| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4811594040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

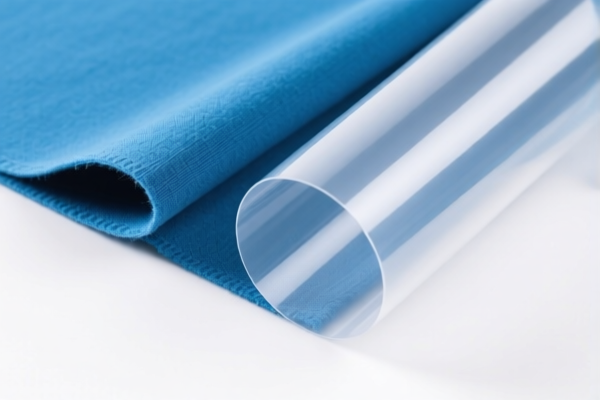

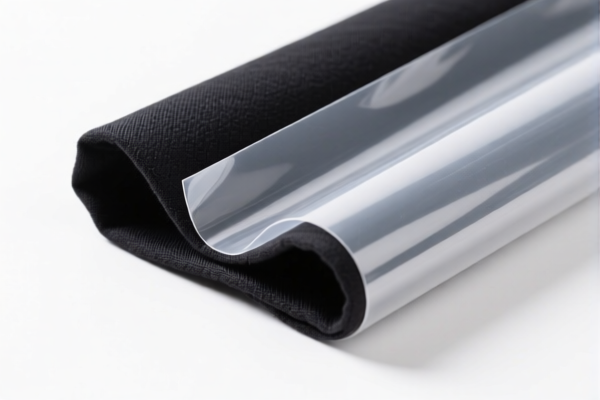

Product Name: Textile Composite Plastic Antistatic Films

Classification: Plastic films with textile composite and antistatic properties

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tax details for your product:

🔢 HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic films, not specifically for composite or antistatic materials.

- Recommendation: Confirm if this code is the most accurate for your product, especially if it contains textile composites or antistatic additives.

🔢 HS CODE: 3921904090

Description: Flexible plastic sheets, plates, films, foils and strips, not specially reinforced

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible plastic films, which may be applicable if your product is not reinforced.

- Recommendation: If your product is flexible and not reinforced, this could be a suitable code.

🔢 HS CODE: 3920992000

Description: Laminated, supported or otherwise combined with other materials, plastic sheets, plates, films, etc.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for composite materials, which may be more accurate if your product is a combination of plastic and textile.

- Recommendation: If your product is a composite of plastic and textile, this may be the most appropriate code.

🔢 HS CODE: 4811594040

Description: Paper coated or impregnated with plastic

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for paper with plastic coating, not for plastic films with textile composites.

- Recommendation: Not suitable for your product unless it is paper-based with plastic coating.

⚠️ Important Notes and Recommendations

- April 11, 2025 Tariff: All the above codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm the exact composition of your product (e.g., type of plastic, textile content, antistatic treatment) to ensure correct classification.

- Certifications: Check if any certifications (e.g., antistatic, fire resistance, environmental compliance) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

📌 Proactive Advice

- Double-check the product composition to ensure the most accurate HS code is used.

- Consult a customs broker or classification expert if the product contains multiple materials or special treatments.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with a specific HS code selection or documentation.

Product Name: Textile Composite Plastic Antistatic Films

Classification: Plastic films with textile composite and antistatic properties

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tax details for your product:

🔢 HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic films, not specifically for composite or antistatic materials.

- Recommendation: Confirm if this code is the most accurate for your product, especially if it contains textile composites or antistatic additives.

🔢 HS CODE: 3921904090

Description: Flexible plastic sheets, plates, films, foils and strips, not specially reinforced

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible plastic films, which may be applicable if your product is not reinforced.

- Recommendation: If your product is flexible and not reinforced, this could be a suitable code.

🔢 HS CODE: 3920992000

Description: Laminated, supported or otherwise combined with other materials, plastic sheets, plates, films, etc.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for composite materials, which may be more accurate if your product is a combination of plastic and textile.

- Recommendation: If your product is a composite of plastic and textile, this may be the most appropriate code.

🔢 HS CODE: 4811594040

Description: Paper coated or impregnated with plastic

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for paper with plastic coating, not for plastic films with textile composites.

- Recommendation: Not suitable for your product unless it is paper-based with plastic coating.

⚠️ Important Notes and Recommendations

- April 11, 2025 Tariff: All the above codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm the exact composition of your product (e.g., type of plastic, textile content, antistatic treatment) to ensure correct classification.

- Certifications: Check if any certifications (e.g., antistatic, fire resistance, environmental compliance) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

📌 Proactive Advice

- Double-check the product composition to ensure the most accurate HS code is used.

- Consult a customs broker or classification expert if the product contains multiple materials or special treatments.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with a specific HS code selection or documentation.

Customer Reviews

No reviews yet.