| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 7616995120 | Doc | 57.5% | CN | US | 2025-05-12 |

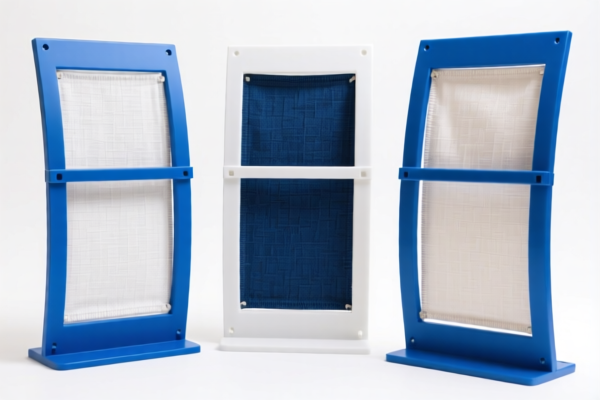

Product Name: Textile Composite Plastic Display Boards

Classification: Based on the provided HS codes and descriptions, the most accurate classification for textile composite plastic display boards is likely HS CODE: 3921901910.

✅ HS CODE: 3921901910

Description:

- Textile composite plastic boards, where the textile component weighs more than any single textile fiber.

Tariff Summary: - Total Tax Rate: 60.3% - Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Additional Tariff after April 11, 2025: 30.0%

📌 Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

Not applicable for this product (no mention of anti-dumping duties on textile composites). -

Material Verification:

Ensure that the textile component in the composite board exceeds the weight of any single textile fiber. This is a critical classification criterion. -

Certifications Required:

Confirm if any customs documentation or certifications (e.g., material composition, origin, etc.) are required for import compliance.

📌 Alternative HS Codes for Reference:

- 3921905050 – Other plastic sheets, plates, etc. (not textile composite)

- Total Tax: 34.8% (lower than 3921901910)

-

Not suitable for textile composites.

-

3921902900 – Plastic sheets over 1.492 kg/m²

- Total Tax: 59.4%

-

Not suitable for textile composites.

-

3920995000 – Laminated or layered non-cellular plastics

- Total Tax: 60.8%

-

Not suitable for textile composites.

-

7616995120 – Aluminum laminated products

- Total Tax: 57.5%

- Not relevant to textile composites.

🛑 Proactive Advice:

- Verify the composition of the product to ensure it falls under 3921901910 and not a different HS code.

- Check the unit price and material breakdown to avoid misclassification.

- Consult customs or a classification expert if the product contains multiple layers or mixed materials.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Textile Composite Plastic Display Boards

Classification: Based on the provided HS codes and descriptions, the most accurate classification for textile composite plastic display boards is likely HS CODE: 3921901910.

✅ HS CODE: 3921901910

Description:

- Textile composite plastic boards, where the textile component weighs more than any single textile fiber.

Tariff Summary: - Total Tax Rate: 60.3% - Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Additional Tariff after April 11, 2025: 30.0%

📌 Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

Not applicable for this product (no mention of anti-dumping duties on textile composites). -

Material Verification:

Ensure that the textile component in the composite board exceeds the weight of any single textile fiber. This is a critical classification criterion. -

Certifications Required:

Confirm if any customs documentation or certifications (e.g., material composition, origin, etc.) are required for import compliance.

📌 Alternative HS Codes for Reference:

- 3921905050 – Other plastic sheets, plates, etc. (not textile composite)

- Total Tax: 34.8% (lower than 3921901910)

-

Not suitable for textile composites.

-

3921902900 – Plastic sheets over 1.492 kg/m²

- Total Tax: 59.4%

-

Not suitable for textile composites.

-

3920995000 – Laminated or layered non-cellular plastics

- Total Tax: 60.8%

-

Not suitable for textile composites.

-

7616995120 – Aluminum laminated products

- Total Tax: 57.5%

- Not relevant to textile composites.

🛑 Proactive Advice:

- Verify the composition of the product to ensure it falls under 3921901910 and not a different HS code.

- Check the unit price and material breakdown to avoid misclassification.

- Consult customs or a classification expert if the product contains multiple layers or mixed materials.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.