Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4105101000 | Doc | 32.0% | CN | US | 2025-05-12 |

| 4103901200 | Doc | 37.5% | CN | US | 2025-05-12 |

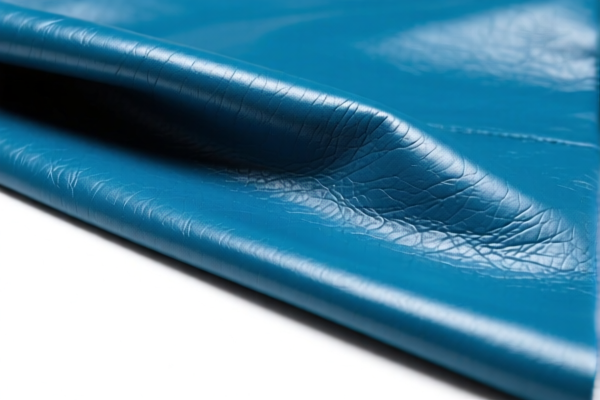

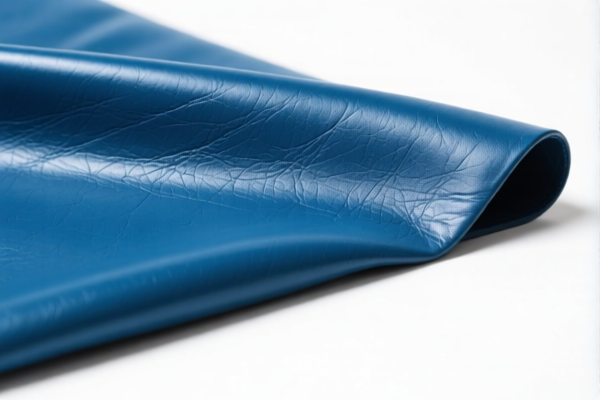

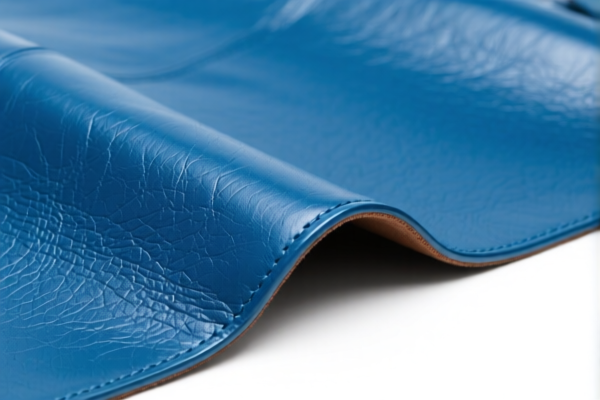

Product Name: Tanned Wet Blue Lambskin

Classification: HS Code 4105101000 or 4103901200 (depending on specific processing)

🔍 HS Code Classification Overview

- HS Code 4105101000

- Description: Untanned or tanned but not further worked, sheep or lamb skins, without hair, whether split or not, but not further worked — wet blue (including wet blue skins).

-

Applicable for: Wet blue lambskin that has not undergone further processing or dyeing.

-

HS Code 4103901200

- Description: Tanned, but not further worked, sheep or lamb skins, whether split or not, but not further worked — plant-tanned pre-treated sheepskin.

- Applicable for: Plant-tanned lambskin that has been pre-treated but not further processed.

📊 Tariff Summary (as of now)

HS Code 4105101000

- Base Tariff Rate: 2.0%

- Additional Tariff (if applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 32.0%

HS Code 4103901200

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both HS codes after this date. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not currently applicable for this product category.

- Material Verification: Confirm the exact processing stage (e.g., whether it is wet blue or plant-tanned) to ensure correct HS code classification.

- Certifications: Check if any specific certifications (e.g., origin, environmental compliance) are required for import.

✅ Proactive Advice

- Verify Material Details: Confirm whether the product is wet blue or plant-tanned, as this determines the correct HS code.

- Check Unit Price: The final tax amount depends on the declared value, so ensure accurate pricing.

- Plan Ahead for April 11, 2025: If importing after this date, budget for the 30% additional tariff.

- Consult Customs Broker: For complex cases, seek professional help to avoid misclassification and penalties.

Let me know if you need further clarification or assistance with customs documentation.

Product Name: Tanned Wet Blue Lambskin

Classification: HS Code 4105101000 or 4103901200 (depending on specific processing)

🔍 HS Code Classification Overview

- HS Code 4105101000

- Description: Untanned or tanned but not further worked, sheep or lamb skins, without hair, whether split or not, but not further worked — wet blue (including wet blue skins).

-

Applicable for: Wet blue lambskin that has not undergone further processing or dyeing.

-

HS Code 4103901200

- Description: Tanned, but not further worked, sheep or lamb skins, whether split or not, but not further worked — plant-tanned pre-treated sheepskin.

- Applicable for: Plant-tanned lambskin that has been pre-treated but not further processed.

📊 Tariff Summary (as of now)

HS Code 4105101000

- Base Tariff Rate: 2.0%

- Additional Tariff (if applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 32.0%

HS Code 4103901200

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both HS codes after this date. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not currently applicable for this product category.

- Material Verification: Confirm the exact processing stage (e.g., whether it is wet blue or plant-tanned) to ensure correct HS code classification.

- Certifications: Check if any specific certifications (e.g., origin, environmental compliance) are required for import.

✅ Proactive Advice

- Verify Material Details: Confirm whether the product is wet blue or plant-tanned, as this determines the correct HS code.

- Check Unit Price: The final tax amount depends on the declared value, so ensure accurate pricing.

- Plan Ahead for April 11, 2025: If importing after this date, budget for the 30% additional tariff.

- Consult Customs Broker: For complex cases, seek professional help to avoid misclassification and penalties.

Let me know if you need further clarification or assistance with customs documentation.

Customer Reviews

No reviews yet.