| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

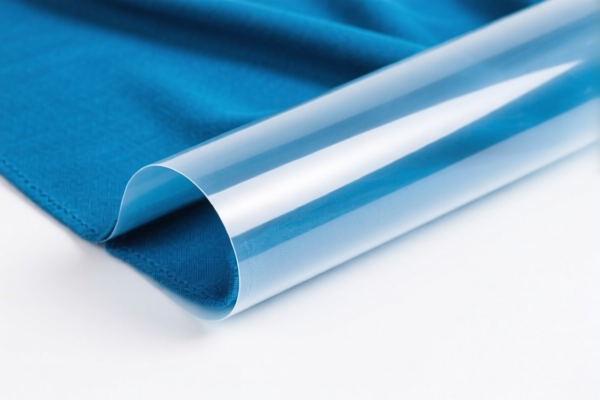

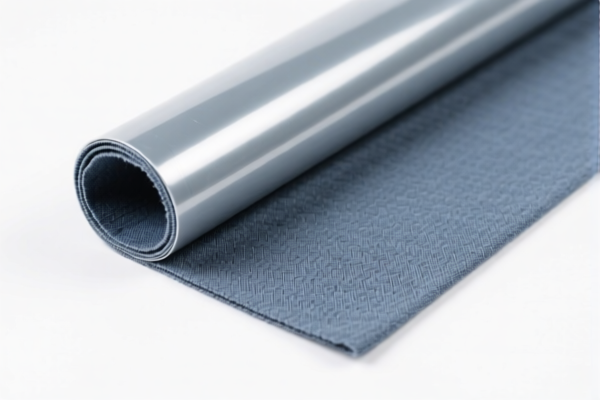

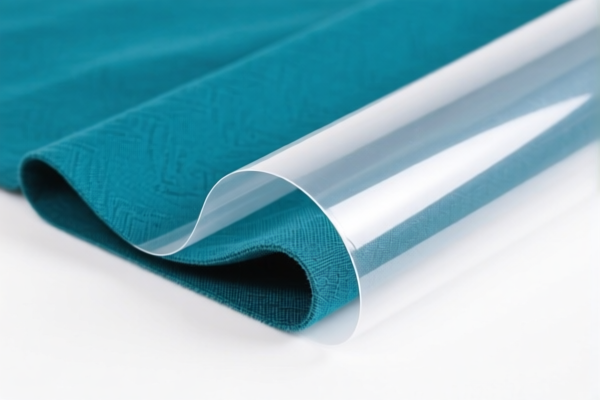

Here is the structured classification and tariff information for Textile Composite Plastic Films for Garment, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Textile composite plastic films for garment

Total Tax Rate: 59.4%

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

- Note: This code is for general textile composite films, not specifying fiber type.

✅ HS CODE: 3921901500

Product Description: Textile fiber composite plastic films for garment

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for composite films made with textile fibers (e.g., polyester, nylon).

✅ HS CODE: 3921902100

Product Description: Cotton fiber composite plastic films for garment

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for composite films made with cotton fibers.

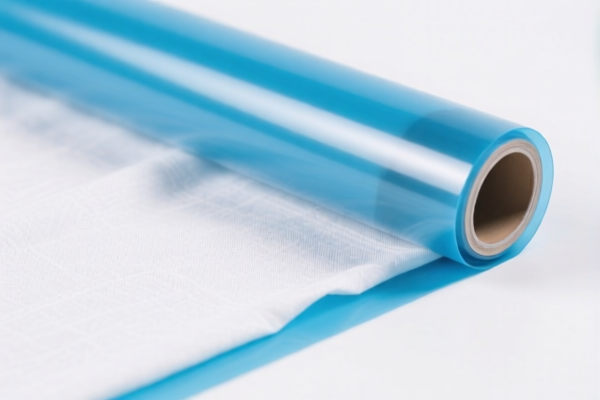

✅ HS CODE: 3920992000

Product Description: Composite plastic films for garment (general)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a broader category, not specifying fiber type or composition.

✅ HS CODE: 3921904090

Product Description: Other plastic composite films for garment

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to other types of composite films not covered by the above categories.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on fiber type (e.g., cotton, polyester, or general textile).

- Check Unit Price: Tariff rates may vary depending on the declared value and classification.

- Confirm Required Certifications: Some products may require specific documentation (e.g., origin certificates, technical specifications).

- Monitor April 11, 2025, Policy Changes: The additional 30% tariff will apply after this date, so plan accordingly.

- Consult Customs Broker: For complex classifications or high-value shipments, seek professional customs advice.

Let me know if you need help determining the correct HS code for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Films for Garment, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Textile composite plastic films for garment

Total Tax Rate: 59.4%

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

- Note: This code is for general textile composite films, not specifying fiber type.

✅ HS CODE: 3921901500

Product Description: Textile fiber composite plastic films for garment

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for composite films made with textile fibers (e.g., polyester, nylon).

✅ HS CODE: 3921902100

Product Description: Cotton fiber composite plastic films for garment

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for composite films made with cotton fibers.

✅ HS CODE: 3920992000

Product Description: Composite plastic films for garment (general)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a broader category, not specifying fiber type or composition.

✅ HS CODE: 3921904090

Product Description: Other plastic composite films for garment

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to other types of composite films not covered by the above categories.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on fiber type (e.g., cotton, polyester, or general textile).

- Check Unit Price: Tariff rates may vary depending on the declared value and classification.

- Confirm Required Certifications: Some products may require specific documentation (e.g., origin certificates, technical specifications).

- Monitor April 11, 2025, Policy Changes: The additional 30% tariff will apply after this date, so plan accordingly.

- Consult Customs Broker: For complex classifications or high-value shipments, seek professional customs advice.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.