| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4202122985 | Doc | 75.0% | CN | US | 2025-05-12 |

| 4202122120 | Doc | 75.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Films for Luggage, based on the provided HS codes and tax details:

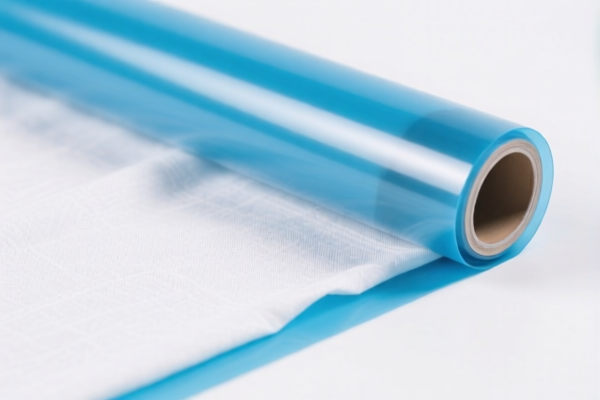

✅ HS CODE: 3921904090

Description: Other plastic sheets, plates, films, foils, and strips (including those of plasticized cellulose, etc.) — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

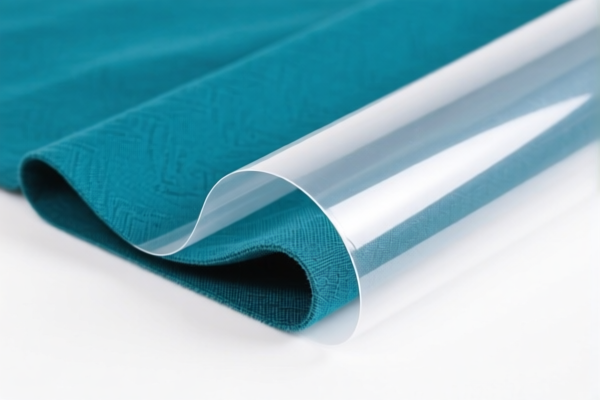

✅ HS CODE: 3920992000

Description: Laminated, supported, or otherwise combined with other materials — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Note: Higher tax due to additional tariffs. Be cautious with product composition and classification.

✅ HS CODE: 4202122985

Description: Cases, suitcases, etc., of plastic sheets — applicable to textile composite plastic films used in luggage.

- Base Tariff Rate: 20.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 75.0%

- Note: This is a higher tax bracket, likely due to being classified as luggage rather than raw materials.

✅ HS CODE: 4202122120

Description: Plastic partitioned suitcases — applicable to textile composite plastic films used in luggage.

- Base Tariff Rate: 20.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 75.0%

- Note: Similar to 4202122985, this is a luggage-specific classification with high tariffs.

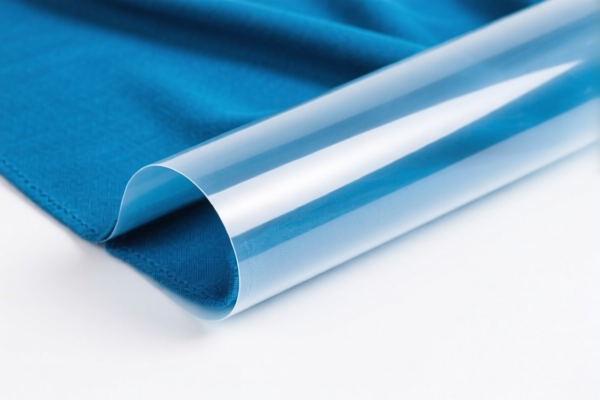

✅ HS CODE: 3921905050

Description: Plastic sheets, plates, films, etc. — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Note: Slightly higher base rate than 3921904090, but still lower than other classifications.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material (e.g., whether it is a composite, laminated, or standalone plastic film).

- Check Unit Price and Classification: Higher HS codes (like 4202) may be classified as luggage, which incurs significantly higher tariffs.

- Confirm Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the destination country.

- Monitor April 11, 2025 Deadline: Tariff rates will increase by 30% after this date for all listed HS codes. Plan accordingly for cost management.

- Review Anti-Dumping Duty Rules: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Films for Luggage, based on the provided HS codes and tax details:

✅ HS CODE: 3921904090

Description: Other plastic sheets, plates, films, foils, and strips (including those of plasticized cellulose, etc.) — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

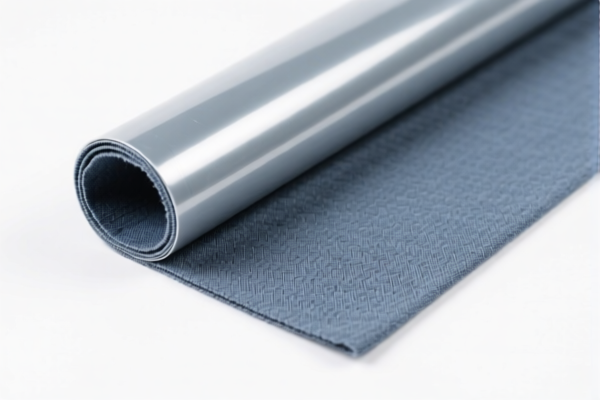

✅ HS CODE: 3920992000

Description: Laminated, supported, or otherwise combined with other materials — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Note: Higher tax due to additional tariffs. Be cautious with product composition and classification.

✅ HS CODE: 4202122985

Description: Cases, suitcases, etc., of plastic sheets — applicable to textile composite plastic films used in luggage.

- Base Tariff Rate: 20.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 75.0%

- Note: This is a higher tax bracket, likely due to being classified as luggage rather than raw materials.

✅ HS CODE: 4202122120

Description: Plastic partitioned suitcases — applicable to textile composite plastic films used in luggage.

- Base Tariff Rate: 20.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 75.0%

- Note: Similar to 4202122985, this is a luggage-specific classification with high tariffs.

✅ HS CODE: 3921905050

Description: Plastic sheets, plates, films, etc. — applicable to textile composite plastic films for luggage.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Note: Slightly higher base rate than 3921904090, but still lower than other classifications.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material (e.g., whether it is a composite, laminated, or standalone plastic film).

- Check Unit Price and Classification: Higher HS codes (like 4202) may be classified as luggage, which incurs significantly higher tariffs.

- Confirm Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the destination country.

- Monitor April 11, 2025 Deadline: Tariff rates will increase by 30% after this date for all listed HS codes. Plan accordingly for cost management.

- Review Anti-Dumping Duty Rules: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.