| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

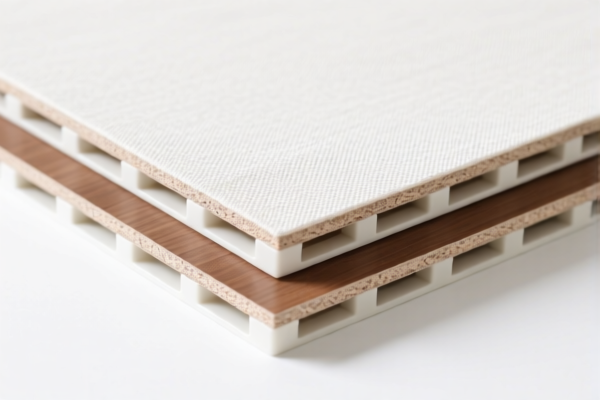

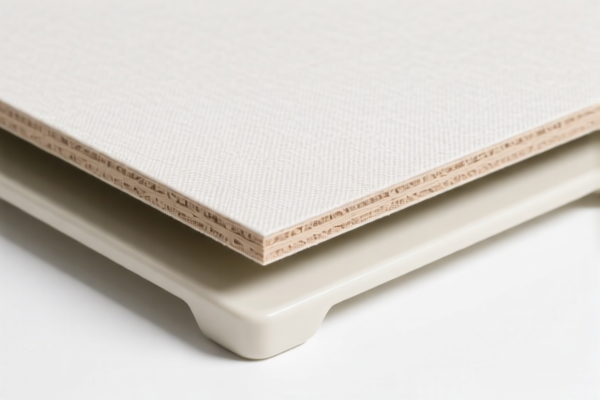

Product Classification: Textile Composite Plastic Furniture Boards

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Furniture Boards" falls under several HS codes depending on specific composition and usage. Below is a structured breakdown of the relevant classifications and associated tariffs:

1. HS CODE: 3921902550

Description:

- Textile composite plastic boards combined with other textile materials, with a weight exceeding 1.492 kg/m².

- The textile component is primarily man-made fiber (by weight), and plastic constitutes more than 70% of the total weight.

- Used for furniture (as per the second entry).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to furniture use.

- Ensure the product is clearly labeled or documented as intended for furniture to qualify under this code.

- Verify the composition (plastic >70%, man-made fiber > other fibers) to meet classification criteria.

2. HS CODE: 3921902510

Description:

- Other plastic sheets, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- Textile component is the main weight, and no single textile fiber exceeds man-made fiber in weight.

- Plastic constitutes more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is not specific to furniture.

- Ensure the product is not intended for furniture to avoid misclassification.

- Check the fiber composition to ensure man-made fiber is the dominant component.

3. HS CODE: 3921904010

Description:

- Flexible plastic sheets, films, foils, and strips reinforced with paper.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This code is not applicable to textile composite boards with man-made fiber.

- Only for paper-reinforced plastic.

- Lower tax rate compared to other codes, but not suitable for the described product.

4. HS CODE: 3920995000

Description:

- Laminated, supported, or otherwise combined with other materials, non-cellular plastics and non-reinforced plastic sheets.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is not suitable for textile composite boards.

- Intended for non-textile, non-paper-reinforced plastic composites.

- Higher tax rate than 3921902550, but not applicable to the product in question.

Proactive Advice for Users:

- Verify the composition of the product (e.g., plastic percentage, fiber type, and weight per square meter).

- Confirm the intended use (e.g., furniture vs. general use) to select the correct HS code.

- Check for certifications (e.g., import permits, product standards) required for customs clearance.

- Review the April 11, 2025, tariff update to avoid unexpected costs.

- Document the product’s specifications clearly to support customs classification.

Summary of Tax Rates (April 11, 2025, onwards):

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 3921902550 | 61.5% | For furniture use, textile composite with man-made fiber |

| 3921902510 | 61.5% | For general use, textile composite with man-made fiber |

| 3921904010 | 34.2% | For paper-reinforced plastic |

| 3920995000 | 60.8% | For non-cellular, non-reinforced plastic composites |

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Textile Composite Plastic Furniture Boards

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Furniture Boards" falls under several HS codes depending on specific composition and usage. Below is a structured breakdown of the relevant classifications and associated tariffs:

1. HS CODE: 3921902550

Description:

- Textile composite plastic boards combined with other textile materials, with a weight exceeding 1.492 kg/m².

- The textile component is primarily man-made fiber (by weight), and plastic constitutes more than 70% of the total weight.

- Used for furniture (as per the second entry).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to furniture use.

- Ensure the product is clearly labeled or documented as intended for furniture to qualify under this code.

- Verify the composition (plastic >70%, man-made fiber > other fibers) to meet classification criteria.

2. HS CODE: 3921902510

Description:

- Other plastic sheets, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- Textile component is the main weight, and no single textile fiber exceeds man-made fiber in weight.

- Plastic constitutes more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is not specific to furniture.

- Ensure the product is not intended for furniture to avoid misclassification.

- Check the fiber composition to ensure man-made fiber is the dominant component.

3. HS CODE: 3921904010

Description:

- Flexible plastic sheets, films, foils, and strips reinforced with paper.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This code is not applicable to textile composite boards with man-made fiber.

- Only for paper-reinforced plastic.

- Lower tax rate compared to other codes, but not suitable for the described product.

4. HS CODE: 3920995000

Description:

- Laminated, supported, or otherwise combined with other materials, non-cellular plastics and non-reinforced plastic sheets.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is not suitable for textile composite boards.

- Intended for non-textile, non-paper-reinforced plastic composites.

- Higher tax rate than 3921902550, but not applicable to the product in question.

Proactive Advice for Users:

- Verify the composition of the product (e.g., plastic percentage, fiber type, and weight per square meter).

- Confirm the intended use (e.g., furniture vs. general use) to select the correct HS code.

- Check for certifications (e.g., import permits, product standards) required for customs clearance.

- Review the April 11, 2025, tariff update to avoid unexpected costs.

- Document the product’s specifications clearly to support customs classification.

Summary of Tax Rates (April 11, 2025, onwards):

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 3921902550 | 61.5% | For furniture use, textile composite with man-made fiber |

| 3921902510 | 61.5% | For general use, textile composite with man-made fiber |

| 3921904010 | 34.2% | For paper-reinforced plastic |

| 3920995000 | 60.8% | For non-cellular, non-reinforced plastic composites |

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.