| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 7607205000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4811596000 | Doc | 55.0% | CN | US | 2025-05-12 |

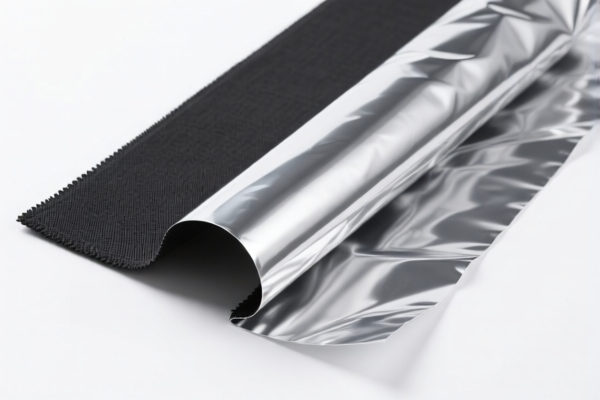

Product Classification: Textile Composite Plastic Foil

HS CODEs and Tax Information Overview:

- HS CODE: 3921902550

- Description: Composite textile plastic foil

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High total tax rate due to multiple layers of tariffs.

-

HS CODE: 3920435000

- Description: PVC composite foil

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to 3921902550, but with a slightly lower base tariff.

-

HS CODE: 3921904010

- Description: Flexible plastic composite foil

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower total tax rate due to no additional tariff, but still subject to the April 11 special tariff.

-

HS CODE: 7607205000

- Description: Aluminum foil plastic composite film

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No base tariff, but subject to anti-dumping duties and the April 11 special tariff.

-

HS CODE: 4811596000

- Description: Plastic composite paper

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but high total tax due to additional and special tariffs.

Key Policy Alerts:

- April 11, 2025 Special Tariff: Applies to all listed HS codes, adding 30.0% to the total tax rate. This is a time-sensitive policy and must be accounted for in cost calculations.

- Anti-dumping duties: May apply to products containing aluminum (e.g., HS CODE 7607205000), depending on the country of origin and specific trade agreements.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the composite foil (e.g., PVC, aluminum, textile) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., environmental, safety) to qualify for preferential treatment.

- Monitor Tariff Updates: Stay informed about changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

-

Consult Customs Broker: For complex classifications or high-value shipments, consider professional customs brokerage assistance. Product Classification: Textile Composite Plastic Foil

HS CODEs and Tax Information Overview: -

HS CODE: 3921902550

- Description: Composite textile plastic foil

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: High total tax rate due to multiple layers of tariffs.

-

HS CODE: 3920435000

- Description: PVC composite foil

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to 3921902550, but with a slightly lower base tariff.

-

HS CODE: 3921904010

- Description: Flexible plastic composite foil

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower total tax rate due to no additional tariff, but still subject to the April 11 special tariff.

-

HS CODE: 7607205000

- Description: Aluminum foil plastic composite film

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No base tariff, but subject to anti-dumping duties and the April 11 special tariff.

-

HS CODE: 4811596000

- Description: Plastic composite paper

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but high total tax due to additional and special tariffs.

Key Policy Alerts:

- April 11, 2025 Special Tariff: Applies to all listed HS codes, adding 30.0% to the total tax rate. This is a time-sensitive policy and must be accounted for in cost calculations.

- Anti-dumping duties: May apply to products containing aluminum (e.g., HS CODE 7607205000), depending on the country of origin and specific trade agreements.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the composite foil (e.g., PVC, aluminum, textile) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., environmental, safety) to qualify for preferential treatment.

- Monitor Tariff Updates: Stay informed about changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For complex classifications or high-value shipments, consider professional customs brokerage assistance.

Customer Reviews

No reviews yet.