| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Embossed Boards, based on the provided HS codes and tax details:

🔍 Product Classification Overview

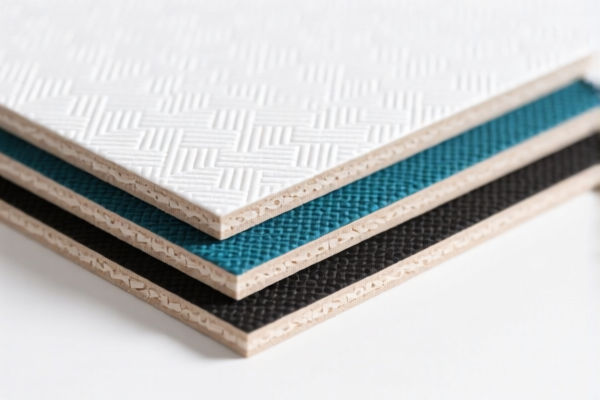

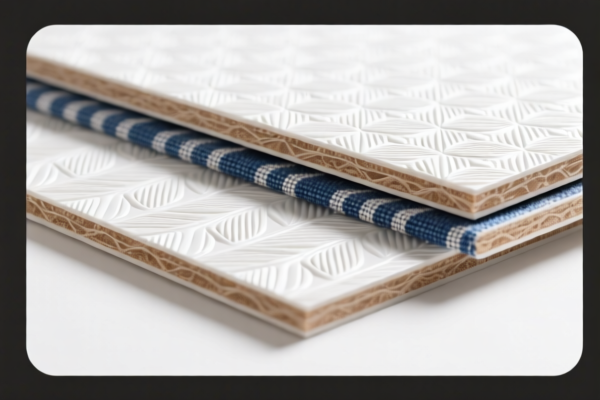

Product Name: Textile Composite Plastic Embossed Boards

Material Composition: Combines textile (e.g., synthetic fibers) and plastic, with plastic content exceeding 70% by weight and total weight over 1.492 kg/m².

📦 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Applicable to textile composite plastic ceiling panels, textile composite plastic boards, and textile plastic composite decorative panels.

- Classification Criteria: Composite with other materials, weight > 1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more general and applies to a broader range of textile-plastic composites.

2. HS CODE: 3921902550

- Description: Applicable to textile composite plastic boards.

- Classification Criteria: Composite with textile materials, weight > 1.492 kg/m², synthetic fiber content is the heaviest single fiber type, and plastic content > 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific and applies when synthetic fibers are the dominant textile component.

3. HS CODE: 3921902510

- Description: Applicable to textile composite plastic boards and textile-reinforced plastic composite boards.

- Classification Criteria: Composite with textile materials, weight > 1.492 kg/m², textile component is the heaviest, but no single fiber type exceeds synthetic fiber in weight, and plastic content > 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies when synthetic fiber is the dominant textile component, but not the only one.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all three codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., plastic percentage, fiber type) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., CE, RoHS, REACH) are required for the destination market.

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the plastic and textile content percentages are accurately documented.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Consult Customs Broker: For complex classifications, especially if the product has multiple components or uses.

- Monitor Policy Updates: Stay informed about tariff changes and trade agreements that may affect your product.

Let me know if you need help determining which HS code applies to your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Embossed Boards, based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Textile Composite Plastic Embossed Boards

Material Composition: Combines textile (e.g., synthetic fibers) and plastic, with plastic content exceeding 70% by weight and total weight over 1.492 kg/m².

📦 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Applicable to textile composite plastic ceiling panels, textile composite plastic boards, and textile plastic composite decorative panels.

- Classification Criteria: Composite with other materials, weight > 1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more general and applies to a broader range of textile-plastic composites.

2. HS CODE: 3921902550

- Description: Applicable to textile composite plastic boards.

- Classification Criteria: Composite with textile materials, weight > 1.492 kg/m², synthetic fiber content is the heaviest single fiber type, and plastic content > 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific and applies when synthetic fibers are the dominant textile component.

3. HS CODE: 3921902510

- Description: Applicable to textile composite plastic boards and textile-reinforced plastic composite boards.

- Classification Criteria: Composite with textile materials, weight > 1.492 kg/m², textile component is the heaviest, but no single fiber type exceeds synthetic fiber in weight, and plastic content > 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies when synthetic fiber is the dominant textile component, but not the only one.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all three codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., plastic percentage, fiber type) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., CE, RoHS, REACH) are required for the destination market.

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the plastic and textile content percentages are accurately documented.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Consult Customs Broker: For complex classifications, especially if the product has multiple components or uses.

- Monitor Policy Updates: Stay informed about tariff changes and trade agreements that may affect your product.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.