Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

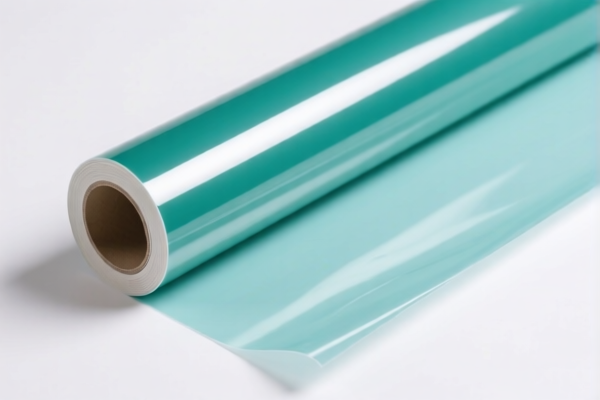

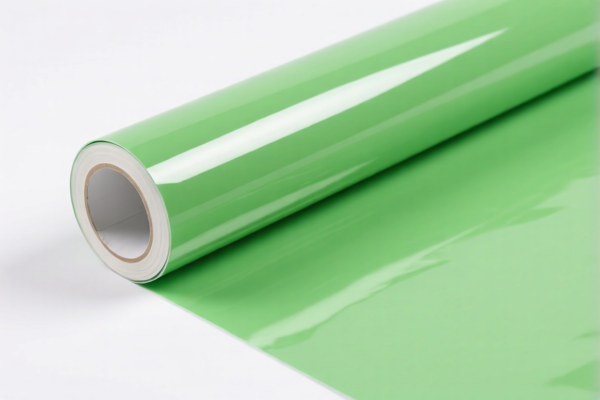

Product Classification: Self Adhesive PVC Anti Mold Wall Film

HS CODE: 3918.10.32.50 and 3918.10.50.00

🔍 Classification Overview

- Product Type: Self-adhesive PVC wall film, wall stickers, or wall panels used for decorative or protective purposes on walls.

- Material: PVC (Polyvinyl Chloride) plastic.

- Function: Anti-mold, decorative, or protective wall covering.

📊 Tariff Breakdown (as of current regulations)

For HS CODE: 3918.10.32.50

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

For HS CODE: 3918.10.50.00

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⏰ Important Time-Sensitive Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to imports after this date. This is a critical date for importers to plan accordingly.

- No Anti-Dumping Duties: As of now, no specific anti-dumping duties are reported for PVC wall films or similar products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, which may change the HS code.

- Check Unit Price and Classification: The HS code may vary based on the product's form (e.g., film vs. panel) and intended use.

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental compliance) are needed for import or sale in the destination country.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025.

📌 Summary of Key Points

- HS CODEs: 3918.10.32.50 and 3918.10.50.00

- Total Tax Rates: 61.5% and 59.2% respectively

- April 11, 2025 Tariff Increase: 30% additional duty

- No Anti-Dumping Duties: Currently not applicable

- Action Required: Confirm product details and prepare for higher tariffs post-April 11, 2025

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: Self Adhesive PVC Anti Mold Wall Film

HS CODE: 3918.10.32.50 and 3918.10.50.00

🔍 Classification Overview

- Product Type: Self-adhesive PVC wall film, wall stickers, or wall panels used for decorative or protective purposes on walls.

- Material: PVC (Polyvinyl Chloride) plastic.

- Function: Anti-mold, decorative, or protective wall covering.

📊 Tariff Breakdown (as of current regulations)

For HS CODE: 3918.10.32.50

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

For HS CODE: 3918.10.50.00

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⏰ Important Time-Sensitive Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to imports after this date. This is a critical date for importers to plan accordingly.

- No Anti-Dumping Duties: As of now, no specific anti-dumping duties are reported for PVC wall films or similar products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, which may change the HS code.

- Check Unit Price and Classification: The HS code may vary based on the product's form (e.g., film vs. panel) and intended use.

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental compliance) are needed for import or sale in the destination country.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025.

📌 Summary of Key Points

- HS CODEs: 3918.10.32.50 and 3918.10.50.00

- Total Tax Rates: 61.5% and 59.2% respectively

- April 11, 2025 Tariff Increase: 30% additional duty

- No Anti-Dumping Duties: Currently not applicable

- Action Required: Confirm product details and prepare for higher tariffs post-April 11, 2025

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.