| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Films for Construction, based on the provided HS codes and tax details:

📦 Product Classification Overview

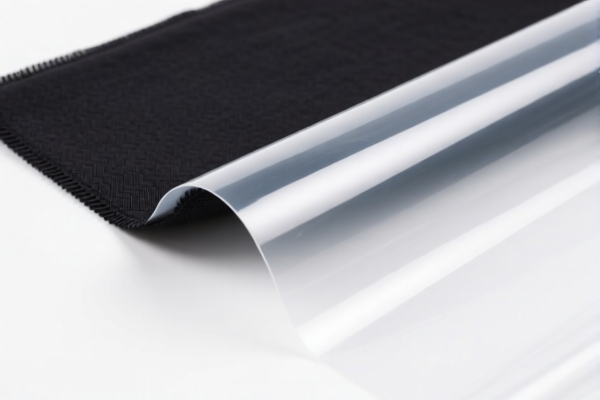

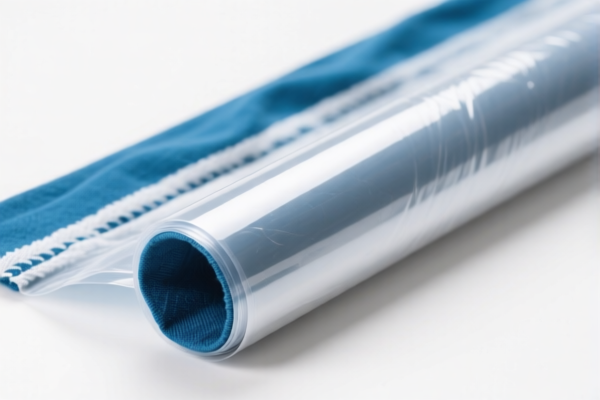

Product Name: Textile Composite Plastic Films for Construction

Classification Basis: HS codes based on material composition and intended use (e.g., plastic + textile, construction use, etc.)

📊 HS Code Breakdown with Tax Rates

1. HS Code: 3921902900

Description: Plastic and textile material combined films

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: High tax rate due to both base and additional tariffs.

2. HS Code: 3920992000

Description: Plastic films for construction

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: Slightly lower base rate than 3921902900.

3. HS Code: 3921905050

Description: Plastic construction films

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: No additional tariff, but still subject to the 2025.4.2 special tariff.

4. HS Code: 3921901500

Description: Plastic and textile fiber composite films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Highest total tax rate due to higher base rate.

5. HS Code: 3921901950

Description: Composite textile plastic construction fabric

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: High tax rate due to composite nature and additional tariffs.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, check for applicable anti-dumping duties.

- Material and Certification Requirements: Verify the material composition and unit price to ensure correct HS code classification. Some codes may require certifications (e.g., fire resistance, environmental compliance) for import.

✅ Proactive Advice for Importers

- Confirm Product Composition: Ensure the product is correctly classified based on whether it is a plastic-textile composite, pure plastic, or textile-based.

- Check for Certifications: Some construction materials may require safety or environmental certifications for import.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult Customs Broker: For complex classifications, consider engaging a customs broker or expert to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Textile Composite Plastic Films for Construction, based on the provided HS codes and tax details:

📦 Product Classification Overview

Product Name: Textile Composite Plastic Films for Construction

Classification Basis: HS codes based on material composition and intended use (e.g., plastic + textile, construction use, etc.)

📊 HS Code Breakdown with Tax Rates

1. HS Code: 3921902900

Description: Plastic and textile material combined films

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: High tax rate due to both base and additional tariffs.

2. HS Code: 3920992000

Description: Plastic films for construction

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: Slightly lower base rate than 3921902900.

3. HS Code: 3921905050

Description: Plastic construction films

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: No additional tariff, but still subject to the 2025.4.2 special tariff.

4. HS Code: 3921901500

Description: Plastic and textile fiber composite films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Highest total tax rate due to higher base rate.

5. HS Code: 3921901950

Description: Composite textile plastic construction fabric

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: High tax rate due to composite nature and additional tariffs.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, check for applicable anti-dumping duties.

- Material and Certification Requirements: Verify the material composition and unit price to ensure correct HS code classification. Some codes may require certifications (e.g., fire resistance, environmental compliance) for import.

✅ Proactive Advice for Importers

- Confirm Product Composition: Ensure the product is correctly classified based on whether it is a plastic-textile composite, pure plastic, or textile-based.

- Check for Certifications: Some construction materials may require safety or environmental certifications for import.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult Customs Broker: For complex classifications, consider engaging a customs broker or expert to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.