| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

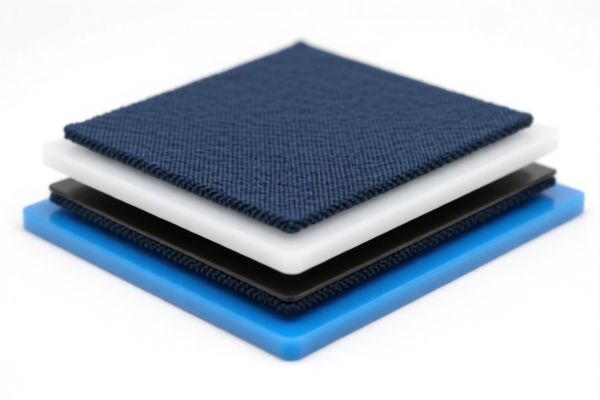

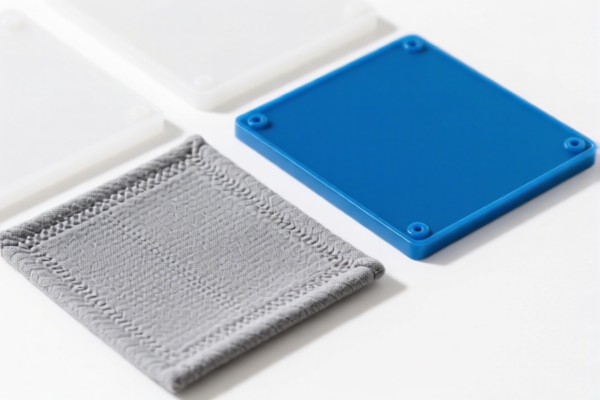

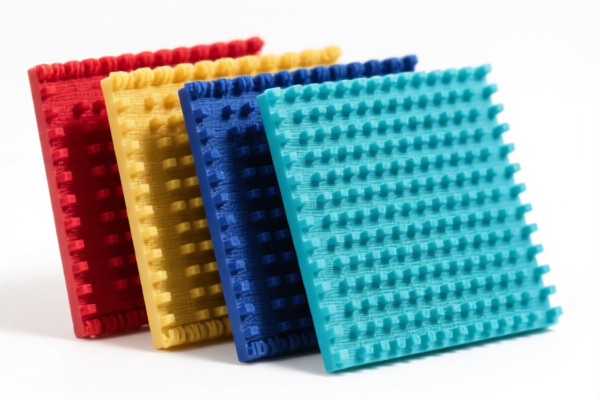

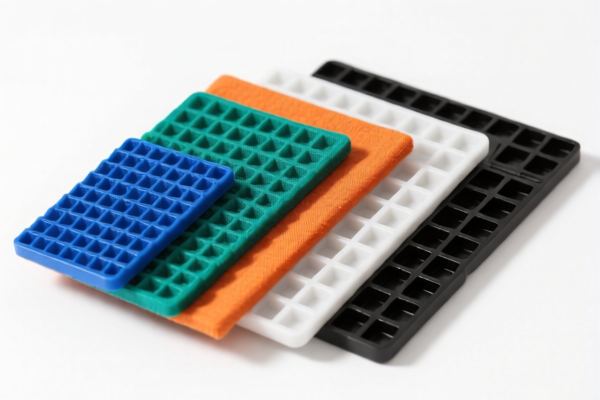

Here is the structured classification and tariff information for Textile Composite Plastic Research Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description:

- Applicable to textile composite plastic boards where the plastic weight exceeds 1.492 kg/m².

- Includes plastic sheets, films, foils, and strips combined with other materials.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921902510

Product Description:

- Applicable to plastic composite boards combined with textile materials, where plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Product Description:

- Applicable to textile composite plastic sheets where artificial fiber weight exceeds any other single textile fiber, and plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs. -

Anti-dumping duties:

Not explicitly mentioned in the data, but if the product contains iron or aluminum components, check for any applicable anti-dumping duties based on the specific country of origin. -

Certifications Required:

Verify if certifications (e.g., material composition, origin, or environmental compliance) are required for customs clearance.

🛠️ Proactive Advice:

-

Confirm Material Composition:

Ensure the plastic and textile weight percentages match the HS code criteria to avoid misclassification. -

Check Unit Price and Tax Calculation:

Use the total tax rate (e.g., 59.4% or 61.5%) to calculate the final import cost accurately. -

Consult Local Customs Authority:

For the most up-to-date and region-specific tariff information, especially regarding anti-dumping duties or special tariffs.

Let me know if you need help with customs documentation or HS code verification for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Research Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description:

- Applicable to textile composite plastic boards where the plastic weight exceeds 1.492 kg/m².

- Includes plastic sheets, films, foils, and strips combined with other materials.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921902510

Product Description:

- Applicable to plastic composite boards combined with textile materials, where plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Product Description:

- Applicable to textile composite plastic sheets where artificial fiber weight exceeds any other single textile fiber, and plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs. -

Anti-dumping duties:

Not explicitly mentioned in the data, but if the product contains iron or aluminum components, check for any applicable anti-dumping duties based on the specific country of origin. -

Certifications Required:

Verify if certifications (e.g., material composition, origin, or environmental compliance) are required for customs clearance.

🛠️ Proactive Advice:

-

Confirm Material Composition:

Ensure the plastic and textile weight percentages match the HS code criteria to avoid misclassification. -

Check Unit Price and Tax Calculation:

Use the total tax rate (e.g., 59.4% or 61.5%) to calculate the final import cost accurately. -

Consult Local Customs Authority:

For the most up-to-date and region-specific tariff information, especially regarding anti-dumping duties or special tariffs.

Let me know if you need help with customs documentation or HS code verification for your specific product.

Customer Reviews

No reviews yet.