| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Composite Plastic Protective Films, based on the provided HS codes and tax details:

🔍 Product Classification Overview

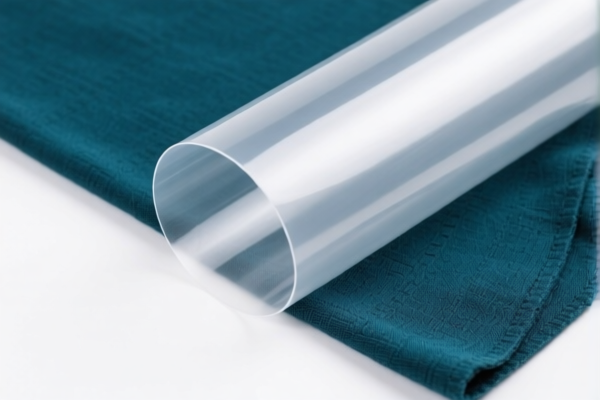

Product Name: Textile Composite Plastic Protective Films

Description: Composite products made of plastic (e.g., film, sheet, foil) combined with textile materials, with a total weight not exceeding 1.492 kg/m².

📦 HS Code Classification & Tax Details

1. HS CODE: 3921901950

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a total weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code applies to general composite products without specific fiber composition requirements.

2. HS CODE: 3921901100

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a total weight not exceeding 1.492 kg/m², where: - Textile component: Artificial fiber weight exceeds any other single textile fiber. - Plastic component: Plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is more favorable for products with a higher proportion of plastic and specific fiber composition.

3. HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials (no weight limit specified).

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for general composite products with no specific weight or fiber composition restrictions.

⚠️ Important Notes on Tariff Changes

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for iron or aluminum components (if any).

- No mention of specific anti-dumping duties for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially if using HS CODE 3921901100 (requires artificial fiber > other fibers and plastic > 70%).

- Check Unit Price and Weight: Ensure the product weight per square meter does not exceed 1.492 kg for eligibility under the 1.492 kg/m² category.

- Certifications: Confirm if any certifications (e.g., safety, environmental compliance) are required for import.

- Tariff Date Awareness: Be mindful of the April 2, 2025 deadline for the special tariff. Consider adjusting import timelines or seeking duty relief if applicable.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Protective Films, based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Textile Composite Plastic Protective Films

Description: Composite products made of plastic (e.g., film, sheet, foil) combined with textile materials, with a total weight not exceeding 1.492 kg/m².

📦 HS Code Classification & Tax Details

1. HS CODE: 3921901950

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a total weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code applies to general composite products without specific fiber composition requirements.

2. HS CODE: 3921901100

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a total weight not exceeding 1.492 kg/m², where: - Textile component: Artificial fiber weight exceeds any other single textile fiber. - Plastic component: Plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is more favorable for products with a higher proportion of plastic and specific fiber composition.

3. HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials (no weight limit specified).

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for general composite products with no specific weight or fiber composition restrictions.

⚠️ Important Notes on Tariff Changes

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for iron or aluminum components (if any).

- No mention of specific anti-dumping duties for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially if using HS CODE 3921901100 (requires artificial fiber > other fibers and plastic > 70%).

- Check Unit Price and Weight: Ensure the product weight per square meter does not exceed 1.492 kg for eligibility under the 1.492 kg/m² category.

- Certifications: Confirm if any certifications (e.g., safety, environmental compliance) are required for import.

- Tariff Date Awareness: Be mindful of the April 2, 2025 deadline for the special tariff. Consider adjusting import timelines or seeking duty relief if applicable.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.