| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

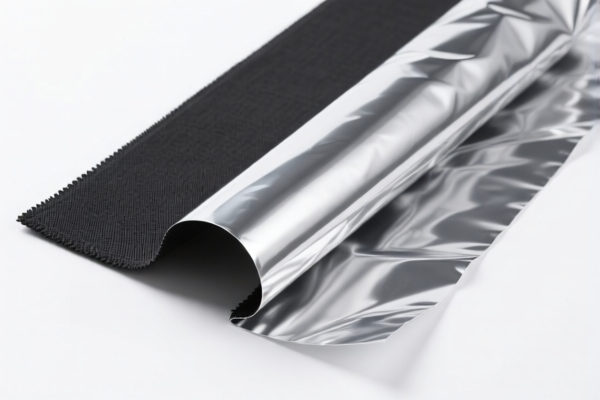

Here is the structured classification and tariff information for Textile Composite Plastic Foils, based on the provided HS codes and tax details:

📦 Product Classification Overview: Textile Composite Plastic Foils

🔢 HS CODE: 3921902900

- Description: Plastic and textile material combined films

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901500

- Description: Plastic and textile fiber composite films

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921902550

- Description: Textile composite plastic film rolls

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all these HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Material and Certification Verification:

Confirm the exact composition of the product (e.g., type of textile fiber, plastic used, and whether it's a film or roll). This will help in selecting the correct HS code and avoiding misclassification penalties. -

Unit Price and Documentation:

Verify the unit price and ensure all customs documentation (e.g., commercial invoice, packing list, and product specifications) are accurate and complete.

✅ Proactive Advice:

- Double-check the HS code based on the specific composition and form of the product (e.g., whether it's a film, roll, or sheet).

- Consult a customs broker or trade compliance expert if the product is close to the boundary of multiple classifications.

- Keep updated records of any certifications required (e.g., REACH, RoHS, or other environmental or safety standards).

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Foils, based on the provided HS codes and tax details:

📦 Product Classification Overview: Textile Composite Plastic Foils

🔢 HS CODE: 3921902900

- Description: Plastic and textile material combined films

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901500

- Description: Plastic and textile fiber composite films

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔢 HS CODE: 3921902550

- Description: Textile composite plastic film rolls

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all these HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Material and Certification Verification:

Confirm the exact composition of the product (e.g., type of textile fiber, plastic used, and whether it's a film or roll). This will help in selecting the correct HS code and avoiding misclassification penalties. -

Unit Price and Documentation:

Verify the unit price and ensure all customs documentation (e.g., commercial invoice, packing list, and product specifications) are accurate and complete.

✅ Proactive Advice:

- Double-check the HS code based on the specific composition and form of the product (e.g., whether it's a film, roll, or sheet).

- Consult a customs broker or trade compliance expert if the product is close to the boundary of multiple classifications.

- Keep updated records of any certifications required (e.g., REACH, RoHS, or other environmental or safety standards).

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.