| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 7607205000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the Textile Composite Plastic Foil for Industrial Use, based on the provided HS codes and details:

✅ HS CODE: 3921902550

Product Description:

- Composite textile plastic foil with a weight exceeding 1.492 kg/m²

- Textile component contains synthetic fibers with a weight greater than any other single textile fiber

- Plastic content exceeds 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to heavier composite foils with a high synthetic fiber content and significant plastic content.

- Proactive Advice: Confirm the exact weight per square meter and fiber composition to ensure correct classification.

✅ HS CODE: 3921905050

Product Description:

- Industrial packaging plastic foil

- Falls under the category of other plastic sheets, films, foils, and strips

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is for general industrial packaging foils not covered by more specific categories.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921901950 or 3921901100).

✅ HS CODE: 3921131950

Product Description:

- Polyurethane textile composite foil

- No indication that plant fibers exceed the weight of any other single textile fiber

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to polyurethane-based composite foils with unspecified fiber dominance.

- Proactive Advice: Verify the exact composition and material specifications to avoid misclassification.

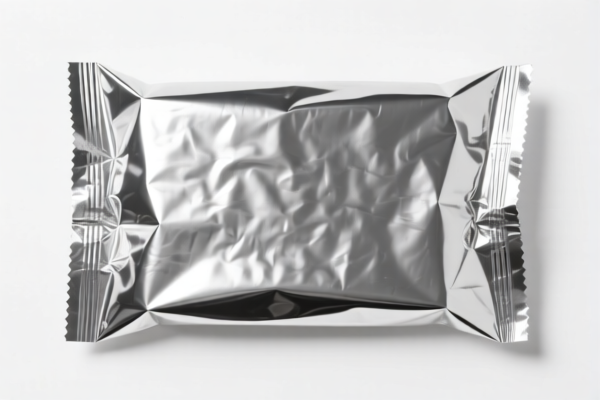

✅ HS CODE: 7607205000

Product Description:

- Industrial aluminum foil composite material

- Thickness not exceeding 0.2 mm

- Back-coated aluminum foil

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

Key Notes:

- This is an aluminum-based composite, not a plastic foil.

- Proactive Advice: Confirm the material composition and thickness to avoid misclassification with plastic composites.

✅ HS CODE: 3921901950

Product Description:

- Textile composite plastic packaging film

- Weight not exceeding 1.492 kg/m²

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to lighter composite films used for packaging.

- Proactive Advice: Confirm the weight per square meter and intended use (packaging vs. industrial).

✅ HS CODE: 3921901100

Product Description:

- Textile composite plastic packaging film

- Weight not exceeding 1.492 kg/m²

- Textile component contains synthetic fibers with a weight greater than any other single textile fiber

- Plastic content exceeds 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This is a lighter version of 3921902550, with the same fiber and plastic composition.

- Proactive Advice: Ensure the weight per square meter is clearly documented.

📌 Important Reminders:

- April 11, 2025 Special Tariff: Applies to all listed codes, adding 30.0% to the base and additional tariffs.

- Anti-dumping duties: Not specified in the data, but may apply depending on the origin and material.

- Certifications: Check if import permits, environmental compliance, or safety certifications are required for industrial use.

- Material Verification: Always confirm weight, composition, and intended use to avoid misclassification and penalties.

Let me know if you need help with customs documentation or certification requirements. Here is the structured classification and tariff information for the Textile Composite Plastic Foil for Industrial Use, based on the provided HS codes and details:

✅ HS CODE: 3921902550

Product Description:

- Composite textile plastic foil with a weight exceeding 1.492 kg/m²

- Textile component contains synthetic fibers with a weight greater than any other single textile fiber

- Plastic content exceeds 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to heavier composite foils with a high synthetic fiber content and significant plastic content.

- Proactive Advice: Confirm the exact weight per square meter and fiber composition to ensure correct classification.

✅ HS CODE: 3921905050

Product Description:

- Industrial packaging plastic foil

- Falls under the category of other plastic sheets, films, foils, and strips

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is for general industrial packaging foils not covered by more specific categories.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921901950 or 3921901100).

✅ HS CODE: 3921131950

Product Description:

- Polyurethane textile composite foil

- No indication that plant fibers exceed the weight of any other single textile fiber

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to polyurethane-based composite foils with unspecified fiber dominance.

- Proactive Advice: Verify the exact composition and material specifications to avoid misclassification.

✅ HS CODE: 7607205000

Product Description:

- Industrial aluminum foil composite material

- Thickness not exceeding 0.2 mm

- Back-coated aluminum foil

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

Key Notes:

- This is an aluminum-based composite, not a plastic foil.

- Proactive Advice: Confirm the material composition and thickness to avoid misclassification with plastic composites.

✅ HS CODE: 3921901950

Product Description:

- Textile composite plastic packaging film

- Weight not exceeding 1.492 kg/m²

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to lighter composite films used for packaging.

- Proactive Advice: Confirm the weight per square meter and intended use (packaging vs. industrial).

✅ HS CODE: 3921901100

Product Description:

- Textile composite plastic packaging film

- Weight not exceeding 1.492 kg/m²

- Textile component contains synthetic fibers with a weight greater than any other single textile fiber

- Plastic content exceeds 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This is a lighter version of 3921902550, with the same fiber and plastic composition.

- Proactive Advice: Ensure the weight per square meter is clearly documented.

📌 Important Reminders:

- April 11, 2025 Special Tariff: Applies to all listed codes, adding 30.0% to the base and additional tariffs.

- Anti-dumping duties: Not specified in the data, but may apply depending on the origin and material.

- Certifications: Check if import permits, environmental compliance, or safety certifications are required for industrial use.

- Material Verification: Always confirm weight, composition, and intended use to avoid misclassification and penalties.

Let me know if you need help with customs documentation or certification requirements.

Customer Reviews

No reviews yet.