| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

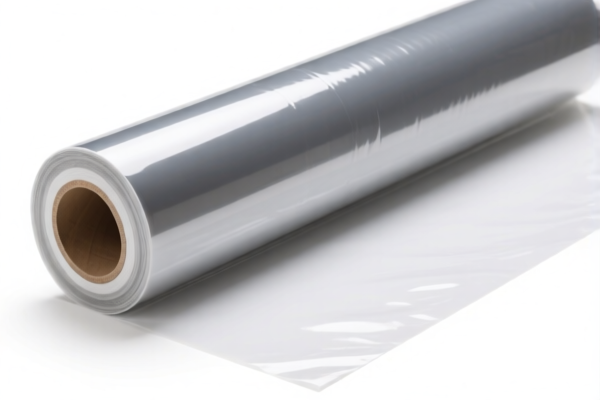

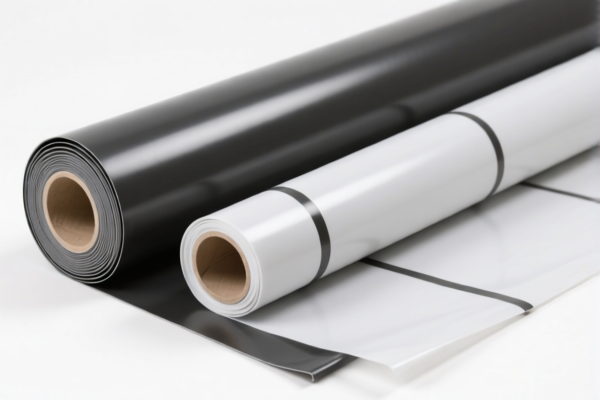

Product Classification: Self Adhesive PVC Floor Covering Rolls

HS CODE: 3918101020 (or 3918101040, depending on specific product details)

🔍 Classification Summary:

- Product: Self-adhesive PVC (polyvinyl chloride) floor covering in roll form.

- HS Code: 3918101020 or 3918101040 (both fall under the broader category of self-adhesive plastic floor coverings).

- Description: These codes specifically apply to self-adhesive plastic floor coverings, including PVC, in roll form.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The additional 30.0% tariff will be imposed after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 Key Considerations:

- Material Verification: Ensure the product is indeed made of PVC and is self-adhesive. If it contains other materials (e.g., rubber or foam), the classification may change.

- Form and Packaging: The product must be in roll form (not tiles or sheets) to qualify under this HS code.

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Unit Price: Confirm the unit price and whether it falls under any preferential trade agreements that may reduce the effective tariff rate.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code 3918101020 or 3918101040.

- Monitor the April 11, 2025, deadline for the additional 30.0% tariff.

- Consult with customs brokers or trade advisors to confirm the most up-to-date classification and tax implications.

- Review any anti-dumping or countervailing duties that may apply to PVC products, especially if imported from countries with known trade disputes.

Let me know if you need help with a specific product description or customs documentation!

Product Classification: Self Adhesive PVC Floor Covering Rolls

HS CODE: 3918101020 (or 3918101040, depending on specific product details)

🔍 Classification Summary:

- Product: Self-adhesive PVC (polyvinyl chloride) floor covering in roll form.

- HS Code: 3918101020 or 3918101040 (both fall under the broader category of self-adhesive plastic floor coverings).

- Description: These codes specifically apply to self-adhesive plastic floor coverings, including PVC, in roll form.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The additional 30.0% tariff will be imposed after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 Key Considerations:

- Material Verification: Ensure the product is indeed made of PVC and is self-adhesive. If it contains other materials (e.g., rubber or foam), the classification may change.

- Form and Packaging: The product must be in roll form (not tiles or sheets) to qualify under this HS code.

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Unit Price: Confirm the unit price and whether it falls under any preferential trade agreements that may reduce the effective tariff rate.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code 3918101020 or 3918101040.

- Monitor the April 11, 2025, deadline for the additional 30.0% tariff.

- Consult with customs brokers or trade advisors to confirm the most up-to-date classification and tax implications.

- Review any anti-dumping or countervailing duties that may apply to PVC products, especially if imported from countries with known trade disputes.

Let me know if you need help with a specific product description or customs documentation!

Customer Reviews

No reviews yet.