Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

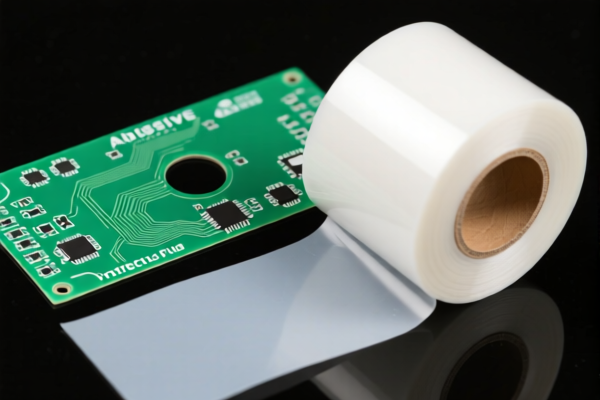

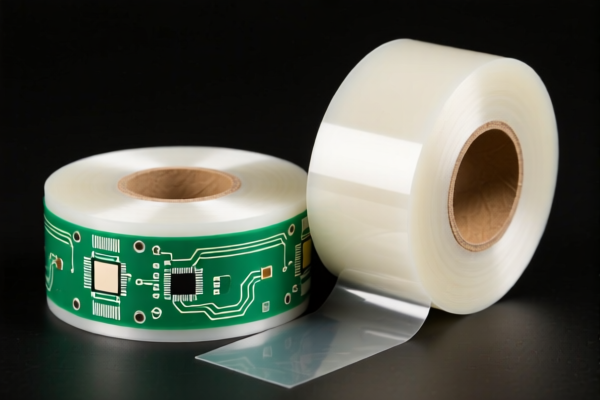

Product Classification: Self Adhesive PCB Protective Film Rolls (Width ≤ 20cm)

HS CODE: 3919.10.20.40 (10-digit code)

🔍 Classification Summary

- Product Type: Self-adhesive plastic tape or film (width ≤ 20cm), used for protecting printed circuit boards (PCBs).

- HS Code: 3919.10.20.40 (commonly used for self-adhesive plastic tapes and films, including protective films).

- Alternative HS Code: 3919.10.20.55 (for self-adhesive plastic sheeting, also applicable if the product is in roll form and ≤20cm wide).

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact composition of the film (e.g., PVC, PE, or other plastics) to ensure correct HS code classification.

- Unit Price: The tax rate may vary based on the declared value and whether the product is considered "simple" or "complex" in terms of manufacturing.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

- Product Description: Use precise and standardized product descriptions to avoid misclassification and potential delays at customs.

🛠️ Proactive Advice for Importers

- Double-check HS Code: Ensure the product is correctly classified under 3919.10.20.40 or 3919.10.20.55 based on its exact form and use.

- Monitor Tariff Changes: Stay updated on any new trade policies or tariff adjustments, especially after April 11, 2025.

- Consult a Customs Broker: For complex or high-value shipments, consider professional customs brokerage services to ensure compliance and avoid penalties.

Let me know if you need help with a specific import scenario or documentation!

Product Classification: Self Adhesive PCB Protective Film Rolls (Width ≤ 20cm)

HS CODE: 3919.10.20.40 (10-digit code)

🔍 Classification Summary

- Product Type: Self-adhesive plastic tape or film (width ≤ 20cm), used for protecting printed circuit boards (PCBs).

- HS Code: 3919.10.20.40 (commonly used for self-adhesive plastic tapes and films, including protective films).

- Alternative HS Code: 3919.10.20.55 (for self-adhesive plastic sheeting, also applicable if the product is in roll form and ≤20cm wide).

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact composition of the film (e.g., PVC, PE, or other plastics) to ensure correct HS code classification.

- Unit Price: The tax rate may vary based on the declared value and whether the product is considered "simple" or "complex" in terms of manufacturing.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

- Product Description: Use precise and standardized product descriptions to avoid misclassification and potential delays at customs.

🛠️ Proactive Advice for Importers

- Double-check HS Code: Ensure the product is correctly classified under 3919.10.20.40 or 3919.10.20.55 based on its exact form and use.

- Monitor Tariff Changes: Stay updated on any new trade policies or tariff adjustments, especially after April 11, 2025.

- Consult a Customs Broker: For complex or high-value shipments, consider professional customs brokerage services to ensure compliance and avoid penalties.

Let me know if you need help with a specific import scenario or documentation!

Customer Reviews

No reviews yet.