| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

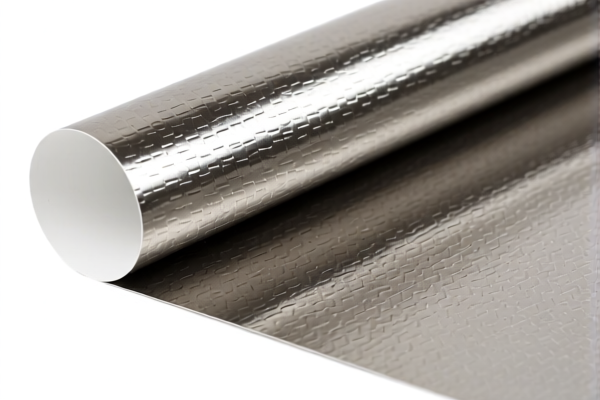

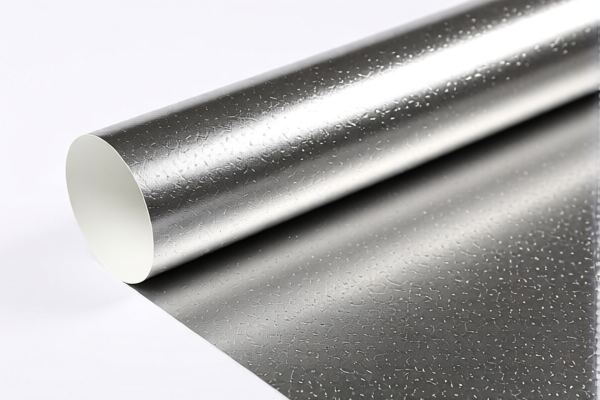

Product Name: Self Adhesive PVC Metal Grain Wall Film

Classification HS Codes and Tax Details:

- HS CODE: 3918103250

- Applicable Products: Self-adhesive PVC wall films, wall panels, wall stickers, and decorative wall membranes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is suitable for general self-adhesive PVC wall films.

-

HS CODE: 3918105000

- Applicable Products: Self-adhesive PVC plastic wall tiles.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is more specific to wall tiles made of PVC plastic.

-

HS CODE: 3918104050

- Applicable Products: PVC wall metal grain film, self-adhesive PVC wall film with metal texture.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is ideal for products with a metallic grain or texture.

📌 Important Notes and Recommendations:

- Time-sensitive Policy Alert:

-

Special Tariff after April 2, 2025: All three codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

-

Anti-dumping duties:

-

If the product contains iron or aluminum components, check for any applicable anti-dumping duties. These are not included in the base or additional tariffs listed above and may vary depending on the country of origin.

-

Proactive Actions Required:

- Verify Material Composition: Confirm whether the product is purely PVC or contains other materials (e.g., metal grain, additives), as this may affect classification.

- Check Unit Price and Certification: Some products may require import licenses or certifications (e.g., environmental compliance, safety standards).

- Consult Customs Broker: For accurate classification and to avoid delays, it is recommended to consult a customs broker or use a customs compliance tool.

Let me know if you need help determining which HS code best fits your specific product description or packaging.

Product Name: Self Adhesive PVC Metal Grain Wall Film

Classification HS Codes and Tax Details:

- HS CODE: 3918103250

- Applicable Products: Self-adhesive PVC wall films, wall panels, wall stickers, and decorative wall membranes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is suitable for general self-adhesive PVC wall films.

-

HS CODE: 3918105000

- Applicable Products: Self-adhesive PVC plastic wall tiles.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is more specific to wall tiles made of PVC plastic.

-

HS CODE: 3918104050

- Applicable Products: PVC wall metal grain film, self-adhesive PVC wall film with metal texture.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is ideal for products with a metallic grain or texture.

📌 Important Notes and Recommendations:

- Time-sensitive Policy Alert:

-

Special Tariff after April 2, 2025: All three codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

-

Anti-dumping duties:

-

If the product contains iron or aluminum components, check for any applicable anti-dumping duties. These are not included in the base or additional tariffs listed above and may vary depending on the country of origin.

-

Proactive Actions Required:

- Verify Material Composition: Confirm whether the product is purely PVC or contains other materials (e.g., metal grain, additives), as this may affect classification.

- Check Unit Price and Certification: Some products may require import licenses or certifications (e.g., environmental compliance, safety standards).

- Consult Customs Broker: For accurate classification and to avoid delays, it is recommended to consult a customs broker or use a customs compliance tool.

Let me know if you need help determining which HS code best fits your specific product description or packaging.

Customer Reviews

No reviews yet.