| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

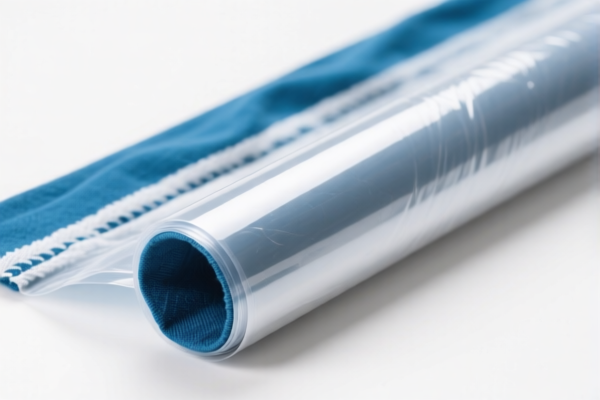

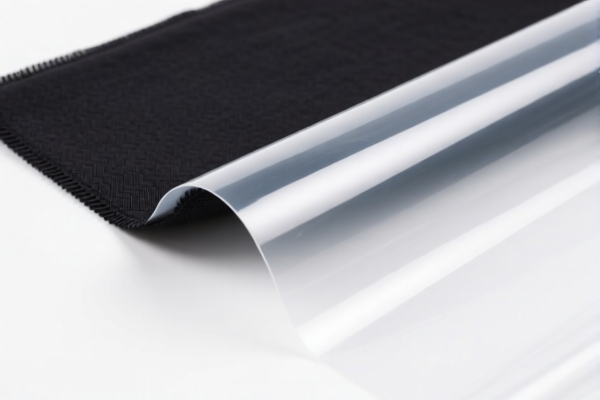

Product Classification: Textile Composite Plastic Films for Industrial Use

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921901500

- Description: Plastic and textile fiber composite films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High tax rate due to composite material composition.

-

HS CODE: 3921902900

- Description: Films combining plastic with textile materials

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base rate but still subject to high additional tariffs.

-

HS CODE: 3921905050

- Description: Plastic films for industrial processing

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base and additional tariffs, but still affected by the April 11 special tariff.

-

HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High tax rate due to composite and packaging use.

-

HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base rate but still subject to high additional tariffs.

Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, further duties may apply. Confirm with customs or a compliance expert.

- Material and Certification Requirements: Verify the exact composition of the film (e.g., type of textile fiber, plastic used) to ensure correct classification. Some HS codes may require specific certifications (e.g., RoHS, REACH) for import compliance.

Proactive Advice:

- Verify Material Composition: Confirm the exact materials used (e.g., polyester, polyethylene, cotton, etc.) to ensure the correct HS code is applied.

- Check Unit Price and Tax Impact: The high additional and special tariffs can significantly increase the total cost. Consider this in pricing and sourcing strategies.

- Consult Customs Authority: For the most up-to-date HS code and tariff information, especially if the product is close to the boundary of multiple classifications.

-

Document and Certify: Ensure all necessary documentation (e.g., commercial invoice, packing list, certificates of origin) is prepared to avoid delays at customs. Product Classification: Textile Composite Plastic Films for Industrial Use

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3921901500

- Description: Plastic and textile fiber composite films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High tax rate due to composite material composition.

-

HS CODE: 3921902900

- Description: Films combining plastic with textile materials

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base rate but still subject to high additional tariffs.

-

HS CODE: 3921905050

- Description: Plastic films for industrial processing

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base and additional tariffs, but still affected by the April 11 special tariff.

-

HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High tax rate due to composite and packaging use.

-

HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base rate but still subject to high additional tariffs.

Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, further duties may apply. Confirm with customs or a compliance expert.

- Material and Certification Requirements: Verify the exact composition of the film (e.g., type of textile fiber, plastic used) to ensure correct classification. Some HS codes may require specific certifications (e.g., RoHS, REACH) for import compliance.

Proactive Advice:

- Verify Material Composition: Confirm the exact materials used (e.g., polyester, polyethylene, cotton, etc.) to ensure the correct HS code is applied.

- Check Unit Price and Tax Impact: The high additional and special tariffs can significantly increase the total cost. Consider this in pricing and sourcing strategies.

- Consult Customs Authority: For the most up-to-date HS code and tariff information, especially if the product is close to the boundary of multiple classifications.

- Document and Certify: Ensure all necessary documentation (e.g., commercial invoice, packing list, certificates of origin) is prepared to avoid delays at customs.

Customer Reviews

No reviews yet.