| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922200000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 4016931050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8309900090 | Doc | 57.6% | CN | US | 2025-05-12 |

Okay, let's break down the classification and tax implications for "TOILET SEAT GASKET" based on the provided HS codes. Here's a detailed analysis, presented in a structured format to help you understand the options and what you need to consider:

Understanding HS Codes: A Quick Primer

Before diving into the specifics, remember that HS codes are internationally standardized. The first two digits generally indicate the chapter, the next two the subheading, and further digits provide more specific classifications. Changes in tariffs often happen at the subheading level (first four digits) or even more granular levels.

1. HS Code 3922.20.00.00 – Baths, shower baths, sinks…seats and covers, flushing cisterns of plastics

- Chapter 39: Plastics and articles thereof. This chapter covers items made primarily from plastic.

- Subheading 3922: Baths, shower baths, sinks, washbasins, bidets, lavatory pans, seats and covers, flushing cisterns and similar sanitary ware.

-

3922.20.00.00: Specifically for lavatory seats and covers made of plastics.

- Tax Details:

- Basic Tariff: 6.3%

- Additional Tariff: 7.5%

- Post April 2, 2025 Additional Tariff: 30%

- Total Tax: 43.8%

- Applicability: This code is a strong contender if your toilet seat gasket is made entirely or primarily of plastic and is designed as a seat or cover component.

- Important Considerations:

- Material Composition: Confirm the primary material is indeed plastic. If it contains significant amounts of rubber or metal, this code may not be appropriate.

- Function: Is it sold as a seat or cover component, or as a separate replacement part?

- Tax Details:

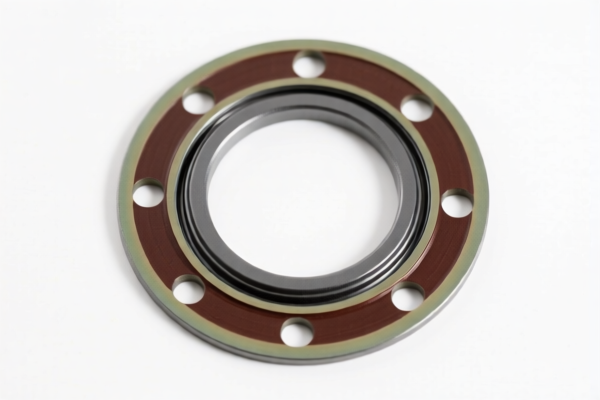

2. HS Code 4016.93.10.50 – Other articles of vulcanized rubber other than hard rubber

- Chapter 40: Rubber and articles thereof. This chapter covers items made from natural or synthetic rubber.

- Subheading 4016: Other articles of vulcanized rubber other than hard rubber.

-

4016.93.10.50: Specifically for gaskets, washers, and other seals used in automotive goods (Chapter 87).

- Tax Details:

- Basic Tariff: 2.5%

- Additional Tariff: 25.0%

- Post April 2, 2025 Additional Tariff: 30%

- Total Tax: 57.5%

- Applicability: This code is relevant if your gasket is made of vulcanized rubber and is specifically designed for use in automotive applications. However, the description is quite specific to automotive goods.

- Important Considerations:

- Material Composition: Confirm the material is vulcanized rubber.

- End Use: Is it exclusively for automotive toilet systems? If it's for general plumbing or other applications, this code is likely incorrect.

- Tax Details:

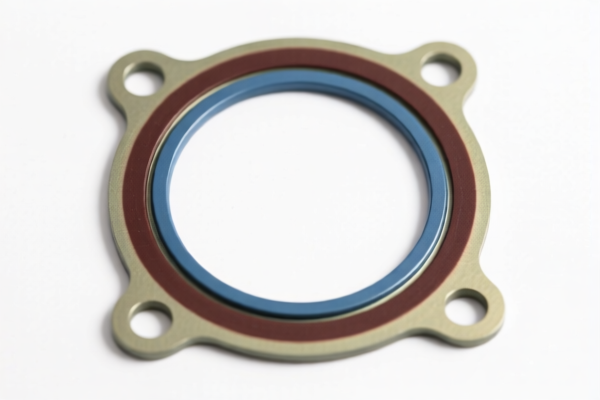

3. HS Code 8309.90.00.90 – Stoppers, caps and lids…seals and other packing accessories, and parts thereof, of base metal

- Chapter 83: Miscellaneous articles of base metal. This chapter covers a wide range of metal articles.

- Subheading 8309: Stoppers, caps and lids, capsules for bottles, threaded bungs, bung covers, seals and other packing accessories, and parts thereof.

-

8309.90.00.90: "Other" – a catch-all for packing accessories not specifically classified elsewhere.

- Tax Details:

- Basic Tariff: 2.6%

- Additional Tariff: 25.0%

- Post April 2, 2025 Additional Tariff: 30%

- Total Tax: 57.6%

- Applicability: This code is a possibility if your gasket is made of base metal (e.g., aluminum, steel) and doesn't fit neatly into the other categories.

- Important Considerations:

- Material Composition: Confirm the material is a base metal.

- Function: This is a broad category. Ensure it's not more specifically covered by another code.

- Tax Details:

Recommendation & Next Steps

Based on the limited information, HS Code 3922.20.00.00 (Plastics) appears to be the most likely candidate if the gasket is primarily plastic. However, the material composition is critical.

Crucial Actions:

- Confirm Material Composition: Get a precise breakdown of the materials used in the gasket.

- Determine End Use: How is the gasket marketed and sold? What is its intended application?

- Review Specific Tariff Rules: Always consult the official tariff schedule for your importing country for the most up-to-date information and any specific notes or exclusions.

- Consider a Binding Ruling: If you are unsure, you can request a binding ruling from your customs authority. This provides a legally binding classification for your product.

- Check for Certifications: Depending on the country of import, you may need specific certifications (e.g., for water contact materials).

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. You should always consult with a qualified customs broker or your local customs authority for accurate and specific guidance.

Customer Reviews

No reviews yet.