| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

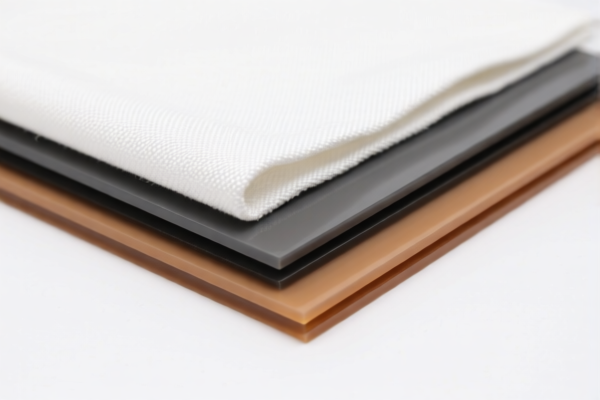

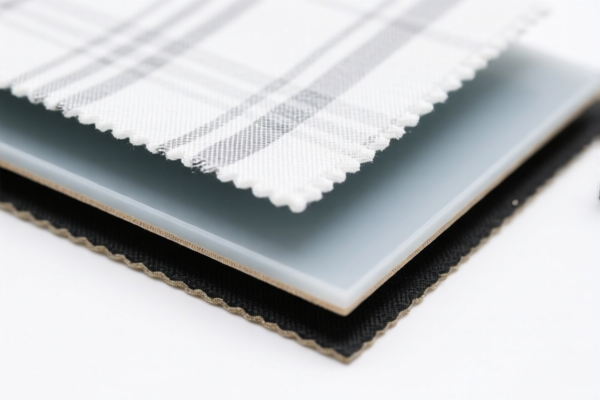

Here is the structured classification and tariff information for Textile Composite Plastic Sheets (for Building) based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code appears multiple times in your input, but it refers to the same classification.

✅ HS CODE: 3920598000

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code may apply if the product is classified under a more specific category of plastic sheets.

✅ HS CODE: 3926400090

Description: Other articles of plastic or of other materials

Total Tax Rate: 35.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code may be used if the product is not clearly classified under the plastic sheets category and is considered a composite or other item.

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff: All three codes will be subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning and compliance.

- Material Verification: Confirm the exact composition of the product (e.g., is it purely plastic, or a composite with textile or other materials?). This will determine the correct HS code.

- Unit Price and Certification: Check if certifications (e.g., safety, environmental compliance) are required for import, especially if the product is used in construction.

- Tariff Variability: The 3920598000 code has a higher base and additional tariff, so it's important to ensure the product is not misclassified into this category unless it fits the specific description.

🛑 Action Required:

- Verify the product's composition and technical specifications to ensure correct HS code classification.

- Check with customs or a classification expert if the product contains textile components or is a composite, as this may affect the applicable tariff.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation. Here is the structured classification and tariff information for Textile Composite Plastic Sheets (for Building) based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code appears multiple times in your input, but it refers to the same classification.

✅ HS CODE: 3920598000

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code may apply if the product is classified under a more specific category of plastic sheets.

✅ HS CODE: 3926400090

Description: Other articles of plastic or of other materials

Total Tax Rate: 35.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Note: This code may be used if the product is not clearly classified under the plastic sheets category and is considered a composite or other item.

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff: All three codes will be subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning and compliance.

- Material Verification: Confirm the exact composition of the product (e.g., is it purely plastic, or a composite with textile or other materials?). This will determine the correct HS code.

- Unit Price and Certification: Check if certifications (e.g., safety, environmental compliance) are required for import, especially if the product is used in construction.

- Tariff Variability: The 3920598000 code has a higher base and additional tariff, so it's important to ensure the product is not misclassified into this category unless it fits the specific description.

🛑 Action Required:

- Verify the product's composition and technical specifications to ensure correct HS code classification.

- Check with customs or a classification expert if the product contains textile components or is a composite, as this may affect the applicable tariff.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.