| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

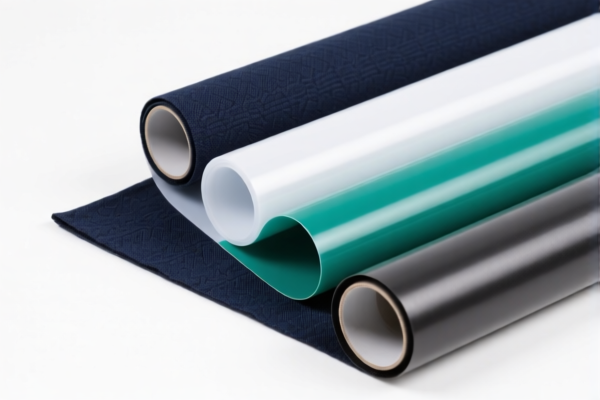

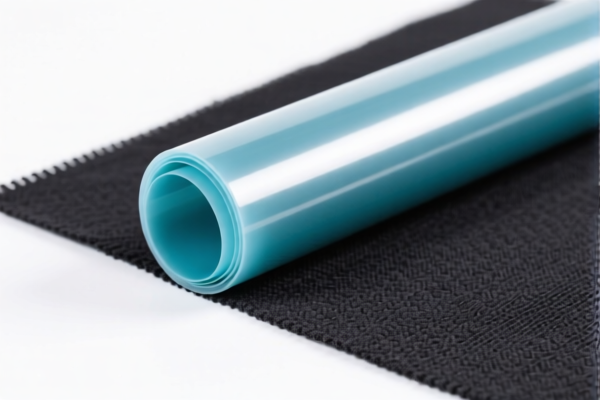

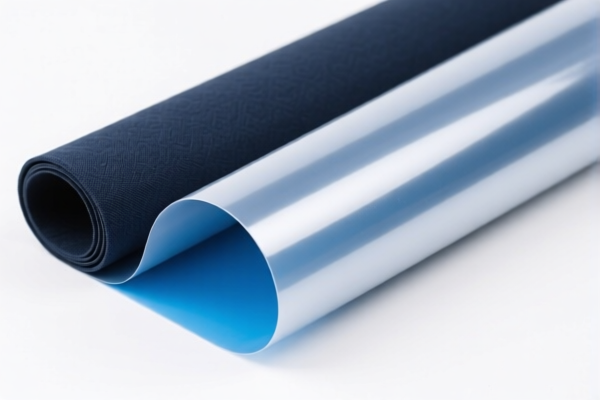

Here is the structured classification and tariff information for Textile Composite Plastic Embossed Films, based on the provided HS codes and tax details:

✅ Product Classification Overview: Textile Composite Plastic Embossed Films

These products are composite materials combining plastic films with textile fibers, and are classified under various HS codes depending on specific composition and weight criteria.

📦 HS Code Classification & Tax Details

1. HS CODE: 3920992000

Description: Plastic embossed films, non-cellular and not reinforced, not laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This code applies to non-composite plastic films, not combined with textile materials.

2. HS CODE: 3921901950

Description: Textile composite plastic packaging film, with textile material combined, and weight ≤ 1.492 kg/m².

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Note: This is a general category for textile-composite films with weight restrictions.

3. HS CODE: 3921901100

Description: Textile composite plastic film, with textile material combined, weight ≤ 1.492 kg/m², and synthetic fiber content exceeds any other single fiber type, plastic content >70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This code applies to specific composition with high plastic content and synthetic fiber dominance.

4. HS CODE: 3921901500

Description: Plastic composite with textile fiber film, described as plastic sheets, films, etc., combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to composite films with textile fibers, but with higher base tariff.

5. HS CODE: 3921902900

Description: Plastic film combined with textile materials, as per HS code description.

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Note: This is a general category for textile-composite films, with lower base tariff.

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not applicable for this product category (no mention of anti-dumping duties on iron/aluminum).

- Material Verification: Confirm the exact composition (e.g., plastic percentage, fiber type) to ensure correct HS code classification.

- Certifications: Check if customs documentation, product certifications, or origin declarations are required for your specific product.

- Unit Price: Verify the unit price and weight per square meter to ensure compliance with HS code weight thresholds (e.g., ≤1.492 kg/m²).

📌 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff |

|---|---|---|---|---|

| 3920992000 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921901950 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921901100 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921901500 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | 59.4% | 4.4% | 25.0% | 30.0% |

If you provide more details about the material composition, weight, and intended use, I can help you select the most accurate HS code and estimate the final cost. Here is the structured classification and tariff information for Textile Composite Plastic Embossed Films, based on the provided HS codes and tax details:

✅ Product Classification Overview: Textile Composite Plastic Embossed Films

These products are composite materials combining plastic films with textile fibers, and are classified under various HS codes depending on specific composition and weight criteria.

📦 HS Code Classification & Tax Details

1. HS CODE: 3920992000

Description: Plastic embossed films, non-cellular and not reinforced, not laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This code applies to non-composite plastic films, not combined with textile materials.

2. HS CODE: 3921901950

Description: Textile composite plastic packaging film, with textile material combined, and weight ≤ 1.492 kg/m².

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Note: This is a general category for textile-composite films with weight restrictions.

3. HS CODE: 3921901100

Description: Textile composite plastic film, with textile material combined, weight ≤ 1.492 kg/m², and synthetic fiber content exceeds any other single fiber type, plastic content >70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This code applies to specific composition with high plastic content and synthetic fiber dominance.

4. HS CODE: 3921901500

Description: Plastic composite with textile fiber film, described as plastic sheets, films, etc., combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to composite films with textile fibers, but with higher base tariff.

5. HS CODE: 3921902900

Description: Plastic film combined with textile materials, as per HS code description.

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Note: This is a general category for textile-composite films, with lower base tariff.

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not applicable for this product category (no mention of anti-dumping duties on iron/aluminum).

- Material Verification: Confirm the exact composition (e.g., plastic percentage, fiber type) to ensure correct HS code classification.

- Certifications: Check if customs documentation, product certifications, or origin declarations are required for your specific product.

- Unit Price: Verify the unit price and weight per square meter to ensure compliance with HS code weight thresholds (e.g., ≤1.492 kg/m²).

📌 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff |

|---|---|---|---|---|

| 3920992000 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921901950 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921901100 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921901500 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | 59.4% | 4.4% | 25.0% | 30.0% |

If you provide more details about the material composition, weight, and intended use, I can help you select the most accurate HS code and estimate the final cost.

Customer Reviews

No reviews yet.