| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

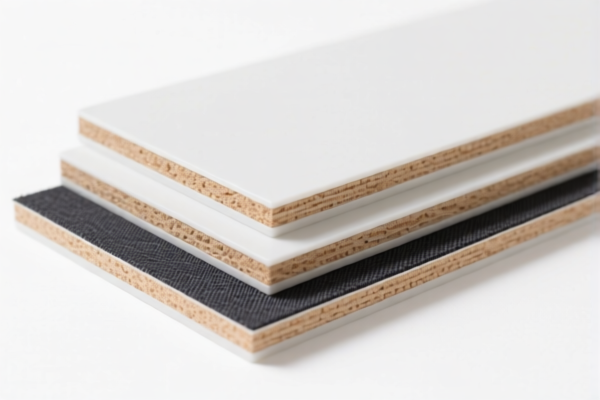

Product Classification: Textile Composite Plastic Antibacterial Boards

Below is the detailed classification and tariff information for the declared product based on the provided HS codes and summaries:

1. HS CODE: 3921902900

Description:

- Applicable to antibacterial textile plastic boards.

- Classified as other plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary:

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

2. HS CODE: 3921902550

Description:

- Applicable to medical textile composite plastic boards.

- Classified as plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single textile fiber.

- Plastic component constitutes more than 70% of the product's weight.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

3. HS CODE: 3921131950

Description:

- Applicable to polyurethane textile composite antibacterial boards.

- Classified as polyurethane plastic sheets combined with textile materials.

- Plant fiber weight is not specified, and it falls under the "other" category.

Tariff Summary:

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

4. HS CODE: 3921131910

Description:

- Applicable to textile composite polyurethane antibacterial coated boards.

- Classified as products combined with textile materials, where textile components weigh more than any other single textile fiber.

Tariff Summary:

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

5. HS CODE: 3921902550 (Duplicate Entry)

Note: This code is repeated in the input. The classification and tariff details are identical to entry #2 above.

Key Observations and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material Composition Matters:

-

The weight ratio of plastic to textile components is critical for accurate classification. Verify the exact composition (e.g., plastic >70%, synthetic fiber > other fibers) to avoid misclassification.

-

Certifications Required:

-

If the product is medical-grade or antibacterial, check if certifications (e.g., ISO, FDA, or specific import permits) are required for customs clearance.

-

Unit Price and Material Verification:

- Confirm the unit price and material specifications with suppliers to ensure compliance with customs regulations and avoid delays.

Proactive Advice:

- Double-check the HS code based on the exact composition and intended use of the product (e.g., medical vs. general use).

- Consult a customs broker or import compliance expert for final confirmation, especially if the product is being imported into China or other countries with strict classification rules.

- Keep documentation on file, including material breakdowns, certifications, and product specifications, to support customs declarations.

Product Classification: Textile Composite Plastic Antibacterial Boards

Below is the detailed classification and tariff information for the declared product based on the provided HS codes and summaries:

1. HS CODE: 3921902900

Description:

- Applicable to antibacterial textile plastic boards.

- Classified as other plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary:

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

2. HS CODE: 3921902550

Description:

- Applicable to medical textile composite plastic boards.

- Classified as plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single textile fiber.

- Plastic component constitutes more than 70% of the product's weight.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

3. HS CODE: 3921131950

Description:

- Applicable to polyurethane textile composite antibacterial boards.

- Classified as polyurethane plastic sheets combined with textile materials.

- Plant fiber weight is not specified, and it falls under the "other" category.

Tariff Summary:

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

4. HS CODE: 3921131910

Description:

- Applicable to textile composite polyurethane antibacterial coated boards.

- Classified as products combined with textile materials, where textile components weigh more than any other single textile fiber.

Tariff Summary:

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

5. HS CODE: 3921902550 (Duplicate Entry)

Note: This code is repeated in the input. The classification and tariff details are identical to entry #2 above.

Key Observations and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material Composition Matters:

-

The weight ratio of plastic to textile components is critical for accurate classification. Verify the exact composition (e.g., plastic >70%, synthetic fiber > other fibers) to avoid misclassification.

-

Certifications Required:

-

If the product is medical-grade or antibacterial, check if certifications (e.g., ISO, FDA, or specific import permits) are required for customs clearance.

-

Unit Price and Material Verification:

- Confirm the unit price and material specifications with suppliers to ensure compliance with customs regulations and avoid delays.

Proactive Advice:

- Double-check the HS code based on the exact composition and intended use of the product (e.g., medical vs. general use).

- Consult a customs broker or import compliance expert for final confirmation, especially if the product is being imported into China or other countries with strict classification rules.

- Keep documentation on file, including material breakdowns, certifications, and product specifications, to support customs declarations.

Customer Reviews

No reviews yet.