| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

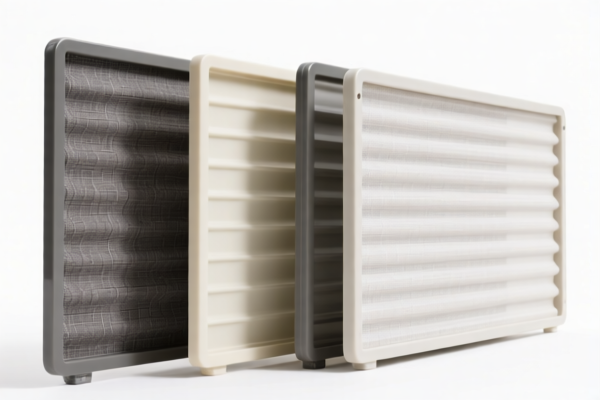

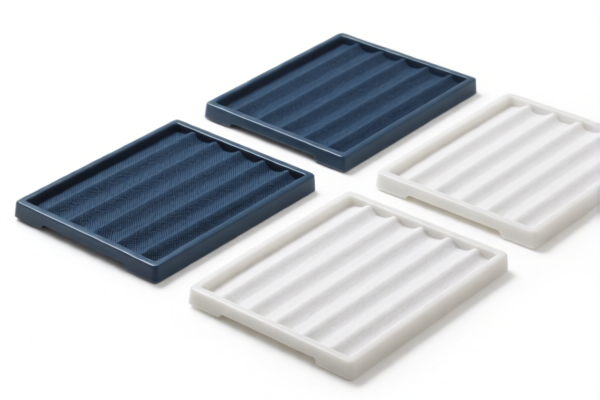

Product Classification: Textile Composite Plastic Shading Boards

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Shading Boards" falls under Chapter 3921 of the Harmonized System (HS), specifically 3921.90.19.10 and similar codes. Below is a structured breakdown of the classification and tariff details:

HS CODE: 3921901910

Product Description: Textile Composite Plastic Shading Boards

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most commonly used code for textile composite plastic shading boards.

HS CODE: 3921901500

Product Description: Textile Composite Plastic Shading Board Fabric / Shading Curtain

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile composite plastic shading fabrics or curtains.

HS CODE: 3921901950

Product Description: Textile Composite Plastic Rainproof Board / Composite Textile Plastic Shading Fabric

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is used for similar products like rainproof boards or shading fabrics.

HS CODE: 3921901100

Product Description: Textile Composite Plastic Rainproof Fabric

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile composite plastic rainproof fabric, with a slightly lower base tariff.

Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to textile or plastic products. -

Material and Certification Requirements:

Verify the material composition (e.g., percentage of textile vs. plastic) and unit price to ensure correct classification. Some HS codes may require certifications (e.g., environmental, safety, or import permits) depending on the country of import.

Proactive Advice:

- Confirm Product Description: Ensure the product is accurately described (e.g., shading board vs. fabric vs. curtain) to match the correct HS code.

- Check for Updates: Monitor for any changes in tariff policies, especially after April 11, 2025.

- Consult Customs Authority: For high-value or complex products, consult local customs or a customs broker to confirm classification and tax implications.

Let me know if you need help with a specific product or country of import!

Product Classification: Textile Composite Plastic Shading Boards

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Shading Boards" falls under Chapter 3921 of the Harmonized System (HS), specifically 3921.90.19.10 and similar codes. Below is a structured breakdown of the classification and tariff details:

HS CODE: 3921901910

Product Description: Textile Composite Plastic Shading Boards

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most commonly used code for textile composite plastic shading boards.

HS CODE: 3921901500

Product Description: Textile Composite Plastic Shading Board Fabric / Shading Curtain

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile composite plastic shading fabrics or curtains.

HS CODE: 3921901950

Product Description: Textile Composite Plastic Rainproof Board / Composite Textile Plastic Shading Fabric

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is used for similar products like rainproof boards or shading fabrics.

HS CODE: 3921901100

Product Description: Textile Composite Plastic Rainproof Fabric

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile composite plastic rainproof fabric, with a slightly lower base tariff.

Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to textile or plastic products. -

Material and Certification Requirements:

Verify the material composition (e.g., percentage of textile vs. plastic) and unit price to ensure correct classification. Some HS codes may require certifications (e.g., environmental, safety, or import permits) depending on the country of import.

Proactive Advice:

- Confirm Product Description: Ensure the product is accurately described (e.g., shading board vs. fabric vs. curtain) to match the correct HS code.

- Check for Updates: Monitor for any changes in tariff policies, especially after April 11, 2025.

- Consult Customs Authority: For high-value or complex products, consult local customs or a customs broker to confirm classification and tax implications.

Let me know if you need help with a specific product or country of import!

Customer Reviews

No reviews yet.