| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the detailed customs compliance analysis for Self Adhesive PVC Floor Tiles and related products, based on the provided HS codes and tax information:

📦 Product Classification Overview

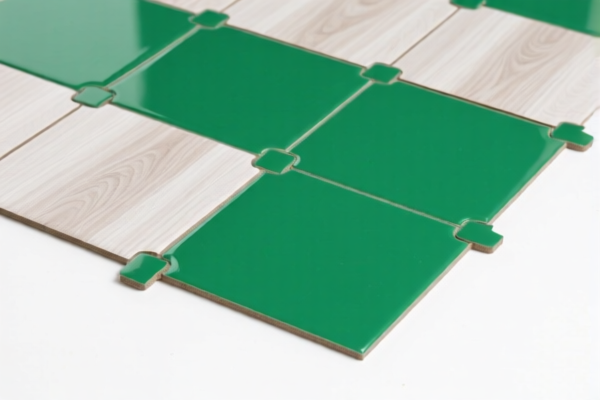

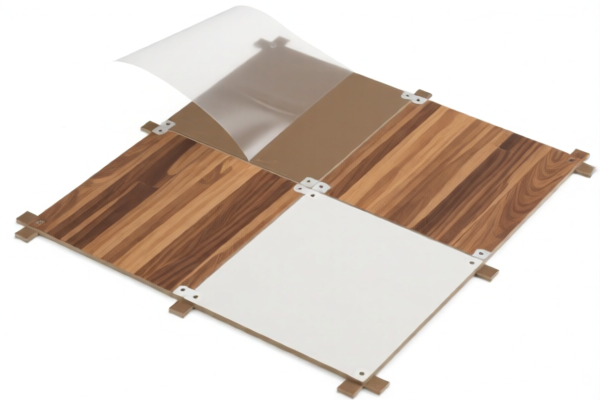

- Product Name: Self Adhesive PVC Floor Tiles / PVC Plastic Floor Tiles / Self Adhesive Floor Stickers / PVC Plastic Floor Rolls

- HS Code Classification: 3918.10.1040, 3918.10.2000, 3918.10.5000, 3918.90.1000, 3918.90.5000

📊 Tariff Summary (as of now)

- Base Tariff Rate: 4.2% to 5.3% (varies by HS code)

- Additional Tariff: 25.0% (applies to all listed HS codes)

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Total Tax Rate: 59.2% to 60.3% (varies by HS code)

📌 Key Tax Rate Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC floor tiles in the provided data. However, it's advisable to verify if any anti-dumping measures are currently in place for PVC products in your region.

📌 Proactive Compliance Advice

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect HS code classification.

- Check Unit Price: The total tax rate is heavily influenced by the unit price. Higher value products may be subject to different regulations or duties.

- Certifications Required: Confirm if any certifications (e.g., CE, ISO, or environmental compliance) are required for import or sale in the destination country.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, and product specifications) to support the HS code classification and tax calculation.

📌 HS Code Breakdown

| HS Code | Product Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3918101040 | Self Adhesive PVC Floor Tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | Self Adhesive PVC Floor Tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918105000 | Self Adhesive PVC Wall Tiles | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918901000 | Self Adhesive Plastic Floor Rolls | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918905000 | Self Adhesive Floor Stickers | 4.2% | 25.0% | 30.0% | 59.2% |

📌 Action Items for Importers

- Confirm the exact product description and material to ensure correct HS code classification.

- Monitor the April 11, 2025 deadline for the special tariff increase.

- Consider consulting a customs broker or compliance expert for complex or high-value shipments.

- Keep updated records of product specifications and tax calculations for audit purposes.

Let me know if you need help with HS code verification or customs documentation for a specific shipment. Here is the detailed customs compliance analysis for Self Adhesive PVC Floor Tiles and related products, based on the provided HS codes and tax information:

📦 Product Classification Overview

- Product Name: Self Adhesive PVC Floor Tiles / PVC Plastic Floor Tiles / Self Adhesive Floor Stickers / PVC Plastic Floor Rolls

- HS Code Classification: 3918.10.1040, 3918.10.2000, 3918.10.5000, 3918.90.1000, 3918.90.5000

📊 Tariff Summary (as of now)

- Base Tariff Rate: 4.2% to 5.3% (varies by HS code)

- Additional Tariff: 25.0% (applies to all listed HS codes)

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Total Tax Rate: 59.2% to 60.3% (varies by HS code)

📌 Key Tax Rate Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC floor tiles in the provided data. However, it's advisable to verify if any anti-dumping measures are currently in place for PVC products in your region.

📌 Proactive Compliance Advice

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect HS code classification.

- Check Unit Price: The total tax rate is heavily influenced by the unit price. Higher value products may be subject to different regulations or duties.

- Certifications Required: Confirm if any certifications (e.g., CE, ISO, or environmental compliance) are required for import or sale in the destination country.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, and product specifications) to support the HS code classification and tax calculation.

📌 HS Code Breakdown

| HS Code | Product Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3918101040 | Self Adhesive PVC Floor Tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | Self Adhesive PVC Floor Tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918105000 | Self Adhesive PVC Wall Tiles | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918901000 | Self Adhesive Plastic Floor Rolls | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918905000 | Self Adhesive Floor Stickers | 4.2% | 25.0% | 30.0% | 59.2% |

📌 Action Items for Importers

- Confirm the exact product description and material to ensure correct HS code classification.

- Monitor the April 11, 2025 deadline for the special tariff increase.

- Consider consulting a customs broker or compliance expert for complex or high-value shipments.

- Keep updated records of product specifications and tax calculations for audit purposes.

Let me know if you need help with HS code verification or customs documentation for a specific shipment.

Customer Reviews

No reviews yet.