted fabric.

-

6304.93.00.00: Other furnishing articles, excluding those of heading 9404: Other: Not knitted or crocheted, of synthetic fibers (666)

- Chapter 63: Linens, etc.

- Heading 6304: Other furnishing articles.

- Subheading 6304.93: Specifically for synthetic fiber articles that aren't knitted or crocheted.

- Tax: 39.3% total (9.3% base + 30% additional tariff after April 2, 2025).

- Suitable if: Your stair mat is primarily made of synthetic fibers (like polyester, nylon, acrylic) and isn't a knitted or crocheted fabric.

-

5705.00.20.90: Other carpets and other textile floor coverings, whether or not made up: Other Other

- Chapter 57: Carpets and textile floor coverings.

- Heading 5705: Other carpets and floor coverings.

- Subheading 5705.00.20: Other.

- Tax: 58.3% total (3.3% base + 25% additional tariff + 30% additional tariff after April 2, 2025).

- Suitable if: The mat is a carpet or rug-like floor covering, regardless of material. This code often applies to thicker, more substantial floor coverings.

-

3918.10.10.20 & 3918.10.10.30: Floor coverings of plastics, whether or not self-adhesive, in rolls or in the form of tiles; wall or ceiling coverings of plastics, as defined in note 9 to this chapter: Of polymers of vinyl chloride: Floor coverings: Vinyl tile Vinyl tile consisting of a rigid solid polymer core / Vinyl tile consisting of a rigid expanded polymer core

- Chapter 39: Plastics and articles thereof.

- Heading 3918: Floor coverings of plastics.

- Subheading 3918.10: Specifically for vinyl (PVC) floor coverings.

- Tax: 60.3% total (5.3% base + 25% additional tariff + 30% additional tariff after April 2, 2025).

- Suitable if: The mat is made of vinyl (PVC) and is in the form of tiles or rolls.

-

4016.91.00.00: Other articles of vulcanized rubber other than hard rubber: Other: Floor coverings and mats

- Chapter 40: Rubber and articles thereof.

- Heading 4016: Other articles of vulcanized rubber.

- Subheading 4016.91: Specifically for floor coverings and mats.

- Tax: 57.7% total (2.7% base + 25% additional tariff + 30% additional tariff after April 2, 2025).

- Suitable if: The mat is made of rubber (natural or synthetic).

Recommendations & Key Considerations

- Material is Crucial: The primary material of your stair mat is the biggest factor in determining the correct HS code.

- Construction: Is it a woven fabric, a carpet-like covering, a plastic tile, or a rubber mat?

- Check the Additional Tariff: Be aware of the 30% additional tariff that will be applied after April 2, 2025.

- Certifications: Depending on the material and intended use, you might need certifications (e.g., for flammability, lead content, etc.). Please check the import regulations for your specific destination country.

- Single Declaration: If your stair mats are made of mixed materials, you'll need to determine the predominant material for classification.

- Accurate Valuation: The declared value (single price) of your mats is important for calculating duties and taxes.

To help me narrow down the best HS code for you, could you please tell me:

- What is the primary material of the stair mat? (e.g., cotton, polyester, vinyl, rubber)

- What is the construction of the mat? (e.g., woven fabric, carpet-like, plastic tiles, rubber sheet)

- Is the mat self-adhesive?

- What is the intended use of the mat? (e.g., indoor, outdoor, residential, commercial)

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. You should always consult with a qualified customs broker or import specialist for accurate classification and compliance.

Customer Reviews

No reviews yet.