| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4418790100 | Doc | 58.2% | CN | US | 2025-05-12 |

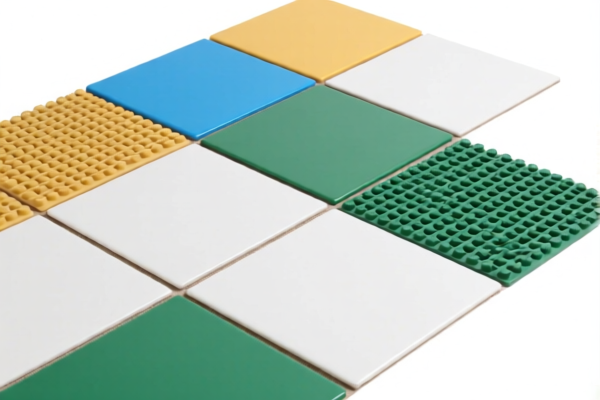

Here is the structured classification and tariff information for the "Self adhesive other plastic floor coverings in tiles" product, based on the provided HS codes and tax details:

✅ HS CODE: 3918101040

Product Description: Self-adhesive PVC floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC-based self-adhesive floor tiles.

✅ HS CODE: 3918901000

Product Description: Plastic self-adhesive floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code covers general plastic self-adhesive floor tiles, not limited to PVC.

✅ HS CODE: 3918101030

Product Description: Plastic floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic floor tiles, not necessarily self-adhesive.

✅ HS CODE: 3919905060

Product Description: Self-adhesive floor tiles

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for self-adhesive floor tiles, possibly with different material compositions.

✅ HS CODE: 4418790100

Product Description: Self-adhesive floor coverings

Total Tax Rate: 58.2%

- Base Tariff Rate: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for self-adhesive floor coverings, possibly made from wood or other materials, not plastic.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Material Verification: Confirm the exact material (e.g., PVC, other plastics, or wood-based) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., CE, RoHS, or fire safety) are required for import into the target market.

- Unit Price: Be aware that higher tax rates may affect the final product cost. Consider this in pricing and compliance strategies.

If you have more details about the product (e.g., material composition, thickness, or intended use), I can help further refine the classification and compliance strategy. Here is the structured classification and tariff information for the "Self adhesive other plastic floor coverings in tiles" product, based on the provided HS codes and tax details:

✅ HS CODE: 3918101040

Product Description: Self-adhesive PVC floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC-based self-adhesive floor tiles.

✅ HS CODE: 3918901000

Product Description: Plastic self-adhesive floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code covers general plastic self-adhesive floor tiles, not limited to PVC.

✅ HS CODE: 3918101030

Product Description: Plastic floor tiles

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic floor tiles, not necessarily self-adhesive.

✅ HS CODE: 3919905060

Product Description: Self-adhesive floor tiles

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for self-adhesive floor tiles, possibly with different material compositions.

✅ HS CODE: 4418790100

Product Description: Self-adhesive floor coverings

Total Tax Rate: 58.2%

- Base Tariff Rate: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for self-adhesive floor coverings, possibly made from wood or other materials, not plastic.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Material Verification: Confirm the exact material (e.g., PVC, other plastics, or wood-based) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., CE, RoHS, or fire safety) are required for import into the target market.

- Unit Price: Be aware that higher tax rates may affect the final product cost. Consider this in pricing and compliance strategies.

If you have more details about the product (e.g., material composition, thickness, or intended use), I can help further refine the classification and compliance strategy.

Customer Reviews

No reviews yet.