| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

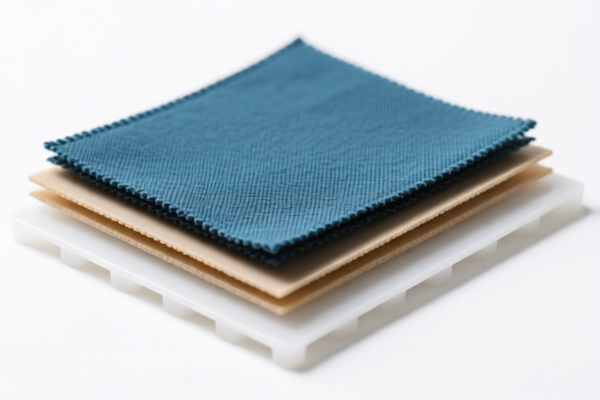

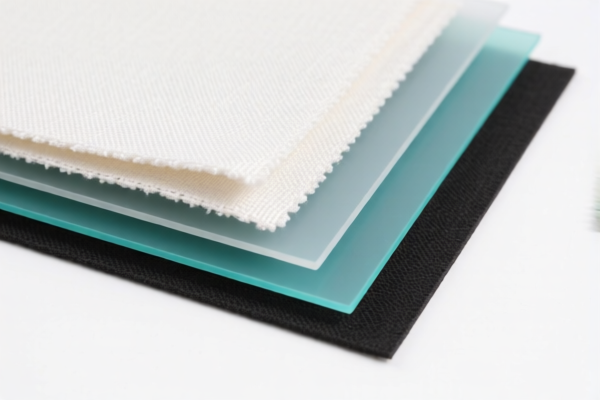

Product Classification: Textile Composite Plastic Sheets (for Automotive Interiors)

Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on specific composition and characteristics. Below is a structured breakdown of the classification and associated tariff details.

1. HS CODE: 3921902550

Description:

- Plastic sheets combined with textile materials.

- Weight > 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single fiber.

- Plastic content > 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This is the most specific and likely correct classification for your product if it meets the weight and composition criteria.

- The high total tax rate is due to both the base and additional tariffs.

2. HS CODE: 3921905050

Description:

- Other plastic sheets, films, foils, and strips.

- Further classified under the "Other" category of plastic products.

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This classification is more general and may apply if the product does not meet the specific criteria for 3921902550.

- Lower base tariff but still subject to the 30% special tariff after April 11, 2025.

3. HS CODE: 3926400090

Description:

- Other items made of plastic or other materials.

- Specifically classified under "Statuettes and other decorative articles, other."

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 35.3%

Key Notes:

- This classification is less likely unless the product is intended for decorative purposes.

- Not ideal for automotive interior use unless the product is marketed as a decorative item.

4. HS CODE: 3920598000

Description:

- Other plastic sheets, films, foils, and strips.

- Further classified under the "Other" category of plastic products.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3921902550 in terms of total tax rate.

- May be used if the product is not clearly defined under 3921902550.

Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific criteria for 3921902550 (e.g., weight, fiber content, and plastic percentage).

- Check Unit Price and Certification: Confirm if any certifications (e.g., REACH, RoHS) are required for automotive use.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 applies to all listed codes.

- Consult Customs Authority: For final classification, especially if the product is borderline between categories.

- Consider Tariff Optimization: If the product can be reclassified or modified, it may help reduce the overall tax burden.

Summary of Tax Rates (by HS Code):

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3926400090 | 5.3% | 0.0% | 30.0% | 35.3% |

| 3920598000 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., exact composition, weight, and intended use), I can help narrow down the most accurate HS code and tax rate.

Product Classification: Textile Composite Plastic Sheets (for Automotive Interiors)

Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on specific composition and characteristics. Below is a structured breakdown of the classification and associated tariff details.

1. HS CODE: 3921902550

Description:

- Plastic sheets combined with textile materials.

- Weight > 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single fiber.

- Plastic content > 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This is the most specific and likely correct classification for your product if it meets the weight and composition criteria.

- The high total tax rate is due to both the base and additional tariffs.

2. HS CODE: 3921905050

Description:

- Other plastic sheets, films, foils, and strips.

- Further classified under the "Other" category of plastic products.

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This classification is more general and may apply if the product does not meet the specific criteria for 3921902550.

- Lower base tariff but still subject to the 30% special tariff after April 11, 2025.

3. HS CODE: 3926400090

Description:

- Other items made of plastic or other materials.

- Specifically classified under "Statuettes and other decorative articles, other."

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 35.3%

Key Notes:

- This classification is less likely unless the product is intended for decorative purposes.

- Not ideal for automotive interior use unless the product is marketed as a decorative item.

4. HS CODE: 3920598000

Description:

- Other plastic sheets, films, foils, and strips.

- Further classified under the "Other" category of plastic products.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3921902550 in terms of total tax rate.

- May be used if the product is not clearly defined under 3921902550.

Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific criteria for 3921902550 (e.g., weight, fiber content, and plastic percentage).

- Check Unit Price and Certification: Confirm if any certifications (e.g., REACH, RoHS) are required for automotive use.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 applies to all listed codes.

- Consult Customs Authority: For final classification, especially if the product is borderline between categories.

- Consider Tariff Optimization: If the product can be reclassified or modified, it may help reduce the overall tax burden.

Summary of Tax Rates (by HS Code):

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3926400090 | 5.3% | 0.0% | 30.0% | 35.3% |

| 3920598000 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., exact composition, weight, and intended use), I can help narrow down the most accurate HS code and tax rate.

Customer Reviews

No reviews yet.