| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811594020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4805934015 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411139090 | Doc | 58.9% | CN | US | 2025-05-12 |

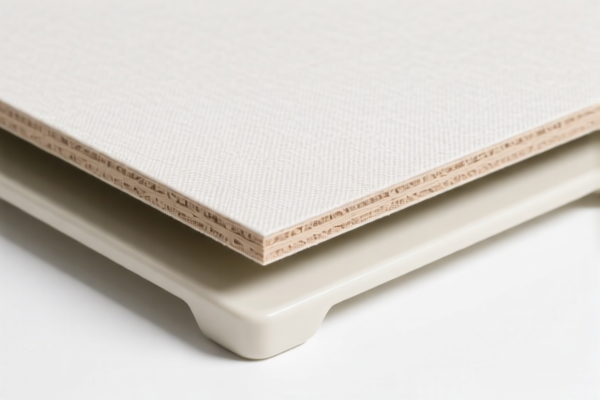

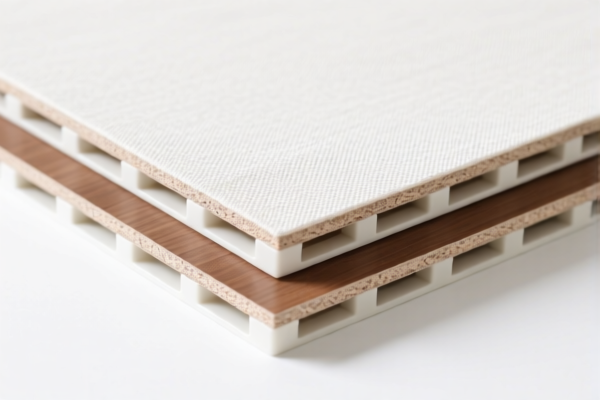

Product Name: Textile Composite Plastic Moistureproof Boards

Classification Analysis and Tax Information:

- HS CODE: 3918905000

- Description: Plastic floor or wall/ceiling coverings, including plastic wall coverings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is the most relevant classification for plastic-based moistureproof boards. Ensure the product is primarily made of plastic and used for wall or floor covering.

-

HS CODE: 4807009400

- Description: Composite paper or paperboard made by bonding multiple layers of paper or paperboard with adhesive, uncoated or unimpregnated, in rolls or sheets.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: May apply if the product is paper-based with adhesive layers, but not suitable for plastic-based boards.

-

HS CODE: 4811594020

- Description: Paperboard coated with plastic, which fits the classification if the "moistureproof" feature is achieved through the plastic coating.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This could be applicable if the board is paperboard with a plastic coating for moisture resistance.

-

HS CODE: 4805934015

- Description: Other uncoated paper and paperboard in rolls or sheets, not further processed, with a weight of 225 g/m² or more, including wet machine board.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Not suitable for plastic-based boards, but may apply to paper-based products.

-

HS CODE: 4411139090

- Description: Wood or other wood fiber boards, medium-density fiberboard (MDF), thickness over 5 mm but not over 9 mm.

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Not applicable for plastic-based boards, but may be relevant if the product contains wood fiber components.

✅ Proactive Advice:

- Verify Material Composition: Confirm whether the product is primarily plastic, paperboard with plastic coating, or contains wood fiber. This will determine the correct HS code.

- Check Unit Price and Certification: If the product is imported from certain countries, additional anti-dumping duties may apply. Ensure you have the necessary certifications (e.g., safety, environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax rate by 5% for all listed HS codes. Plan accordingly for import costs.

-

Consult Customs Authority: For complex or borderline cases, seek confirmation from local customs or a customs broker to avoid misclassification penalties. Product Name: Textile Composite Plastic Moistureproof Boards

Classification Analysis and Tax Information: -

HS CODE: 3918905000

- Description: Plastic floor or wall/ceiling coverings, including plastic wall coverings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is the most relevant classification for plastic-based moistureproof boards. Ensure the product is primarily made of plastic and used for wall or floor covering.

-

HS CODE: 4807009400

- Description: Composite paper or paperboard made by bonding multiple layers of paper or paperboard with adhesive, uncoated or unimpregnated, in rolls or sheets.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: May apply if the product is paper-based with adhesive layers, but not suitable for plastic-based boards.

-

HS CODE: 4811594020

- Description: Paperboard coated with plastic, which fits the classification if the "moistureproof" feature is achieved through the plastic coating.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This could be applicable if the board is paperboard with a plastic coating for moisture resistance.

-

HS CODE: 4805934015

- Description: Other uncoated paper and paperboard in rolls or sheets, not further processed, with a weight of 225 g/m² or more, including wet machine board.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Not suitable for plastic-based boards, but may apply to paper-based products.

-

HS CODE: 4411139090

- Description: Wood or other wood fiber boards, medium-density fiberboard (MDF), thickness over 5 mm but not over 9 mm.

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Not applicable for plastic-based boards, but may be relevant if the product contains wood fiber components.

✅ Proactive Advice:

- Verify Material Composition: Confirm whether the product is primarily plastic, paperboard with plastic coating, or contains wood fiber. This will determine the correct HS code.

- Check Unit Price and Certification: If the product is imported from certain countries, additional anti-dumping duties may apply. Ensure you have the necessary certifications (e.g., safety, environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax rate by 5% for all listed HS codes. Plan accordingly for import costs.

- Consult Customs Authority: For complex or borderline cases, seek confirmation from local customs or a customs broker to avoid misclassification penalties.

Customer Reviews

No reviews yet.