| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 6809110010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4814200000 | Doc | 37.5% | CN | US | 2025-05-12 |

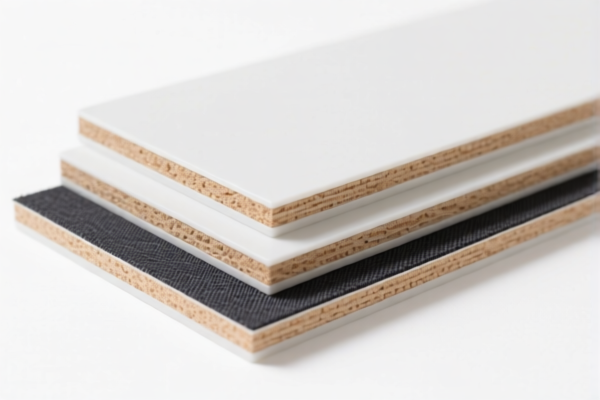

Product Classification: Textile Composite Plastic Fireproof Boards

HS CODE: 3921902550, 3921905050, 3920995000, 6809110010, 4814200000

🔍 Classification Overview

Your product, Textile Composite Plastic Fireproof Boards, may fall under several HS codes depending on the material composition, structure, and intended use. Below is a breakdown of the relevant HS codes and their associated tariff rates and regulations.

📌 HS Code 3921902550

Description:

- Applicable to plastic composite boards with textile materials, such as polyester fiber plastic composite boards, polypropylene fiber plastic composite boards, etc.

- Best match for your product if it is a textile-plastic composite board.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to textile-plastic composites, so ensure your product is not just a plastic board but includes textile fibers.

📌 HS Code 3921905050

Description:

- Applicable to other plastic sheets, films, foils, and strips, including plastic composite material boards.

- May be used if your product is not explicitly textile-based but is a composite of plastic and other materials.

Tariff Details:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is broader and may apply if the textile component is minimal or not the primary material.

📌 HS Code 3920995000

Description:

- Applicable to composite plastic boards that are laminated, supported, or combined with other materials, such as non-cellular and non-reinforced plastic boards.

Tariff Details:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is more general and may apply if your product is not clearly textile-based but is a multi-layered composite.

📌 HS Code 6809110010

Description:

- Applicable to fire-resistant boards based on gypsum.

- This is not a match for your product unless it is gypsum-based.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- Not recommended for your product unless it is gypsum-based.

📌 HS Code 4814200000

Description:

- Applicable to fireproof plastic wallpapers made of paper with a plastic layer or coating.

- This is not a match for your product unless it is wallpaper.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

Key Notes:

- Not recommended for your product unless it is paper-based with a plastic coating.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not currently applicable for these HS codes, but always verify with the latest customs updates.

- Certifications: Ensure your product meets fireproofing standards and has relevant certifications (e.g., fire resistance ratings, safety compliance).

✅ Proactive Advice

- Verify the material composition (e.g., is it textile-based, plastic-based, or gypsum-based?).

- Check the unit price and total value to ensure correct classification.

- Consult with customs or a classification expert if the product is a new or complex composite.

- Keep documentation on the manufacturing process and material specifications for customs clearance.

Let me know if you need help with certification requirements or customs documentation.

Product Classification: Textile Composite Plastic Fireproof Boards

HS CODE: 3921902550, 3921905050, 3920995000, 6809110010, 4814200000

🔍 Classification Overview

Your product, Textile Composite Plastic Fireproof Boards, may fall under several HS codes depending on the material composition, structure, and intended use. Below is a breakdown of the relevant HS codes and their associated tariff rates and regulations.

📌 HS Code 3921902550

Description:

- Applicable to plastic composite boards with textile materials, such as polyester fiber plastic composite boards, polypropylene fiber plastic composite boards, etc.

- Best match for your product if it is a textile-plastic composite board.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to textile-plastic composites, so ensure your product is not just a plastic board but includes textile fibers.

📌 HS Code 3921905050

Description:

- Applicable to other plastic sheets, films, foils, and strips, including plastic composite material boards.

- May be used if your product is not explicitly textile-based but is a composite of plastic and other materials.

Tariff Details:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is broader and may apply if the textile component is minimal or not the primary material.

📌 HS Code 3920995000

Description:

- Applicable to composite plastic boards that are laminated, supported, or combined with other materials, such as non-cellular and non-reinforced plastic boards.

Tariff Details:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is more general and may apply if your product is not clearly textile-based but is a multi-layered composite.

📌 HS Code 6809110010

Description:

- Applicable to fire-resistant boards based on gypsum.

- This is not a match for your product unless it is gypsum-based.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- Not recommended for your product unless it is gypsum-based.

📌 HS Code 4814200000

Description:

- Applicable to fireproof plastic wallpapers made of paper with a plastic layer or coating.

- This is not a match for your product unless it is wallpaper.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

Key Notes:

- Not recommended for your product unless it is paper-based with a plastic coating.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not currently applicable for these HS codes, but always verify with the latest customs updates.

- Certifications: Ensure your product meets fireproofing standards and has relevant certifications (e.g., fire resistance ratings, safety compliance).

✅ Proactive Advice

- Verify the material composition (e.g., is it textile-based, plastic-based, or gypsum-based?).

- Check the unit price and total value to ensure correct classification.

- Consult with customs or a classification expert if the product is a new or complex composite.

- Keep documentation on the manufacturing process and material specifications for customs clearance.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.