| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

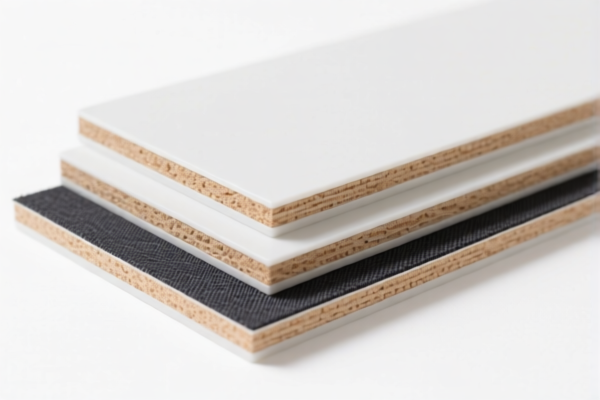

Product Classification: Textile Composite Plastic Anticorrosion Boards

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921131100

- Product Name: Polyurethane Textile Composite Anticorrosion Board

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to polyurethane-based composite boards with textile reinforcement.

-

HS CODE: 3921901910

- Product Name 1: Textile Composite Plastic UV-Resistant Board

- Product Name 2: Textile Backed Plastic Anticorrosion Board

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to multiple product types with textile backing or UV resistance features.

-

HS CODE: 3921902510

- Product Name: Textile Reinforced Plastic Composite Board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for reinforced composite boards with textile layers, likely used in industrial applications.

-

HS CODE: 3921902900

- Product Name: Textile Composite Plastic Board

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for textile composite plastic boards not covered by more specific codes.

Key Observations:

-

Tariff Increase Alert:

A 30.0% additional tariff is imposed after April 11, 2025, for all the listed HS codes. This is a significant increase and should be factored into cost planning. -

Anti-Dumping Duty Note:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain plastic and metal products, especially if imported from countries with known dumping practices. Verify if your product is subject to such duties. -

Certification Requirements:

- Ensure your product meets customs classification criteria and has proper technical documentation (e.g., material composition, manufacturing process).

-

Confirm if certifications (e.g., fire resistance, UV resistance, or environmental compliance) are required for import.

-

Proactive Advice:

- Verify the exact material composition (e.g., type of plastic, textile used) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult a customs broker or tax authority for confirmation, especially if the product is used in sensitive industries (e.g., construction, chemical).

Let me know if you need help with HS code verification or customs documentation.

Product Classification: Textile Composite Plastic Anticorrosion Boards

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921131100

- Product Name: Polyurethane Textile Composite Anticorrosion Board

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to polyurethane-based composite boards with textile reinforcement.

-

HS CODE: 3921901910

- Product Name 1: Textile Composite Plastic UV-Resistant Board

- Product Name 2: Textile Backed Plastic Anticorrosion Board

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to multiple product types with textile backing or UV resistance features.

-

HS CODE: 3921902510

- Product Name: Textile Reinforced Plastic Composite Board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for reinforced composite boards with textile layers, likely used in industrial applications.

-

HS CODE: 3921902900

- Product Name: Textile Composite Plastic Board

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for textile composite plastic boards not covered by more specific codes.

Key Observations:

-

Tariff Increase Alert:

A 30.0% additional tariff is imposed after April 11, 2025, for all the listed HS codes. This is a significant increase and should be factored into cost planning. -

Anti-Dumping Duty Note:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain plastic and metal products, especially if imported from countries with known dumping practices. Verify if your product is subject to such duties. -

Certification Requirements:

- Ensure your product meets customs classification criteria and has proper technical documentation (e.g., material composition, manufacturing process).

-

Confirm if certifications (e.g., fire resistance, UV resistance, or environmental compliance) are required for import.

-

Proactive Advice:

- Verify the exact material composition (e.g., type of plastic, textile used) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult a customs broker or tax authority for confirmation, especially if the product is used in sensitive industries (e.g., construction, chemical).

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.