| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

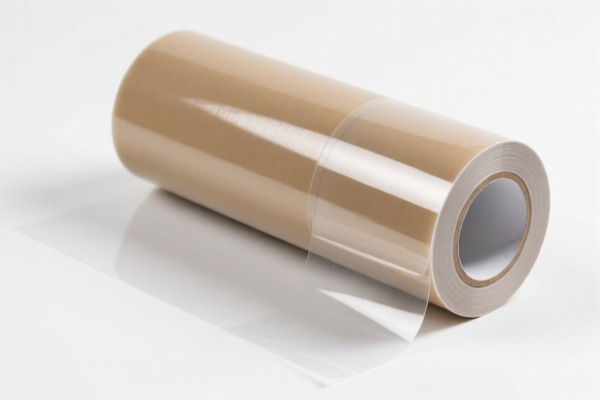

Product Classification: Self Adhesive Protective Film Rolls (Width ≤ 20cm)

HS CODE: 3919.10.20.40 and 3919.10.20.55 (both applicable to self-adhesive plastic films or tapes with width ≤ 20cm)

🔍 Classification Summary:

- Product Type: Self-adhesive plastic films or tapes (e.g., transparent plastic tape, self-adhesive protective film rolls)

- Width Limit: ≤ 20cm

- Form: Rolls or sheets (varies by HS code)

📊 Tariff Breakdown (as of current data):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties:

- Not Applicable: No specific anti-dumping duties are listed for this product category (iron and aluminum-related duties do not apply here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of plastic and not a composite or mixed material, which may affect classification.

- Check Unit Price: Tariff rates may vary based on the declared value and origin of the product.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product type.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product has multiple components or uses.

📚 Example:

If you are importing transparent plastic tape (width ≤ 20cm), the HS code 3919.10.20.40 applies, with a total tax rate of 60.8%, including the 30.0% special tariff after April 11, 2025.

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: Self Adhesive Protective Film Rolls (Width ≤ 20cm)

HS CODE: 3919.10.20.40 and 3919.10.20.55 (both applicable to self-adhesive plastic films or tapes with width ≤ 20cm)

🔍 Classification Summary:

- Product Type: Self-adhesive plastic films or tapes (e.g., transparent plastic tape, self-adhesive protective film rolls)

- Width Limit: ≤ 20cm

- Form: Rolls or sheets (varies by HS code)

📊 Tariff Breakdown (as of current data):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties:

- Not Applicable: No specific anti-dumping duties are listed for this product category (iron and aluminum-related duties do not apply here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of plastic and not a composite or mixed material, which may affect classification.

- Check Unit Price: Tariff rates may vary based on the declared value and origin of the product.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product type.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product has multiple components or uses.

📚 Example:

If you are importing transparent plastic tape (width ≤ 20cm), the HS code 3919.10.20.40 applies, with a total tax rate of 60.8%, including the 30.0% special tariff after April 11, 2025.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.