| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

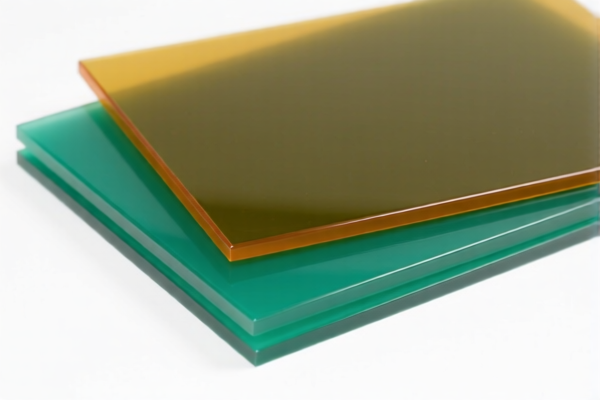

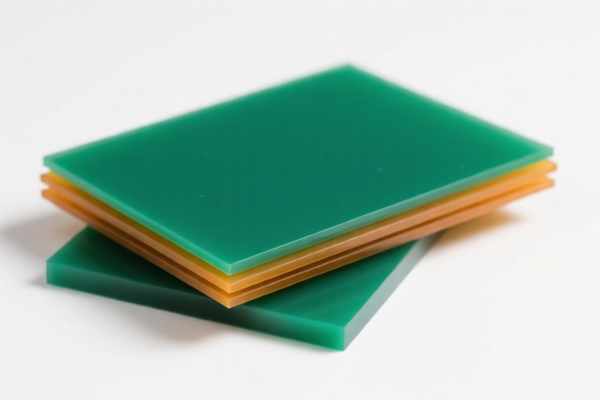

Product Classification: Supported Phenolic Resin Sheets

Based on your input, the product "Supported Phenolic Resin Sheets" can be classified under the following HS codes, depending on its specific form and use:

✅ HS CODE: 3920940000

Description:

- Applies to non-cellular and non-reinforced phenolic resin plastic sheets, plates, films, foils, and strips, including phenolic resin boards used in construction, furniture, packaging, and chemical applications.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes: - This classification is suitable if the product is a non-reinforced phenolic resin sheet and not in a cellular or foam-like structure. - Ensure the product is not reinforced (e.g., with fiber or fabric) to qualify under this code.

✅ HS CODE: 3909390000

Description:

- Applies to primary forms of phenolic resin products, such as phenolic resin sheets in their raw or semi-processed state.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is more appropriate if the product is in a primary or raw form, such as phenolic resin sheets before final processing. - If the product is already processed into a finished product (e.g., for furniture or construction), 3920940000 is likely the correct classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is reinforced or non-reinforced, and whether it is in a primary form or finished product.

- Check Unit Price and Certification: Some customs authorities may require technical specifications or certifications (e.g., material safety, fire resistance) for phenolic resin products.

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025 — ensure your import timeline aligns with this.

- Consider Anti-Dumping Duties: If the product is made of iron or aluminum, check for any anti-dumping duties that may apply (though not directly relevant to phenolic resin, it's worth noting for related components).

📌 Action Steps:

- Confirm the exact product form (reinforced vs. non-reinforced, primary vs. finished).

- Obtain technical documentation (e.g., material composition, intended use).

- Review customs declarations and ensure the correct HS code is used to avoid penalties.

- Stay updated on tariff changes and trade policies post-April 11, 2025.

Let me know if you need help with HS code selection based on specific product details.

Product Classification: Supported Phenolic Resin Sheets

Based on your input, the product "Supported Phenolic Resin Sheets" can be classified under the following HS codes, depending on its specific form and use:

✅ HS CODE: 3920940000

Description:

- Applies to non-cellular and non-reinforced phenolic resin plastic sheets, plates, films, foils, and strips, including phenolic resin boards used in construction, furniture, packaging, and chemical applications.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes: - This classification is suitable if the product is a non-reinforced phenolic resin sheet and not in a cellular or foam-like structure. - Ensure the product is not reinforced (e.g., with fiber or fabric) to qualify under this code.

✅ HS CODE: 3909390000

Description:

- Applies to primary forms of phenolic resin products, such as phenolic resin sheets in their raw or semi-processed state.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is more appropriate if the product is in a primary or raw form, such as phenolic resin sheets before final processing. - If the product is already processed into a finished product (e.g., for furniture or construction), 3920940000 is likely the correct classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is reinforced or non-reinforced, and whether it is in a primary form or finished product.

- Check Unit Price and Certification: Some customs authorities may require technical specifications or certifications (e.g., material safety, fire resistance) for phenolic resin products.

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025 — ensure your import timeline aligns with this.

- Consider Anti-Dumping Duties: If the product is made of iron or aluminum, check for any anti-dumping duties that may apply (though not directly relevant to phenolic resin, it's worth noting for related components).

📌 Action Steps:

- Confirm the exact product form (reinforced vs. non-reinforced, primary vs. finished).

- Obtain technical documentation (e.g., material composition, intended use).

- Review customs declarations and ensure the correct HS code is used to avoid penalties.

- Stay updated on tariff changes and trade policies post-April 11, 2025.

Let me know if you need help with HS code selection based on specific product details.

Customer Reviews

No reviews yet.