| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4418999195 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4418999140 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4403240165 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4403230116 | Doc | 55.0% | CN | US | 2025-05-12 |

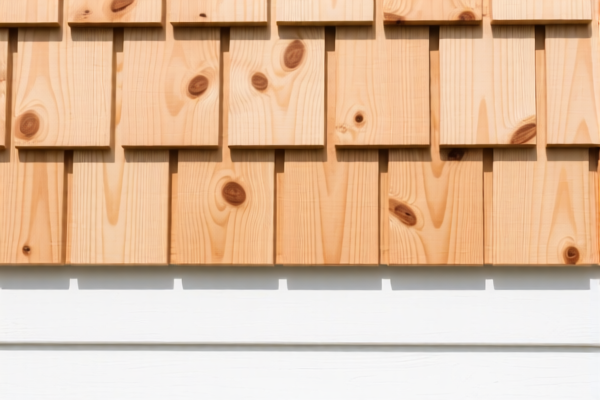

Customs Compliance Analysis for Spruce Wood Siding (Other)

Below is a structured breakdown of the HS codes and associated tariff rates for the products you've listed, with a focus on Spruce Wood Siding (Other), which is likely covered under HS Code 4418999195 or 4418999140.

✅ HS Code: 4418999195

Product Description:

- Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Other: Other Other: Other

Tariff Breakdown: - Base Tariff Rate: 3.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff Rate: 58.2%

✅ HS Code: 4418999140

Product Description:

- Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Other: Other Other: Other fabricated structural wood members

Tariff Breakdown: - Base Tariff Rate: 3.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff Rate: 58.2%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

No Anti-Dumping or Countervailing Duties:

As of now, there are no specific anti-dumping or countervailing duties reported for these HS codes in the context of spruce wood siding.

📌 Proactive Advice for Importers:

-

Verify Product Classification:

Ensure that your product is correctly classified under HS Code 4418999195 or 4418999140. Misclassification can lead to penalties or delays. -

Check Material Specifications:

Confirm the type of wood (e.g., spruce, fir), processing (rough or finished), and intended use (e.g., siding, flooring, structural members) to ensure proper classification. -

Review Documentation:

Prepare all necessary certifications, origin documents, and compliance statements to support your import declaration. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, and consider import timing to optimize costs.

📊 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 4418999195 | Builders' joinery, shingles, shakes (other) | 3.2% | 25.0% | 30.0% | 58.2% |

| 4418999140 | Structural wood members (other) | 3.2% | 25.0% | 30.0% | 58.2% |

If you need further clarification on certification requirements or origin rules, feel free to provide more details about the product's country of origin and intended market.

Customs Compliance Analysis for Spruce Wood Siding (Other)

Below is a structured breakdown of the HS codes and associated tariff rates for the products you've listed, with a focus on Spruce Wood Siding (Other), which is likely covered under HS Code 4418999195 or 4418999140.

✅ HS Code: 4418999195

Product Description:

- Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Other: Other Other: Other

Tariff Breakdown: - Base Tariff Rate: 3.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff Rate: 58.2%

✅ HS Code: 4418999140

Product Description:

- Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Other: Other Other: Other fabricated structural wood members

Tariff Breakdown: - Base Tariff Rate: 3.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff Rate: 58.2%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

No Anti-Dumping or Countervailing Duties:

As of now, there are no specific anti-dumping or countervailing duties reported for these HS codes in the context of spruce wood siding.

📌 Proactive Advice for Importers:

-

Verify Product Classification:

Ensure that your product is correctly classified under HS Code 4418999195 or 4418999140. Misclassification can lead to penalties or delays. -

Check Material Specifications:

Confirm the type of wood (e.g., spruce, fir), processing (rough or finished), and intended use (e.g., siding, flooring, structural members) to ensure proper classification. -

Review Documentation:

Prepare all necessary certifications, origin documents, and compliance statements to support your import declaration. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, and consider import timing to optimize costs.

📊 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 4418999195 | Builders' joinery, shingles, shakes (other) | 3.2% | 25.0% | 30.0% | 58.2% |

| 4418999140 | Structural wood members (other) | 3.2% | 25.0% | 30.0% | 58.2% |

If you need further clarification on certification requirements or origin rules, feel free to provide more details about the product's country of origin and intended market.

Customer Reviews

No reviews yet.