Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112302000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112302000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5408333000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

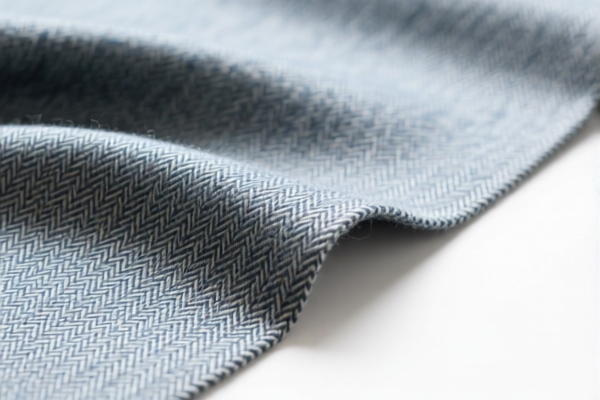

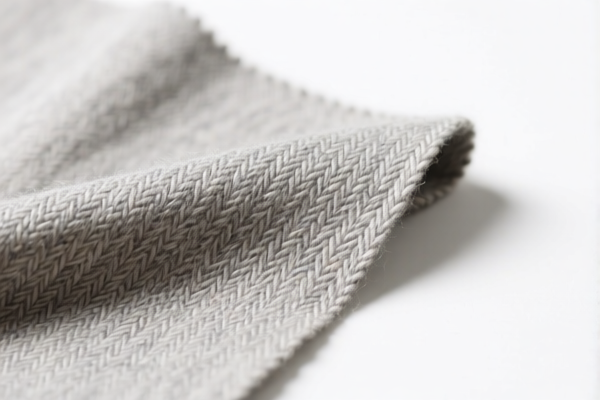

Product Name: Silk blended combed wool woven fabric

HS CODE: 5112303000

🔍 Classification Summary:

- HS CODE: 5112303000

- Description: Mixed combed wool woven fabric (e.g., silk blended combed wool woven fabric)

- Total Tax Rate: 80.0%

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date for customs clearance planning.

- Anti-dumping duties: Not applicable for this product category (wool and silk blended fabrics).

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of silk and wool) to ensure correct classification.

- Certifications: Check if any specific certifications (e.g., origin, environmental, or textile standards) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed a blend of silk and combed wool, as this directly affects HS code classification.

- Check Unit Price: Tariff rates may vary based on the declared value and unit price of the fabric.

- Consult Customs Authority: For the most up-to-date information on tariff changes and compliance requirements, especially after April 11, 2025.

- Document Preparation: Maintain detailed documentation (e.g., invoices, certificates of origin) to support the declared classification and avoid delays in customs clearance.

Let me know if you need help with HS code verification or customs compliance for other products.

Product Name: Silk blended combed wool woven fabric

HS CODE: 5112303000

🔍 Classification Summary:

- HS CODE: 5112303000

- Description: Mixed combed wool woven fabric (e.g., silk blended combed wool woven fabric)

- Total Tax Rate: 80.0%

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date for customs clearance planning.

- Anti-dumping duties: Not applicable for this product category (wool and silk blended fabrics).

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of silk and wool) to ensure correct classification.

- Certifications: Check if any specific certifications (e.g., origin, environmental, or textile standards) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed a blend of silk and combed wool, as this directly affects HS code classification.

- Check Unit Price: Tariff rates may vary based on the declared value and unit price of the fabric.

- Consult Customs Authority: For the most up-to-date information on tariff changes and compliance requirements, especially after April 11, 2025.

- Document Preparation: Maintain detailed documentation (e.g., invoices, certificates of origin) to support the declared classification and avoid delays in customs clearance.

Let me know if you need help with HS code verification or customs compliance for other products.

Customer Reviews

No reviews yet.