| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

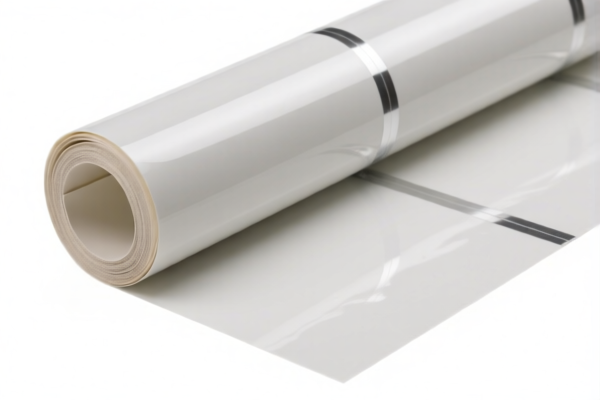

Here is the structured classification and tariff information for Self Adhesive PVC Ceiling Covering based on the provided HS codes and tax details:

✅ HS CODE: 3918103250

Product Name: PVC Ceiling Self-Adhesive Roll Material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for PVC ceiling self-adhesive roll materials.

✅ HS CODE: 3918905000

Product Name: Self-Adhesive Ceiling Sticker

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to self-adhesive ceiling stickers.

✅ HS CODE: 3918103210

Product Name: PVC Wall Sticker (Self-Adhesive)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC wall stickers (self-adhesive), not ceiling-specific.

✅ HS CODE: 3920435000

Product Name: PVC Self-Adhesive Wallpaper

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC self-adhesive wallpaper, typically used for walls.

✅ HS CODE: 3920490000

Product Name: PVC Self-Adhesive Wall Sticker

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC self-adhesive wall stickers, which may be used for both walls and ceilings.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy, so plan your import schedule accordingly.

-

Material Verification: Ensure the product is PVC-based and self-adhesive to match the correct HS code. Misclassification can lead to delays and penalties.

-

Unit Price and Certification: Confirm the unit price and whether certifications (e.g., fire resistance, environmental compliance) are required for import into your destination country.

-

Customs Declaration: Provide detailed product descriptions, including material composition, usage, and application (e.g., ceiling vs. wall use), to avoid classification disputes.

Let me know if you need help selecting the most appropriate HS code based on your product specifications. Here is the structured classification and tariff information for Self Adhesive PVC Ceiling Covering based on the provided HS codes and tax details:

✅ HS CODE: 3918103250

Product Name: PVC Ceiling Self-Adhesive Roll Material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for PVC ceiling self-adhesive roll materials.

✅ HS CODE: 3918905000

Product Name: Self-Adhesive Ceiling Sticker

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to self-adhesive ceiling stickers.

✅ HS CODE: 3918103210

Product Name: PVC Wall Sticker (Self-Adhesive)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC wall stickers (self-adhesive), not ceiling-specific.

✅ HS CODE: 3920435000

Product Name: PVC Self-Adhesive Wallpaper

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC self-adhesive wallpaper, typically used for walls.

✅ HS CODE: 3920490000

Product Name: PVC Self-Adhesive Wall Sticker

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC self-adhesive wall stickers, which may be used for both walls and ceilings.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy, so plan your import schedule accordingly.

-

Material Verification: Ensure the product is PVC-based and self-adhesive to match the correct HS code. Misclassification can lead to delays and penalties.

-

Unit Price and Certification: Confirm the unit price and whether certifications (e.g., fire resistance, environmental compliance) are required for import into your destination country.

-

Customs Declaration: Provide detailed product descriptions, including material composition, usage, and application (e.g., ceiling vs. wall use), to avoid classification disputes.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Customer Reviews

No reviews yet.