| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Coated Films, based on the provided HS codes and tax details:

✅ HS CODE: 3921901100

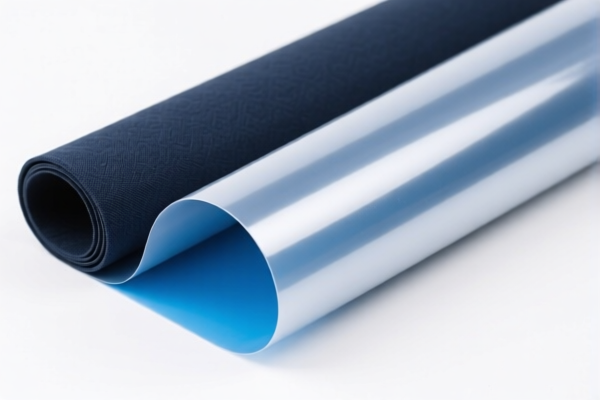

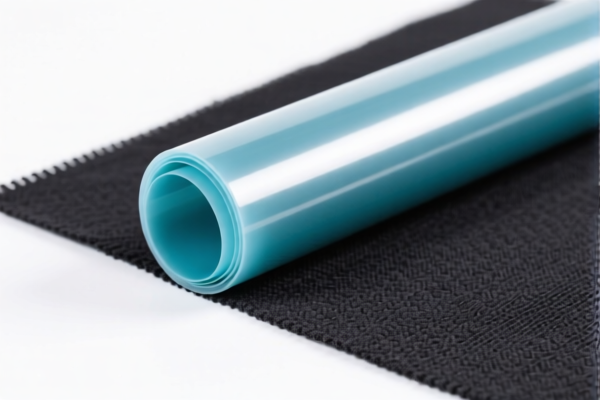

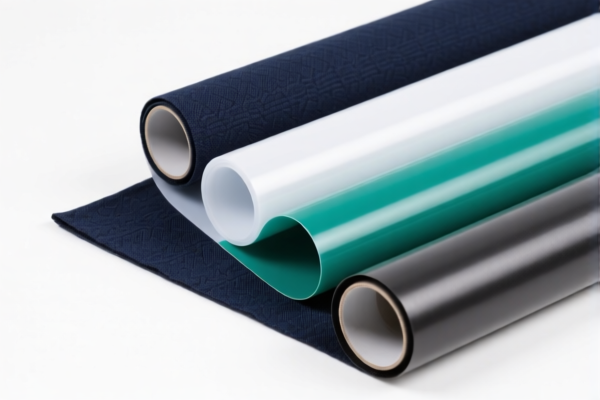

Product Description:

- Textile composite plastic coated films, where the textile component contains synthetic fibers in greater weight than any other single textile fiber, and the plastic content exceeds 70% by weight.

- Weight per square meter must not exceed 1.492 kg.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921902900

Product Description:

- Plastic textile composite films, where the product is a combination of plastic and textile materials, with a weight not exceeding 1.492 kg/m².

- This code applies to other types of plastic films combined with textiles, not covered under 3921901100.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921901950

Product Description:

- Textile composite plastic packaging films, with a weight not exceeding 1.492 kg/m².

- This code is for other types of textile-composite plastic films, not covered under 3921901100.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all three HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

Anti-Dumping Duties:

Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum). -

Certifications Required:

Verify if your product requires customs documentation, material certifications, or compliance with textile and plastic standards (e.g., REACH, RoHS, etc.).

📌 Proactive Advice:

-

Confirm Material Composition:

Ensure the product meets the weight and fiber composition criteria for the selected HS code (e.g., plastic >70%, synthetic fiber > other fibers). -

Check Unit Price and Classification:

The final HS code may vary based on material composition, intended use, and product structure. Double-check with a customs expert or classification service if in doubt. -

Plan for Tariff Increases:

If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Textile Composite Plastic Coated Films, based on the provided HS codes and tax details:

✅ HS CODE: 3921901100

Product Description:

- Textile composite plastic coated films, where the textile component contains synthetic fibers in greater weight than any other single textile fiber, and the plastic content exceeds 70% by weight.

- Weight per square meter must not exceed 1.492 kg.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921902900

Product Description:

- Plastic textile composite films, where the product is a combination of plastic and textile materials, with a weight not exceeding 1.492 kg/m².

- This code applies to other types of plastic films combined with textiles, not covered under 3921901100.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921901950

Product Description:

- Textile composite plastic packaging films, with a weight not exceeding 1.492 kg/m².

- This code is for other types of textile-composite plastic films, not covered under 3921901100.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all three HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

Anti-Dumping Duties:

Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum). -

Certifications Required:

Verify if your product requires customs documentation, material certifications, or compliance with textile and plastic standards (e.g., REACH, RoHS, etc.).

📌 Proactive Advice:

-

Confirm Material Composition:

Ensure the product meets the weight and fiber composition criteria for the selected HS code (e.g., plastic >70%, synthetic fiber > other fibers). -

Check Unit Price and Classification:

The final HS code may vary based on material composition, intended use, and product structure. Double-check with a customs expert or classification service if in doubt. -

Plan for Tariff Increases:

If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.