| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Films for Agricultural Covering, based on the provided HS codes and tax details:

📦 Product Classification Overview

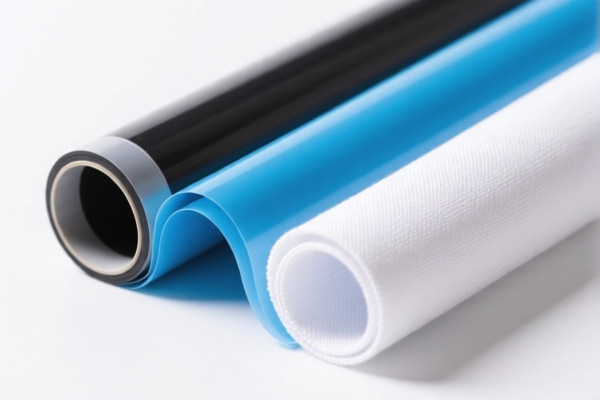

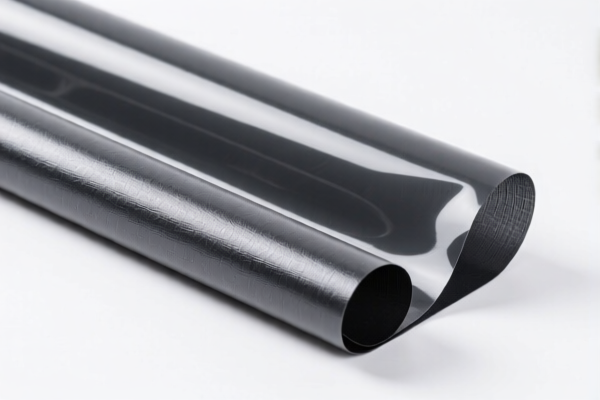

Product Name: Textile Composite Plastic Films for Agricultural Covering

Key Materials: Plastic + Textile, Paper + Plastic, Plastic Coated Textile

📊 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Plastic films combined with textile materials, e.g., agricultural textile plastic films

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: High tax rate due to both base and additional tariffs.

2. HS CODE: 3921904010

- Description: Flexible plastic sheets, films, etc., reinforced with paper, e.g., agricultural paper-plastic composite film

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower base tax rate, but still subject to the 30% special tariff after April 11, 2025.

3. HS CODE: 3921901100

- Description: Composite materials combining plastic and textile, e.g., plastic-textile composite agricultural fabric

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Similar to 3921902900, with a slightly lower total tax due to a lower base rate.

4. HS CODE: 3920992000

- Description: Agricultural cover films, plastic films

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Pure plastic films used in agriculture, subject to the same high tax rate.

5. HS CODE: 5903903090

- Description: Plastic-coated textiles, e.g., agricultural plastic-coated textiles

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower base rate but still high overall due to additional and special tariffs.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., plastic type, textile type, paper reinforcement) to ensure correct HS code classification.

- Certifications: Check if any customs or import certifications are required (e.g., product standards, environmental compliance).

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on its exact materials (e.g., plastic + textile vs. paper + plastic).

- Check Unit Price: High tax rates may affect competitiveness; consider cost implications.

- Review Tariff Dates: Be aware of the April 11, 2025 deadline for the special tariff.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Textile Composite Plastic Films for Agricultural Covering, based on the provided HS codes and tax details:

📦 Product Classification Overview

Product Name: Textile Composite Plastic Films for Agricultural Covering

Key Materials: Plastic + Textile, Paper + Plastic, Plastic Coated Textile

📊 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Plastic films combined with textile materials, e.g., agricultural textile plastic films

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: High tax rate due to both base and additional tariffs.

2. HS CODE: 3921904010

- Description: Flexible plastic sheets, films, etc., reinforced with paper, e.g., agricultural paper-plastic composite film

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower base tax rate, but still subject to the 30% special tariff after April 11, 2025.

3. HS CODE: 3921901100

- Description: Composite materials combining plastic and textile, e.g., plastic-textile composite agricultural fabric

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Similar to 3921902900, with a slightly lower total tax due to a lower base rate.

4. HS CODE: 3920992000

- Description: Agricultural cover films, plastic films

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Pure plastic films used in agriculture, subject to the same high tax rate.

5. HS CODE: 5903903090

- Description: Plastic-coated textiles, e.g., agricultural plastic-coated textiles

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower base rate but still high overall due to additional and special tariffs.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., plastic type, textile type, paper reinforcement) to ensure correct HS code classification.

- Certifications: Check if any customs or import certifications are required (e.g., product standards, environmental compliance).

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on its exact materials (e.g., plastic + textile vs. paper + plastic).

- Check Unit Price: High tax rates may affect competitiveness; consider cost implications.

- Review Tariff Dates: Be aware of the April 11, 2025 deadline for the special tariff.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.