| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

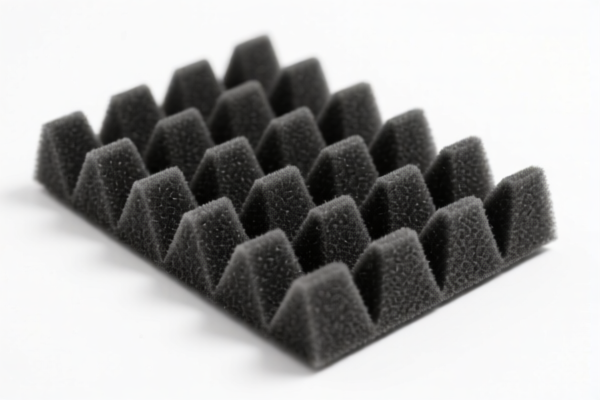

Product Name: Sound Absorbing Polyurethane Textile Composite Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code applies to products where the textile component is not restricted by plant fiber weight.

- Ensure the product description matches the "honeycomb" structure and textile combination.

🔍 HS Code: 3921131500

Description: Polyurethane plastic and plastic combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is broader and may apply to a wider range of composite products.

- Confirm that the product is not more specifically classified under another code (e.g., 3921131950 or 3921131910).

🔍 HS Code: 3921131910

Description: Polyurethane plastic sheets combined with textile materials, where the textile component exceeds any single textile fiber by weight.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is specific to products where the textile component is the heaviest single fiber type.

- Verify the composition by weight to ensure correct classification.

🔍 HS Code: 3921131100

Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is the most favorable tax rate among the four.

- Ensure the product has a honeycomb structure, plastic content >70%, and synthetic fibers are the dominant textile component.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially the type and weight of fibers used.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., fire resistance, acoustic performance) for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all four codes, so plan accordingly for increased costs.

- Consult Customs Authority: If in doubt, seek a pre-classification ruling from the customs authority to avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Product Name: Sound Absorbing Polyurethane Textile Composite Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code applies to products where the textile component is not restricted by plant fiber weight.

- Ensure the product description matches the "honeycomb" structure and textile combination.

🔍 HS Code: 3921131500

Description: Polyurethane plastic and plastic combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is broader and may apply to a wider range of composite products.

- Confirm that the product is not more specifically classified under another code (e.g., 3921131950 or 3921131910).

🔍 HS Code: 3921131910

Description: Polyurethane plastic sheets combined with textile materials, where the textile component exceeds any single textile fiber by weight.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is specific to products where the textile component is the heaviest single fiber type.

- Verify the composition by weight to ensure correct classification.

🔍 HS Code: 3921131100

Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is the most favorable tax rate among the four.

- Ensure the product has a honeycomb structure, plastic content >70%, and synthetic fibers are the dominant textile component.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially the type and weight of fibers used.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., fire resistance, acoustic performance) for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all four codes, so plan accordingly for increased costs.

- Consult Customs Authority: If in doubt, seek a pre-classification ruling from the customs authority to avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.