| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

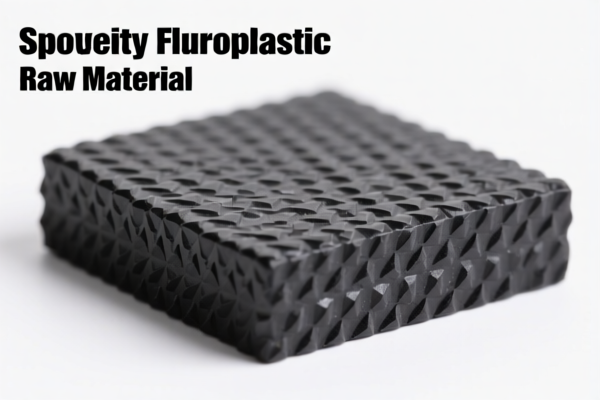

Here is the structured and professional breakdown of the HS codes and associated tariff information for Specialty Fluoroplastic Raw Materials:

✅ HS CODE: 3904695000

Product Description:

- Fluoroplastic raw materials in the primary form of halogenated olefins polymer.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for fluorinated polymers in their primary form.

- Be sure to confirm the exact chemical structure and polymer type to ensure correct classification.

- Proactive Advice: Verify the material composition and obtain any required technical documentation for customs clearance.

✅ HS CODE: 3902205000

Product Description:

- Specialty raw materials for polyisobutylene, classified under 3902.90.00, which covers primary forms of polymers of propylene or other olefins.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to primary forms of polyisobutylene.

- Ensure the product is not processed or modified beyond the primary polymer stage.

- Proactive Advice: Confirm the polymerization process and source of raw materials.

✅ HS CODE: 4002600000

Product Description:

- Fluororubber raw materials, classified under synthetic rubber raw materials.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for fluororubber in its raw, unprocessed form.

- Be cautious of any additives or processing that may change the classification.

- Proactive Advice: Check if the material is blended with other substances, which may affect the HS code.

✅ HS CODE: 3908902000

Product Description:

- High-performance plastic raw materials, classified under polyamide (nylon) in primary form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to polyamide in its primary form.

- Ensure the product is not compounded or modified with fillers or additives.

- Proactive Advice: Confirm the polymer type and whether it is a modified or compounded product.

✅ HS CODE: 3907992000

Product Description:

- Special engineering plastics, typically polyester-based, classified under 3907, covering polyesters and their copolymers.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for polyesters and their copolymers in primary form.

- Be aware of any modifications or blending with other polymers.

- Proactive Advice: Verify the polymer composition and ensure compliance with any technical standards or certifications.

📌 Important Reminders:

- April 11, 2025 Special Tariff: Applies to all the above HS codes. Ensure your import timeline is aligned with this date to avoid unexpected costs.

- Certifications: Some fluoroplastic materials may require specific certifications (e.g., REACH, RoHS, or technical data sheets) for customs clearance.

- Material Verification: Always confirm the exact chemical and polymer composition to avoid misclassification and potential penalties.

Let me know if you need help with HS code verification or customs documentation. Here is the structured and professional breakdown of the HS codes and associated tariff information for Specialty Fluoroplastic Raw Materials:

✅ HS CODE: 3904695000

Product Description:

- Fluoroplastic raw materials in the primary form of halogenated olefins polymer.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for fluorinated polymers in their primary form.

- Be sure to confirm the exact chemical structure and polymer type to ensure correct classification.

- Proactive Advice: Verify the material composition and obtain any required technical documentation for customs clearance.

✅ HS CODE: 3902205000

Product Description:

- Specialty raw materials for polyisobutylene, classified under 3902.90.00, which covers primary forms of polymers of propylene or other olefins.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to primary forms of polyisobutylene.

- Ensure the product is not processed or modified beyond the primary polymer stage.

- Proactive Advice: Confirm the polymerization process and source of raw materials.

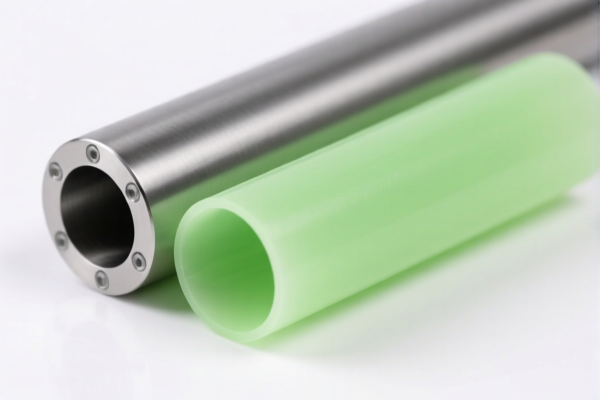

✅ HS CODE: 4002600000

Product Description:

- Fluororubber raw materials, classified under synthetic rubber raw materials.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for fluororubber in its raw, unprocessed form.

- Be cautious of any additives or processing that may change the classification.

- Proactive Advice: Check if the material is blended with other substances, which may affect the HS code.

✅ HS CODE: 3908902000

Product Description:

- High-performance plastic raw materials, classified under polyamide (nylon) in primary form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to polyamide in its primary form.

- Ensure the product is not compounded or modified with fillers or additives.

- Proactive Advice: Confirm the polymer type and whether it is a modified or compounded product.

✅ HS CODE: 3907992000

Product Description:

- Special engineering plastics, typically polyester-based, classified under 3907, covering polyesters and their copolymers.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for polyesters and their copolymers in primary form.

- Be aware of any modifications or blending with other polymers.

- Proactive Advice: Verify the polymer composition and ensure compliance with any technical standards or certifications.

📌 Important Reminders:

- April 11, 2025 Special Tariff: Applies to all the above HS codes. Ensure your import timeline is aligned with this date to avoid unexpected costs.

- Certifications: Some fluoroplastic materials may require specific certifications (e.g., REACH, RoHS, or technical data sheets) for customs clearance.

- Material Verification: Always confirm the exact chemical and polymer composition to avoid misclassification and potential penalties.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.