| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

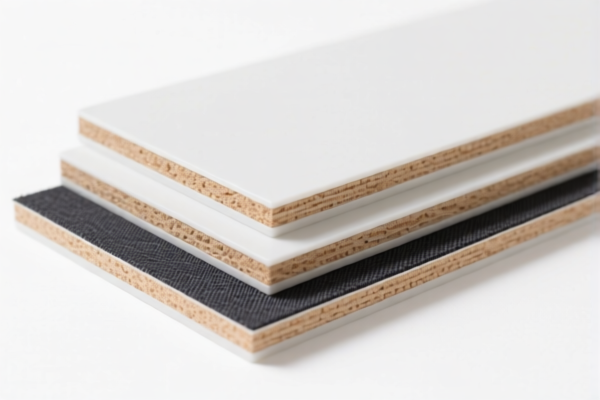

Product Classification: Textile Composite Plastic Building Boards

HS CODEs and Tax Information Overview:

- HS CODE: 3921902550

- Description: Plastic boards composite with textile materials, such as polyester fiber plastic composite boards.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for textile-composite plastic boards with a defined composition.

-

HS CODE: 3921902900

- Description: Textile composite plastic boards, applicable for plastic sheets, films, foils, etc., composite with other materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for composite plastic boards with specific weight and material requirements.

-

HS CODE: 3920995000

- Description: Composite plastic boards, including laminated or supported with other materials, for non-cellular and non-reinforced plastics.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is broader and includes various composite plastic boards.

-

HS CODE: 3920690000

- Description: Polyester composite boards, non-cellular and non-reinforced plastic boards with polyester as the main component.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyester-based composite boards.

-

HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, etc., such as composite plastic boards.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower additional tariff but still applies the special tariff after April 11, 2025.

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (e.g., polyester, textile composites, etc.).

- Check Unit Price and Weight: Some HS codes (e.g., 3921902900) have specific weight thresholds (e.g., >1.492 kg/m²).

- Certifications Required: Confirm if any certifications (e.g., safety, environmental compliance) are needed for import.

- Monitor Tariff Changes: The special tariff of 30.0% applies after April 11, 2025—plan accordingly for cost estimation and compliance.

-

Anti-Dumping Duties: If the product is imported from countries under anti-dumping measures, additional duties may apply. Check with customs or a trade compliance expert. Product Classification: Textile Composite Plastic Building Boards

HS CODEs and Tax Information Overview: -

HS CODE: 3921902550

- Description: Plastic boards composite with textile materials, such as polyester fiber plastic composite boards.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for textile-composite plastic boards with a defined composition.

-

HS CODE: 3921902900

- Description: Textile composite plastic boards, applicable for plastic sheets, films, foils, etc., composite with other materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for composite plastic boards with specific weight and material requirements.

-

HS CODE: 3920995000

- Description: Composite plastic boards, including laminated or supported with other materials, for non-cellular and non-reinforced plastics.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is broader and includes various composite plastic boards.

-

HS CODE: 3920690000

- Description: Polyester composite boards, non-cellular and non-reinforced plastic boards with polyester as the main component.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyester-based composite boards.

-

HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, etc., such as composite plastic boards.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower additional tariff but still applies the special tariff after April 11, 2025.

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (e.g., polyester, textile composites, etc.).

- Check Unit Price and Weight: Some HS codes (e.g., 3921902900) have specific weight thresholds (e.g., >1.492 kg/m²).

- Certifications Required: Confirm if any certifications (e.g., safety, environmental compliance) are needed for import.

- Monitor Tariff Changes: The special tariff of 30.0% applies after April 11, 2025—plan accordingly for cost estimation and compliance.

- Anti-Dumping Duties: If the product is imported from countries under anti-dumping measures, additional duties may apply. Check with customs or a trade compliance expert.

Customer Reviews

No reviews yet.