| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

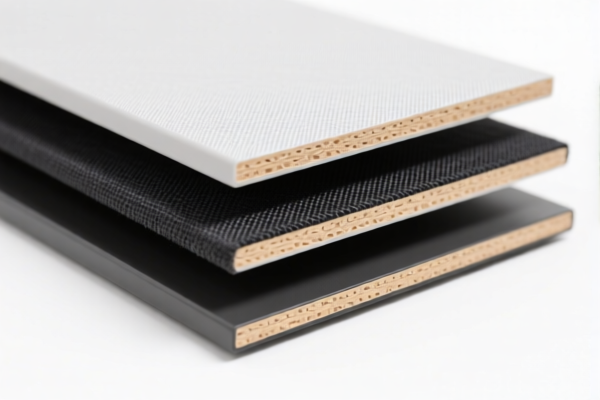

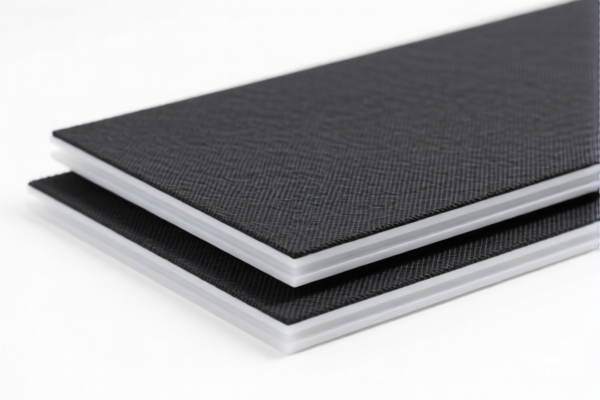

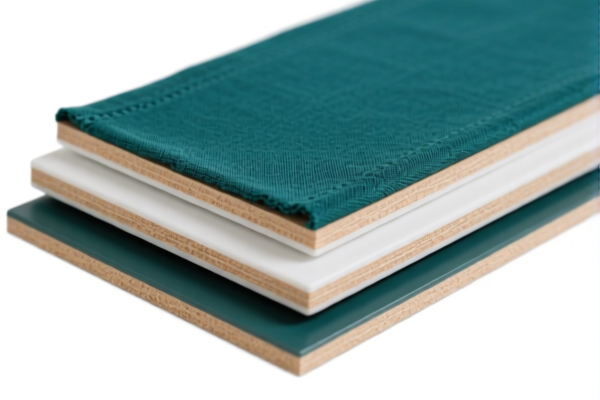

Product Classification: Textile Composite Plastic Industrial Boards

HS CODE: 3921902900, 3921902510, 3921902550, 3921131950

Below is a structured breakdown of the HS codes and associated tariff information for your product:

🔍 HS CODE: 3921902900

Description: Applicable to composite boards combining plastic and textile materials, matching the classification under HS code 3921902900.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general composite boards with a mix of plastic and textile materials, without specific emphasis on the composition ratio.

🔍 HS CODE: 3921902510

Description: Applicable to composite boards combining plastic and textile materials, where plastic weight exceeds 70%.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for products with a plastic content over 70%, which may be relevant if your product has a higher plastic composition.

🔍 HS CODE: 3921902550

Description: Applicable to textile composite plastic boards where textile components are primarily synthetic fibers, and plastic weight exceeds 70%.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for products with synthetic fiber textiles and plastic content over 70%. Ensure your product meets this composition requirement.

🔍 HS CODE: 3921131950

Description: Applicable to polyurethane textile composite industrial boards, matching the description under HS code 3921131950.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to polyurethane-based composite boards. Confirm if your product is made of polyurethane.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: If your product contains iron or aluminum components, check for any applicable anti-dumping duties based on the country of origin.

- Material Verification: Confirm the exact composition (plastic vs. textile ratio, type of fibers, and polymer used) to ensure correct HS code classification.

- Certifications: Some products may require customs documentation, material certifications, or origin declarations. Verify with your customs broker or local authority.

- Unit Price: Be aware that tariff rates may vary based on the unit price or product classification under specific trade agreements.

✅ Proactive Advice:

- Double-check the composition of your product to match the most accurate HS code.

- Consult a customs expert or use a HS code lookup tool for confirmation.

- Keep records of material composition, origin, and pricing to support customs declarations.

Let me know if you need help determining the most suitable HS code for your specific product.

Product Classification: Textile Composite Plastic Industrial Boards

HS CODE: 3921902900, 3921902510, 3921902550, 3921131950

Below is a structured breakdown of the HS codes and associated tariff information for your product:

🔍 HS CODE: 3921902900

Description: Applicable to composite boards combining plastic and textile materials, matching the classification under HS code 3921902900.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general composite boards with a mix of plastic and textile materials, without specific emphasis on the composition ratio.

🔍 HS CODE: 3921902510

Description: Applicable to composite boards combining plastic and textile materials, where plastic weight exceeds 70%.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for products with a plastic content over 70%, which may be relevant if your product has a higher plastic composition.

🔍 HS CODE: 3921902550

Description: Applicable to textile composite plastic boards where textile components are primarily synthetic fibers, and plastic weight exceeds 70%.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for products with synthetic fiber textiles and plastic content over 70%. Ensure your product meets this composition requirement.

🔍 HS CODE: 3921131950

Description: Applicable to polyurethane textile composite industrial boards, matching the description under HS code 3921131950.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to polyurethane-based composite boards. Confirm if your product is made of polyurethane.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: If your product contains iron or aluminum components, check for any applicable anti-dumping duties based on the country of origin.

- Material Verification: Confirm the exact composition (plastic vs. textile ratio, type of fibers, and polymer used) to ensure correct HS code classification.

- Certifications: Some products may require customs documentation, material certifications, or origin declarations. Verify with your customs broker or local authority.

- Unit Price: Be aware that tariff rates may vary based on the unit price or product classification under specific trade agreements.

✅ Proactive Advice:

- Double-check the composition of your product to match the most accurate HS code.

- Consult a customs expert or use a HS code lookup tool for confirmation.

- Keep records of material composition, origin, and pricing to support customs declarations.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.