| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3915300000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

Here is the detailed customs compliance analysis for Soft PVC Material based on the provided HS codes and tariff information:

📦 Product Classification Overview: Soft PVC Material

Below are the HS codes and corresponding tariff details for various classifications of soft PVC material:

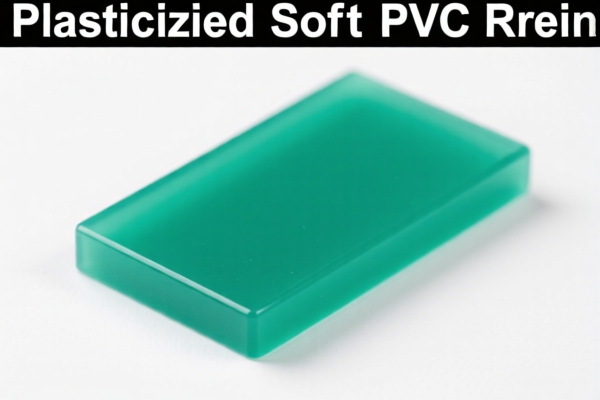

🔢 HS Code: 3904100000 - Soft PVC Resin

- Description: Soft PVC resin (raw material)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is the raw material form of soft PVC.

- Higher tax rate due to being a primary chemical.

- Proactive Advice: Confirm if the product is in resin form and whether it's intended for further processing.

🗑️ HS Code: 3915300000 - Soft PVC Waste

- Description: Soft PVC waste or scrap

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This classification is for waste or scrap of soft PVC.

- Proactive Advice: Ensure the product is not for reprocessing and is classified as waste.

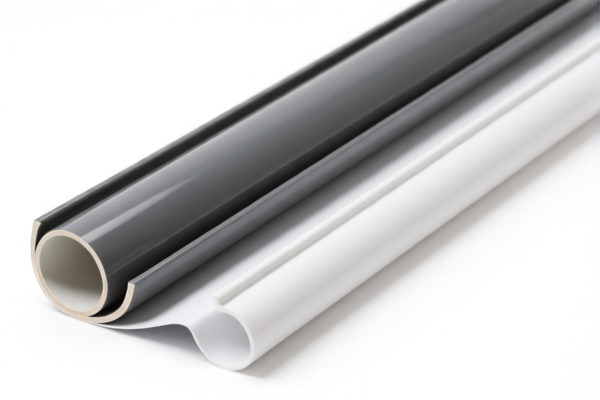

📄 HS Code: 3920490000 - Soft PVC Sheet

- Description: Soft PVC sheet (flexible sheet material)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a finished product in sheet form.

- Proactive Advice: Confirm the thickness and intended use (e.g., for packaging, signage, etc.).

🧱 HS Code: 3916200020 - Soft PVC Profiles

- Description: Soft PVC profiles (e.g., window frames, door frames)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a semi-finished product used in construction or manufacturing.

- Proactive Advice: Verify if the product is custom-made or standard profile.

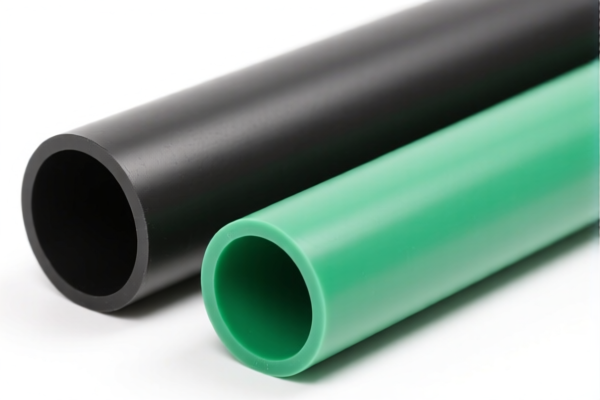

🛠️ HS Code: 3917320010 - Soft PVC Tubing

- Description: Soft PVC tubing (flexible pipes)

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a finished product used in various industries (e.g., medical, plumbing).

- Proactive Advice: Confirm the diameter, length, and application (e.g., medical, industrial).

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for PVC products in this classification.

- Certifications: Ensure compliance with import permits, product standards, and environmental regulations if applicable.

✅ Proactive Actions for Importers:

- Verify the exact product form (resin, waste, sheet, profile, tubing).

- Check the unit price to determine if it falls under a different HS code.

- Confirm the origin of the product to determine if preferential tariffs apply.

- Review documentation (e.g., commercial invoice, packing list, certificate of origin).

- Consult a customs broker for accurate classification and compliance.

Let me know if you need help with customs documentation, tariff calculation, or product classification for a specific shipment. Here is the detailed customs compliance analysis for Soft PVC Material based on the provided HS codes and tariff information:

📦 Product Classification Overview: Soft PVC Material

Below are the HS codes and corresponding tariff details for various classifications of soft PVC material:

🔢 HS Code: 3904100000 - Soft PVC Resin

- Description: Soft PVC resin (raw material)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is the raw material form of soft PVC.

- Higher tax rate due to being a primary chemical.

- Proactive Advice: Confirm if the product is in resin form and whether it's intended for further processing.

🗑️ HS Code: 3915300000 - Soft PVC Waste

- Description: Soft PVC waste or scrap

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This classification is for waste or scrap of soft PVC.

- Proactive Advice: Ensure the product is not for reprocessing and is classified as waste.

📄 HS Code: 3920490000 - Soft PVC Sheet

- Description: Soft PVC sheet (flexible sheet material)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a finished product in sheet form.

- Proactive Advice: Confirm the thickness and intended use (e.g., for packaging, signage, etc.).

🧱 HS Code: 3916200020 - Soft PVC Profiles

- Description: Soft PVC profiles (e.g., window frames, door frames)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a semi-finished product used in construction or manufacturing.

- Proactive Advice: Verify if the product is custom-made or standard profile.

🛠️ HS Code: 3917320010 - Soft PVC Tubing

- Description: Soft PVC tubing (flexible pipes)

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a finished product used in various industries (e.g., medical, plumbing).

- Proactive Advice: Confirm the diameter, length, and application (e.g., medical, industrial).

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for PVC products in this classification.

- Certifications: Ensure compliance with import permits, product standards, and environmental regulations if applicable.

✅ Proactive Actions for Importers:

- Verify the exact product form (resin, waste, sheet, profile, tubing).

- Check the unit price to determine if it falls under a different HS code.

- Confirm the origin of the product to determine if preferential tariffs apply.

- Review documentation (e.g., commercial invoice, packing list, certificate of origin).

- Consult a customs broker for accurate classification and compliance.

Let me know if you need help with customs documentation, tariff calculation, or product classification for a specific shipment.

Customer Reviews

No reviews yet.