Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4418790100 | Doc | 58.2% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

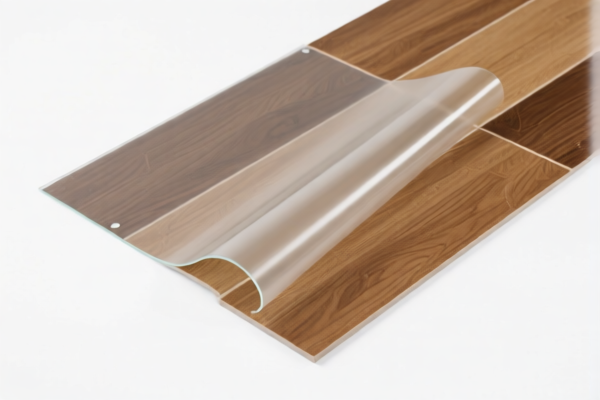

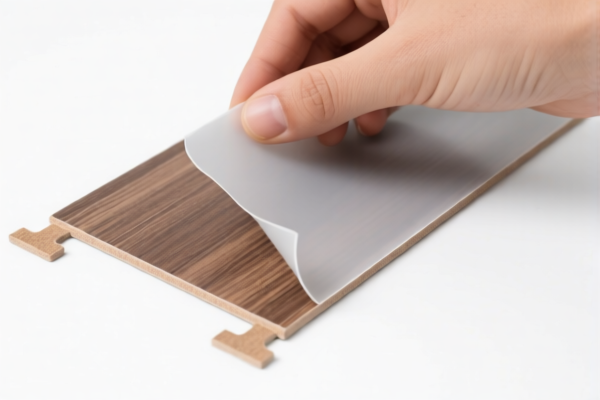

Product Classification: Self Adhesive PVC Floor Tile

HS CODEs and Tax Information Summary:

✅ HS CODE: 3918901000

- Description: Self-adhesive PVC floor tiles, classified under "self-adhesive" and "plastic floor coverings."

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a common classification for self-adhesive PVC floor tiles made of plastic.

✅ HS CODE: 3918101040

- Description: Self-adhesive PVC floor tiles, matching the description of "self-adhesive" PVC tiles.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code may be used for specific types of PVC tiles with particular specifications.

✅ HS CODE: 3918102000

- Description: Self-adhesive PVC floor tiles, matching the description under this HS code.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code may apply to PVC tiles with specific thickness or composition.

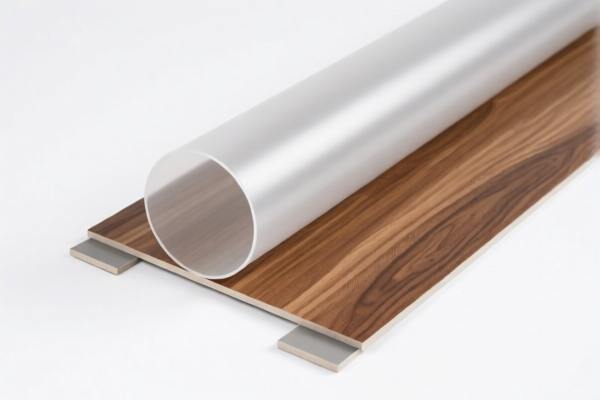

✅ HS CODE: 4418790100

- Description: Self-adhesive floor tiles classified under wooden construction and carpentry products.

- Total Tax Rate: 58.2%

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for wooden products, not PVC. Ensure the product is not made of wood to avoid misclassification.

✅ HS CODE: 3918905000

- Description: PVC floor film, classified under plastic products.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for PVC floor film, not full tiles. Ensure the product is not just a film or coating.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes will have an additional 30.0% tariff applied after April 11, 2025. This is a time-sensitive policy—plan accordingly.

- Anti-dumping duties: Not applicable for this product category (PVC floor tiles).

- Material Verification: Confirm the material composition (PVC vs. wood) to avoid misclassification.

- Certifications: Check if any product certifications (e.g., fire resistance, environmental standards) are required for import.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

📌 Proactive Advice:

- Double-check the product composition and intended use to ensure the correct HS code is applied.

- If the product is not purely PVC, consider other classifications (e.g., wood or composite materials).

- Keep updated records of product specifications and certifications for customs compliance.

Product Classification: Self Adhesive PVC Floor Tile

HS CODEs and Tax Information Summary:

✅ HS CODE: 3918901000

- Description: Self-adhesive PVC floor tiles, classified under "self-adhesive" and "plastic floor coverings."

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a common classification for self-adhesive PVC floor tiles made of plastic.

✅ HS CODE: 3918101040

- Description: Self-adhesive PVC floor tiles, matching the description of "self-adhesive" PVC tiles.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code may be used for specific types of PVC tiles with particular specifications.

✅ HS CODE: 3918102000

- Description: Self-adhesive PVC floor tiles, matching the description under this HS code.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code may apply to PVC tiles with specific thickness or composition.

✅ HS CODE: 4418790100

- Description: Self-adhesive floor tiles classified under wooden construction and carpentry products.

- Total Tax Rate: 58.2%

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for wooden products, not PVC. Ensure the product is not made of wood to avoid misclassification.

✅ HS CODE: 3918905000

- Description: PVC floor film, classified under plastic products.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for PVC floor film, not full tiles. Ensure the product is not just a film or coating.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes will have an additional 30.0% tariff applied after April 11, 2025. This is a time-sensitive policy—plan accordingly.

- Anti-dumping duties: Not applicable for this product category (PVC floor tiles).

- Material Verification: Confirm the material composition (PVC vs. wood) to avoid misclassification.

- Certifications: Check if any product certifications (e.g., fire resistance, environmental standards) are required for import.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

📌 Proactive Advice:

- Double-check the product composition and intended use to ensure the correct HS code is applied.

- If the product is not purely PVC, consider other classifications (e.g., wood or composite materials).

- Keep updated records of product specifications and certifications for customs compliance.

Customer Reviews

No reviews yet.