Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

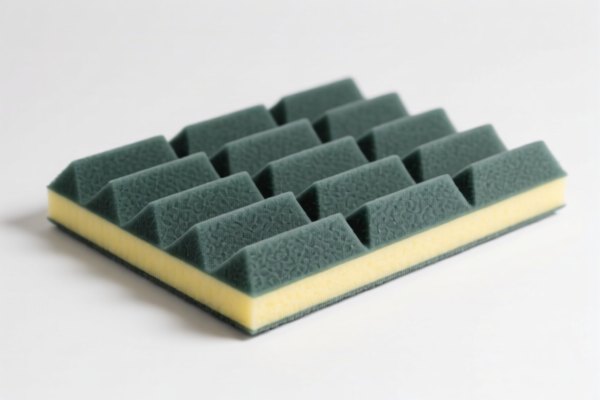

Product Name: Soundproofing Grade Ethylene Elastomer Resin

HS CODE: 3901901000 and 3901105030

🔍 Product Classification Overview

- Material Type: Ethylene-based elastomer resin, used for soundproofing applications.

- HS Code 3901901000:

- Chapter 3901: Polymers of ethylene, in primary forms.

- Subheading 3901901000: Other ethylene polymers, specifically elastic types.

- HS Code 3901105030:

- Chapter 3901: Polymers of ethylene, in primary forms.

- Subheading 3901105030: Medium-density polyethylene, high elasticity.

📊 Tariff Summary (as of now)

HS Code: 3901901000

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS Code: 3901105030

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs will increase from 25.0% to 30.0% for both HS codes.

- Plan ahead: If your product is scheduled for import after this date, the total tax rate will increase by 5 percentage points.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for this product (ethylene elastomer resin).

- Other Anti-Dumping Measures: No known anti-dumping duties currently apply to this HS code classification.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed an ethylene elastomer and not a composite or modified polymer, which may change the HS code.

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the total cost.

- Certifications Required: Ensure compliance with any import certifications (e.g., REACH, RoHS, or customs documentation).

- Consult a Customs Broker: For accurate classification and to avoid delays or penalties during customs clearance.

Let me know if you need help with customs documentation or further clarification on tariff implications.

Product Name: Soundproofing Grade Ethylene Elastomer Resin

HS CODE: 3901901000 and 3901105030

🔍 Product Classification Overview

- Material Type: Ethylene-based elastomer resin, used for soundproofing applications.

- HS Code 3901901000:

- Chapter 3901: Polymers of ethylene, in primary forms.

- Subheading 3901901000: Other ethylene polymers, specifically elastic types.

- HS Code 3901105030:

- Chapter 3901: Polymers of ethylene, in primary forms.

- Subheading 3901105030: Medium-density polyethylene, high elasticity.

📊 Tariff Summary (as of now)

HS Code: 3901901000

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS Code: 3901105030

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs will increase from 25.0% to 30.0% for both HS codes.

- Plan ahead: If your product is scheduled for import after this date, the total tax rate will increase by 5 percentage points.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for this product (ethylene elastomer resin).

- Other Anti-Dumping Measures: No known anti-dumping duties currently apply to this HS code classification.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed an ethylene elastomer and not a composite or modified polymer, which may change the HS code.

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the total cost.

- Certifications Required: Ensure compliance with any import certifications (e.g., REACH, RoHS, or customs documentation).

- Consult a Customs Broker: For accurate classification and to avoid delays or penalties during customs clearance.

Let me know if you need help with customs documentation or further clarification on tariff implications.

Customer Reviews

No reviews yet.