| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4810991050 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4810291035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810131140 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810141300 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810921235 | Doc | 55.0% | CN | US | 2025-05-12 |

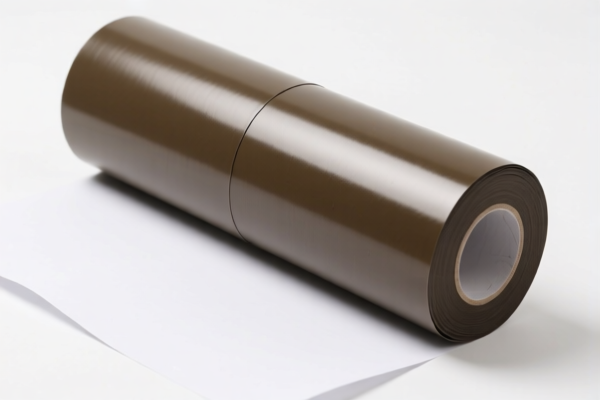

Product Classification: Surface Coated Paper Rolls

HS CODEs and Tax Information Overview:

- HS CODE: 4810991050

- Description: Surface coated paper rolls, coated with kaolin or other inorganic substances, in rolls or rectangular form.

- Total Tax Rate: 30.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810291035

- Description: Surface coated paper rolls, coated with kaolin or other inorganic substances, in rolls.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810131140

- Description: Printed surface coated paper rolls, coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810141300

- Description: Coated writing paper rolls, coated with kaolin, for writing, printing, or other graphic purposes.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810921235

- Description: Coated paperboard rolls, coated with kaolin or other inorganic substances.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

✅ Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for customs clearance planning.

- Base Tariff: All products have a 0.0% base tariff, but additional tariffs apply.

- Additional Tariff: Most products are subject to a 25.0% additional tariff, except for 4810991050, which has 0.0% additional tariff.

- No Anti-Dumping Duties: None of the listed HS codes are subject to anti-dumping duties on iron or aluminum.

🛑 Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition of the paper (e.g., kaolin content, coating type) and unit price to ensure correct classification.

- Check Required Certifications: Ensure compliance with any required documentation (e.g., import licenses, product standards).

- Monitor April 11, 2025 Deadline: If your shipment is planned after this date, be prepared for the 30.0% additional tariff.

-

Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays. Product Classification: Surface Coated Paper Rolls

HS CODEs and Tax Information Overview: -

HS CODE: 4810991050

- Description: Surface coated paper rolls, coated with kaolin or other inorganic substances, in rolls or rectangular form.

- Total Tax Rate: 30.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810291035

- Description: Surface coated paper rolls, coated with kaolin or other inorganic substances, in rolls.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810131140

- Description: Printed surface coated paper rolls, coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810141300

- Description: Coated writing paper rolls, coated with kaolin, for writing, printing, or other graphic purposes.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

-

HS CODE: 4810921235

- Description: Coated paperboard rolls, coated with kaolin or other inorganic substances.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply.

✅ Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for customs clearance planning.

- Base Tariff: All products have a 0.0% base tariff, but additional tariffs apply.

- Additional Tariff: Most products are subject to a 25.0% additional tariff, except for 4810991050, which has 0.0% additional tariff.

- No Anti-Dumping Duties: None of the listed HS codes are subject to anti-dumping duties on iron or aluminum.

🛑 Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition of the paper (e.g., kaolin content, coating type) and unit price to ensure correct classification.

- Check Required Certifications: Ensure compliance with any required documentation (e.g., import licenses, product standards).

- Monitor April 11, 2025 Deadline: If your shipment is planned after this date, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays.

Customer Reviews

No reviews yet.