| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

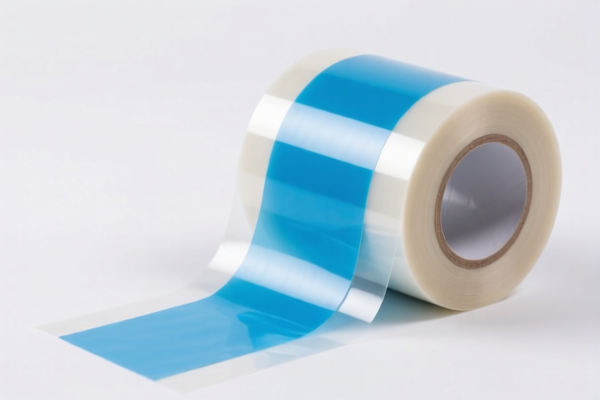

Product Classification: Self Adhesive Plastic Label Film Rolls (Width ≤ 20cm)

HS CODE:

- 3919102040 – Self-adhesive plastic tape (in rolls, width ≤ 20cm)

- 3919102055 – Self-adhesive plastic label film rolls (width ≤ 20cm)

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. Ensure your customs clearance is completed before this date if possible. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (iron or aluminum-related).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Confirm the exact material (e.g., PVC, PE, etc.) and unit price to ensure correct classification and tax calculation. -

Check Required Certifications:

Some products may require certifications (e.g., RoHS, REACH) depending on the destination country and product use. -

Monitor Tariff Updates:

Keep an eye on any changes in customs policies, especially around the April 11, 2025 deadline. -

Consult a Customs Broker:

For complex or high-value shipments, consider working with a customs broker to ensure compliance and avoid delays.

Let me know if you need help with customs documentation or further classification details.

Product Classification: Self Adhesive Plastic Label Film Rolls (Width ≤ 20cm)

HS CODE:

- 3919102040 – Self-adhesive plastic tape (in rolls, width ≤ 20cm)

- 3919102055 – Self-adhesive plastic label film rolls (width ≤ 20cm)

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. Ensure your customs clearance is completed before this date if possible. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (iron or aluminum-related).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Confirm the exact material (e.g., PVC, PE, etc.) and unit price to ensure correct classification and tax calculation. -

Check Required Certifications:

Some products may require certifications (e.g., RoHS, REACH) depending on the destination country and product use. -

Monitor Tariff Updates:

Keep an eye on any changes in customs policies, especially around the April 11, 2025 deadline. -

Consult a Customs Broker:

For complex or high-value shipments, consider working with a customs broker to ensure compliance and avoid delays.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.