| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3915300000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

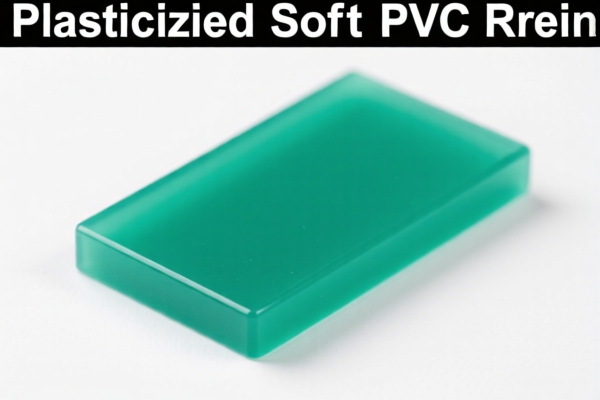

Product Classification: Soft PVC Resin and Related Products

HS CODEs and Tax Information Overview

Below is a structured breakdown of the HS codes and associated tariff information for the declared product "Soft PVC Resin" and related items:

✅ HS CODE: 3904100000

Product Description: Soft PVC Resin (unmixed with other substances)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to pure PVC resin that has not been mixed with other materials.

✅ HS CODE: 3917320050

Product Description: Soft PVC Soft Tubes (plastic soft tubes)

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to finished products such as soft PVC tubes.

✅ HS CODE: 3915300000

Product Description: Soft PVC Waste (vinyl polymer waste)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to waste or scrap of soft PVC.

✅ HS CODE: 3904220000

Product Description: PVC Film or Sheet (primary form of polyvinyl chloride)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to PVC sheets or films in primary form (not processed further).

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning.

-

Anti-dumping duties: Not applicable for PVC resin or related products in this classification (no specific anti-dumping duties listed for these HS codes).

-

Material Verification: Ensure the product is pure PVC resin or not mixed with other substances for HS CODE 3904100000. For processed items like soft tubes or sheets, confirm the finished product status and material composition.

-

Certifications: Check if any customs certifications or product compliance documents are required (e.g., Material Safety Data Sheets, origin certificates, etc.).

-

Unit Price: Verify the unit price and product form (e.g., resin, film, waste) to ensure correct HS code classification and tax calculation.

🛑 Action Required:

- Confirm the exact product form (resin, film, waste, etc.) and material composition.

- Review tariff changes after April 11, 2025 and adjust pricing or sourcing accordingly.

- Ensure all customs documentation is complete and accurate to avoid delays or penalties.

Let me know if you need help with HS code selection or customs compliance for specific product details.

Product Classification: Soft PVC Resin and Related Products

HS CODEs and Tax Information Overview

Below is a structured breakdown of the HS codes and associated tariff information for the declared product "Soft PVC Resin" and related items:

✅ HS CODE: 3904100000

Product Description: Soft PVC Resin (unmixed with other substances)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to pure PVC resin that has not been mixed with other materials.

✅ HS CODE: 3917320050

Product Description: Soft PVC Soft Tubes (plastic soft tubes)

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to finished products such as soft PVC tubes.

✅ HS CODE: 3915300000

Product Description: Soft PVC Waste (vinyl polymer waste)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to waste or scrap of soft PVC.

✅ HS CODE: 3904220000

Product Description: PVC Film or Sheet (primary form of polyvinyl chloride)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to PVC sheets or films in primary form (not processed further).

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning.

-

Anti-dumping duties: Not applicable for PVC resin or related products in this classification (no specific anti-dumping duties listed for these HS codes).

-

Material Verification: Ensure the product is pure PVC resin or not mixed with other substances for HS CODE 3904100000. For processed items like soft tubes or sheets, confirm the finished product status and material composition.

-

Certifications: Check if any customs certifications or product compliance documents are required (e.g., Material Safety Data Sheets, origin certificates, etc.).

-

Unit Price: Verify the unit price and product form (e.g., resin, film, waste) to ensure correct HS code classification and tax calculation.

🛑 Action Required:

- Confirm the exact product form (resin, film, waste, etc.) and material composition.

- Review tariff changes after April 11, 2025 and adjust pricing or sourcing accordingly.

- Ensure all customs documentation is complete and accurate to avoid delays or penalties.

Let me know if you need help with HS code selection or customs compliance for specific product details.

Customer Reviews

No reviews yet.