Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

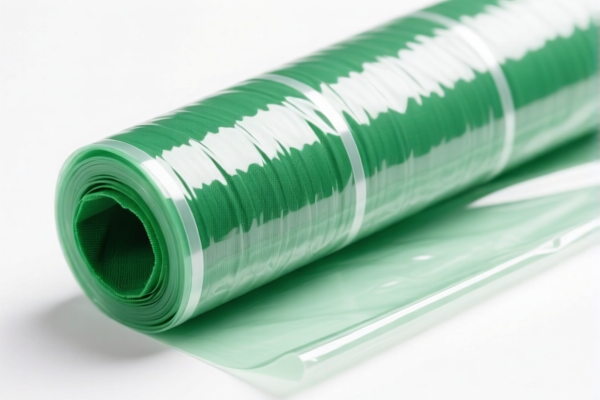

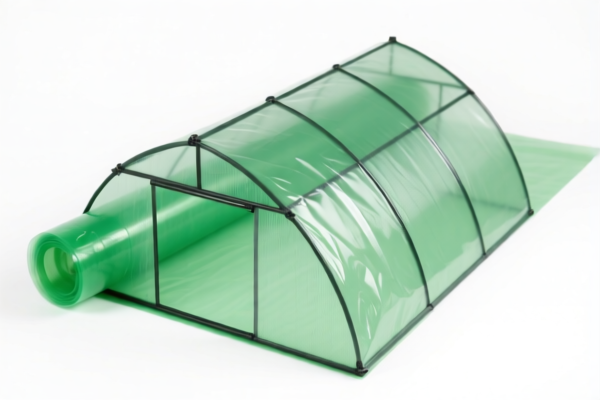

Here is the structured classification and tariff information for Textile Composite Plastic Greenhouse Films, based on the provided HS codes and tax details:

📦 Product Classification Overview: Textile Composite Plastic Greenhouse Films

✅ HS CODE: 3921902900

- Description: Applicable to plastic films combined with textile materials.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This code is suitable for textile-plastic composite films.

- High tax burden due to both additional and special tariffs.

- Proactive Advice: Confirm the composition ratio of textile and plastic materials to ensure correct classification.

✅ HS CODE: 3921902100

- Description: Applicable to cotton-plastic composite films, where textile content by weight exceeds any single textile fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Highest tax rate among the options.

- Proactive Advice: Verify material composition and weight percentage of cotton and plastic to ensure compliance.

✅ HS CODE: 3921904090

- Description: Applicable to plastic greenhouse films, which fall under flexible plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Lower tax rate compared to textile-composite films.

- Proactive Advice: Ensure the product is not combined with textile materials, as that would change the classification.

✅ HS CODE: 3921905050

- Description: Applicable to plastic composite films, covering plastic sheets, films, etc..

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Similar to 3921904090, but may include composite materials.

- Proactive Advice: Clarify if the film is pure plastic or composite with other materials.

✅ HS CODE: 3921904010

- Description: Applicable to paper-reinforced plastic films, which are flexible plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Lower tax rate but still subject to special tariffs after April 11, 2025.

- Proactive Advice: Confirm if the product is paper-reinforced or textile-reinforced to avoid misclassification.

📌 Important Reminders for Users:

- Verify Material Composition: Ensure the product is not textile-composite unless it falls under the correct HS code (e.g., 3921902900 or 3921902100).

- Check Unit Price and Certification: Some products may require import licenses or certifications (e.g., for textile content).

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not applicable for this product category, but always confirm with customs or a compliance expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Textile Composite Plastic Greenhouse Films, based on the provided HS codes and tax details:

📦 Product Classification Overview: Textile Composite Plastic Greenhouse Films

✅ HS CODE: 3921902900

- Description: Applicable to plastic films combined with textile materials.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This code is suitable for textile-plastic composite films.

- High tax burden due to both additional and special tariffs.

- Proactive Advice: Confirm the composition ratio of textile and plastic materials to ensure correct classification.

✅ HS CODE: 3921902100

- Description: Applicable to cotton-plastic composite films, where textile content by weight exceeds any single textile fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Highest tax rate among the options.

- Proactive Advice: Verify material composition and weight percentage of cotton and plastic to ensure compliance.

✅ HS CODE: 3921904090

- Description: Applicable to plastic greenhouse films, which fall under flexible plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Lower tax rate compared to textile-composite films.

- Proactive Advice: Ensure the product is not combined with textile materials, as that would change the classification.

✅ HS CODE: 3921905050

- Description: Applicable to plastic composite films, covering plastic sheets, films, etc..

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Similar to 3921904090, but may include composite materials.

- Proactive Advice: Clarify if the film is pure plastic or composite with other materials.

✅ HS CODE: 3921904010

- Description: Applicable to paper-reinforced plastic films, which are flexible plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- Lower tax rate but still subject to special tariffs after April 11, 2025.

- Proactive Advice: Confirm if the product is paper-reinforced or textile-reinforced to avoid misclassification.

📌 Important Reminders for Users:

- Verify Material Composition: Ensure the product is not textile-composite unless it falls under the correct HS code (e.g., 3921902900 or 3921902100).

- Check Unit Price and Certification: Some products may require import licenses or certifications (e.g., for textile content).

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not applicable for this product category, but always confirm with customs or a compliance expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.