| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408323000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5408343000 | Doc | 55.0% | CN | US | 2025-05-12 |

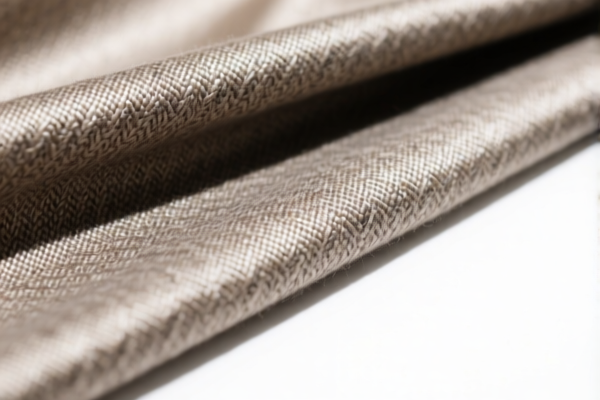

Product Classification: Silk blended woven wool fabrics (containing 30% or more silk, valued over $33/kg)

✅ HS CODE: 5408.32.30.00

Description:

Applicable to dyed other woven fabrics containing 30% or more by weight of silk or silk waste, valued over $33 per kg.

🔍 Key Tax Rate Breakdown:

- Base Tariff Rate: 6.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.9%

📌 Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-dumping duties on iron and aluminum:

This product is not subject to anti-dumping duties on iron or aluminum, as it is a textile product.

🛠️ Proactive Advice:

-

Verify Material Composition:

Ensure the fabric contains at least 30% silk by weight and that the value exceeds $33 per kg. This is critical for correct classification. -

Check Certification Requirements:

Confirm if any certifications (e.g., origin, sustainability, or textile standards) are required for import into the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly. -

Consider Alternative HS Codes:

If the product does not meet the criteria for 5408.32.30.00, consider 5408.34.30.00 (which has a lower total tax rate of 55.0%) and ensure it matches the description exactly.

Let me know if you need help with certification requirements or customs documentation for this product. Product Classification: Silk blended woven wool fabrics (containing 30% or more silk, valued over $33/kg)

✅ HS CODE: 5408.32.30.00

Description:

Applicable to dyed other woven fabrics containing 30% or more by weight of silk or silk waste, valued over $33 per kg.

🔍 Key Tax Rate Breakdown:

- Base Tariff Rate: 6.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.9%

📌 Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-dumping duties on iron and aluminum:

This product is not subject to anti-dumping duties on iron or aluminum, as it is a textile product.

🛠️ Proactive Advice:

-

Verify Material Composition:

Ensure the fabric contains at least 30% silk by weight and that the value exceeds $33 per kg. This is critical for correct classification. -

Check Certification Requirements:

Confirm if any certifications (e.g., origin, sustainability, or textile standards) are required for import into the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly. -

Consider Alternative HS Codes:

If the product does not meet the criteria for 5408.32.30.00, consider 5408.34.30.00 (which has a lower total tax rate of 55.0%) and ensure it matches the description exactly.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.